Cara Membuat Arus Kas Metode Langsung || Cash Flow Statement Direct Method #TutorialAkuntansi

Summary

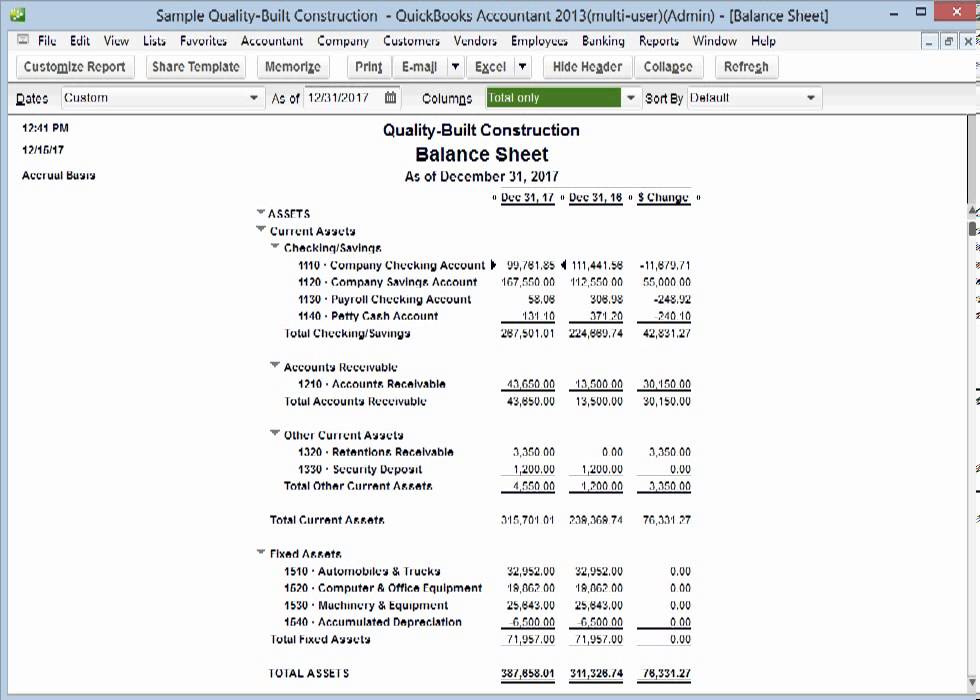

TLDRThis tutorial explains the process of preparing a cash flow report using the direct method. It covers the essential stages, including analyzing transactions, journaling, creating a ledger, compiling a balance, and finally generating a cash flow report. The video provides detailed examples of transactions such as deposits, payments, and equipment purchases for a newly established company. By the end, viewers understand how to calculate net cash flow for operational, investing, and financing activities. The tutorial is geared toward helping businesses, whether large or small, manage and track cash flows effectively.

Takeaways

- 😀 Cash flow is essential for businesses of all sizes and is used to evaluate past performance and plan for future investments and financing activities.

- 😀 The cash flow report is divided into three types of activities: operational, investment, and financing activities.

- 😀 The primary purpose of a cash flow report is to predict future cash flow, determine which payments need to be made, and support decision-making for financial managers.

- 😀 In this tutorial, the direct method for preparing a cash flow report is demonstrated, but the indirect method will also be covered in a future video.

- 😀 A detailed journal is created to track all transactions, including deposits, payments, and expenses, before compiling the cash flow report.

- 😀 The general ledger is a critical step in summarizing all journal entries and providing a clear picture of the company's financial status.

- 😀 Compiling a balance list from the general ledger is necessary to assess the debit and credit balances for accurate cash flow reporting.

- 😀 Cash flow from operational activities involves receipts from customers and payments for expenses like rent, transportation, and employee salaries.

- 😀 Investing activities include purchasing long-term assets like equipment, which impacts the cash flow but also contributes to the company’s investment portfolio.

- 😀 Financing activities include the owner's capital deposits and withdrawals, which affect the company's capital balance and overall cash flow.

- 😀 At the end of the period, the cash flow report should match the cash and cash equivalents balance in the general ledger to ensure accuracy.

Q & A

What is the purpose of a cash flow report?

-A cash flow report shows detailed information about the cash that comes into and goes out of a company. It is used to evaluate the company’s past performance and plan for future investment and financing activities.

What are the three types of activities included in a cash flow report?

-The three types of activities in a cash flow report are operational activities, investment activities, and financing activities.

Why is a cash flow report important for financial managers?

-A cash flow report helps financial managers predict future cash flow, determine payment obligations based on the company's ability, and serve as a basis for decision-making to improve and enhance the company's performance.

What is the first step in preparing a cash flow report?

-The first step in preparing a cash flow report is analyzing the transactions that have occurred in the company.

What are the two methods commonly used to prepare a cash flow report?

-The two methods commonly used are the direct method and the indirect method.

What is an example of a transaction included in a cash flow report?

-An example of a transaction is the initial capital deposit of 30 million into the company’s bank account. This is recorded in the cash flow report as part of the financing activities.

What is the role of journals in preparing a cash flow report?

-Journals are used to record transactions, and they help organize and summarize financial data, which is essential for compiling accurate cash flow reports.

How does a ledger differ from a journal in the cash flow preparation process?

-A journal records individual transactions, while a ledger summarizes and organizes these transactions into specific accounts, showing a clearer picture of the company's financial standing.

How is the cash flow from operating activities calculated?

-The cash flow from operating activities is calculated by subtracting the total expenses (such as prepaid rent, transportation expenses, and salaries) from the receipts (like customer payments), resulting in net cash flow from operations.

Why is an equipment purchase considered an investment activity in a cash flow report?

-An equipment purchase is considered an investment activity because it involves the acquisition of long-term assets that will provide benefits over time, rather than being an immediate cost.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)