Today's Stock Market News - 11/6/2025 | Aaj ki Taaza Khabar

Summary

TLDRShruti Khopade provides a detailed update on global and Indian economies, focusing on trade talks between the US and China, tariff impacts, and growth projections from the World Bank. While global growth is slowing, India is expected to remain a fast-growing economy. The non-life insurance sector shows a slower growth rate due to regulatory changes. Private sector capex is set to double in the next five years. Noteworthy updates include Maruti Suzuki cutting EV production, PSU banks outpacing private banks in loan growth, and record-breaking mutual fund inflows despite market volatility.

Takeaways

- 😀 The ongoing US-China trade talks are still in progress, with discussions focusing on tariff pauses, but China has recently stopped supplying rare earth magnets, disrupting global auto OEMs.

- 😀 The World Bank forecasts global growth at 2.3% for 2025, a slowdown from 2.8% in 2024, primarily due to trade disruptions caused by tariff strategies.

- 😀 India's growth for 2025 is projected at 6.3%, slightly down from 6.5% in 2024, making it the fastest-growing major economy despite global challenges.

- 😀 The US economy is expected to grow at 1.4% in 2025, half of what was forecasted earlier due to the impacts of aggressive tariff policies.

- 😀 China's economy is projected to grow at 4.5% in 2025, with challenges in exports, real estate, and an aging population affecting growth.

- 😀 Eurozone countries are forecasted to grow at just 7% in 2025 due to the effects of tariffs imposed by the US, leading to uncertainty in exports.

- 😀 The non-life insurance industry in India reported a 6.5% YoY growth in gross direct premiums in May 2025, slower than last year due to regulatory changes in premium reporting.

- 😀 SMP Global Ratings projects that India's private capital expenditure (capex) will double to $850 billion in the next five years, with sectors like power, transmission, and green hydrogen leading the way.

- 😀 Public sector banks (PSUs) outpaced private banks for the first time in 14 years in loan growth, reporting a 13.1% growth in FY25, driven by corporate and retail loans.

- 😀 Maruti Suzuki has reduced its near-term EV production targets by 23% due to a supply shortage of rare earth magnets, mostly sourced from China.

- 😀 SIP contributions in India reached an all-time high of ₹26,688 crore in May 2025, reflecting growing retail participation in equity markets despite market volatility.

- 😀 HDFC and ICICI banks have reduced their fixed deposit rates by 25 basis points following the RBI’s repo rate cut, reflecting efforts to manage liquidity in the economy.

Q & A

What is the latest development in the US-China trade talks?

-The US and China are continuing their trade talks, with ongoing discussions about a tariff pause. Despite some supply disruptions, there are positive signs in the markets, as US Commerce Secretary has hinted at a potential positive resolution.

What is the World Bank's forecast for global economic growth in 2025?

-The World Bank has forecast global growth of 2.3% for 2025, a decrease from 2.8% in 2024, due to factors like ongoing tariff disputes and their impact on international trade.

How is India's economy expected to perform according to the World Bank?

-India is forecast to be the fastest growing major economy in 2025, with a projected growth rate of 6.3%, though slightly reduced from the 6.5% growth rate in 2024.

What are the recent growth figures for the non-life insurance industry in India?

-The gross direct premium in the non-life insurance industry grew by 6.5% on a year-over-year basis in May 2025, a slowdown compared to the 14.9% growth in May 2024, mainly due to the implementation of the IRDAI's one-by-nine rule.

What are the expected trends in private capital expenditure (Capex) in India?

-S&P Global Ratings projects that private capital expenditure in India will double over the next five years, reaching $850 billion. Key sectors driving this growth will include power and transmission, airlines, and green hydrogen.

How have PSU banks performed in terms of loan growth compared to private banks?

-Public Sector Banks (PSU) have outperformed private banks for the first time in 14 years, reporting a 13.1% loan growth in FY25, compared to 9% growth in private banks, largely driven by corporate loans and mortgages.

Why has Maruti Suzuki reduced its production target for electric vehicles (EVs)?

-Maruti Suzuki has reduced its production target for its electric vehicle, the E Vitara, due to a supply disruption of rare earth magnets from China, which are critical components in EVs. The company now aims to produce only 4,437 units instead of the original 26,500.

What is the latest data on mutual fund SIP contributions in India?

-In May 2025, SIP contributions reached an all-time high of ₹26,688 crore, reflecting growing retail investor participation in equity markets, despite some fluctuations in monthly equity inflows.

What is the impact of RBI's recent repo rate cut on FD rates?

-Following the RBI's repo rate cut by 50 basis points, both HDFC and ICICI Bank have reduced their fixed deposit interest rates by 25 basis points for selected tenures, aiming to adjust liquidity in the economy.

What challenges are China and global automakers facing due to rare earth magnet supply issues?

-China has halted the supply of rare earth magnets, affecting global automakers like Maruti Suzuki, which has reduced its EV production targets. This disruption is particularly significant because China controls most of the global supply and refining capacity for these magnets.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

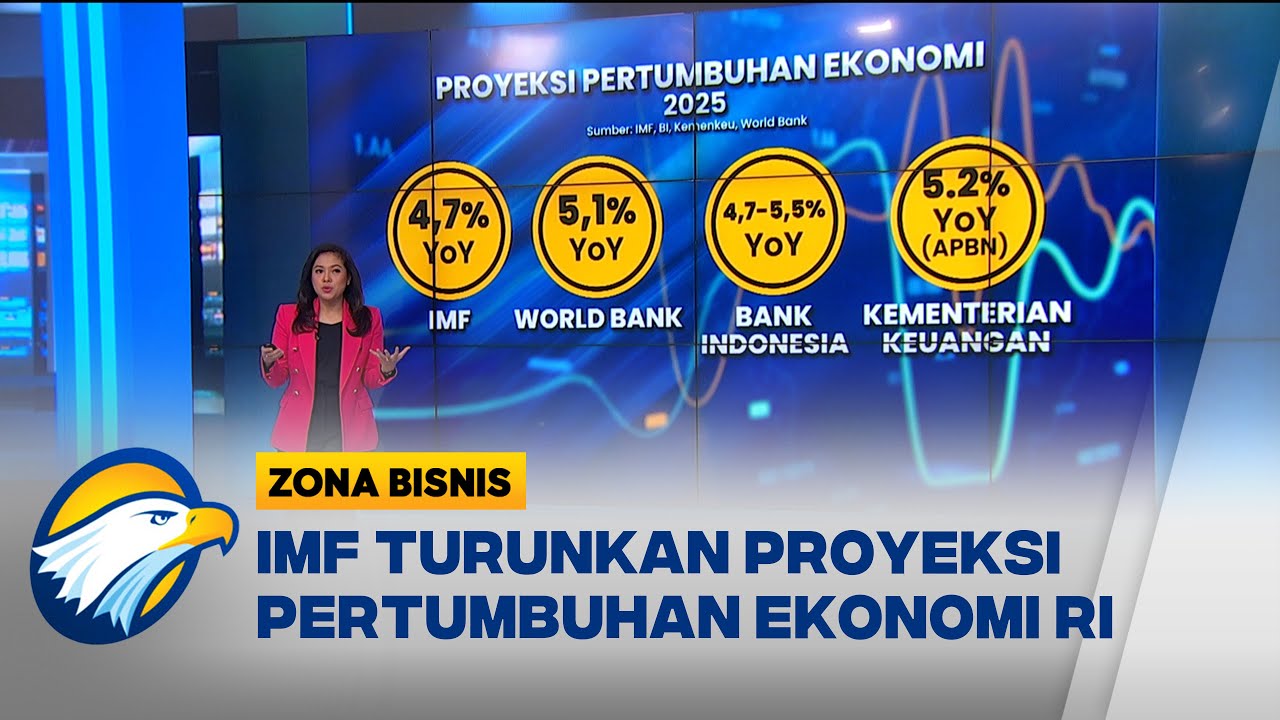

IMF Ramal Ekonomi Indonesia 2025-2026 Bakal Anjlok! [Zona Bisnis]

Worst week for US stocks since Covid as President Trump's tariffs kick in | BBC News

Americans Rush To Buy Cars Ahead of Tariffs!

Tariffs and Treasuries - The China-US Trade War

From trade shocks to top four — how India’s economy powered through 2025

Perang Dagang AS-China Pecah Lagi, Trump Patok Tarif 100 Persen!

5.0 / 5 (0 votes)