Maximum Cash Limit to Avoid Income Tax Notice in 2025 || UPI Limit to Avoid Notice

Summary

TLDRThis video discusses key financial transactions that can attract Income Tax notices if not handled properly, including cash transactions, UPI payments, fixed deposits (FDs), and credit card expenses. It explains the limits on cash deposits, withdrawals, and the scrutiny of UPI transactions, particularly those linked to cashback and rewards. It also highlights the importance of matching your income with your transaction volumes to avoid penalties. The video provides practical advice on how to stay within legal limits, avoid unnecessary taxes, and how to seek professional help if faced with scrutiny from the Income Tax Department.

Takeaways

- 😀 Cash transactions in a savings account are limited to ₹10 lakh annually. Exceeding this limit without proper proof can trigger an income tax notice.

- 😀 If you withdraw more than ₹1 crore from your savings account, a 2% TDS will be levied on the amount above ₹1 crore, provided your ITR is filed on time.

- 😀 Cash transactions above ₹2 lakh in a single transaction need to be supported with proof. For real estate, the limit is ₹20,000.

- 😀 In a current account, the annual cash transaction limit is ₹50 lakh. If you withdraw more than ₹10,000 per day, you cannot deduct this from taxable income.

- 😀 UPI transactions above ₹50,000 in a year can trigger an income tax review. Cashback and rewards over ₹500 from UPI transactions are taxable as income.

- 😀 If your total UPI transactions exceed ₹2 lakh in a year, they will be compared to your ITR. If your ITR is less than your UPI transactions, you may receive a notice.

- 😀 UPI transactions above ₹20 lakh in a year could trigger GST registration and obligations, as the government views it as part of a business turnover.

- 😀 Fixed deposits (FDs) above ₹10 lakh annually are reported to the Income Tax Department by the bank. Ensure your FD balance aligns with your reported income to avoid issues.

- 😀 Credit card expenses exceeding ₹10 lakh in a year will be scrutinized by the Income Tax Department. They will match your income with your expenses to ensure consistency.

- 😀 If your income is much less than your credit card expenses, a notice from the Income Tax Department is likely. For business owners, shifting transactions to a current account can reduce scrutiny.

Q & A

What is the maximum cash deposit and withdrawal limit in a savings account to avoid an income tax notice?

-The maximum cash deposit and withdrawal limit in a savings account is Rs 10 lakh per year. If you exceed this amount, you need to provide proper proof, or you could receive an income tax notice.

What happens if I withdraw more than Rs 10 lakh in cash from my savings account?

-If you withdraw more than Rs 10 lakh in cash, you must provide proper proof of the transactions. If the proof is not sufficient, you may receive an income tax notice and face a penalty.

How does the government levy TDS on large cash withdrawals?

-If you withdraw cash exceeding Rs 1 crore in a year and file your income tax return (ITR) on time, you will be charged 2% TDS on the amount above Rs 1 crore. If you don't file your ITR on time, you may face a higher TDS rate, such as 5% on amounts exceeding Rs 1 crore.

What are the restrictions on cash transactions for business accounts?

-For a business account, you can make a maximum cash transaction of Rs 50 lakh in a year. However, if you make a cash transaction of more than Rs 10,000 in a day, you cannot deduct the expense from your taxable income, potentially increasing your tax liability.

Are there any restrictions on UPI transactions?

-UPI transactions under Rs 50,000 per year do not raise concerns for the Income Tax Department. However, if you make more than 500 UPI transactions in a year, the department may compare your UPI transactions with your ITR. If your ITR does not align with your transaction volume, you could receive a notice.

Are cashback and rewards from UPI transactions taxable?

-Yes, cashback and rewards earned through UPI transactions are considered income under 'other sources' and are taxable. If you earn more than Rs 500 in cashback or rewards, you will need to pay tax on it.

What is the limit for GST registration based on UPI transactions?

-If your UPI transaction volume exceeds Rs 20 lakh in a year, you may be required to register for GST and pay GST on your transactions. This is mandatory if the total transaction volume crosses Rs 20 lakh.

What is the reporting requirement for fixed deposits (FDs) above Rs 10 lakh?

-Banks will report your cumulative FDs exceeding Rs 10 lakh in a year to the Income Tax Department. However, if your savings align with your income minus your expenses, the chances of receiving an income tax notice are reduced.

How does the Income Tax Department monitor credit card transactions?

-If your total credit card spending exceeds Rs 10 lakh, the Income Tax Department will cross-check your income details with your credit card expenses. If your income is significantly lower than your credit card expenses, you may receive a notice.

What happens if I spend more than my income using credit cards?

-If your credit card expenses far exceed your income, such as spending Rs 25 lakh while earning Rs 6-7 lakh, it is highly likely that the Income Tax Department will flag your case and issue a notice for further investigation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

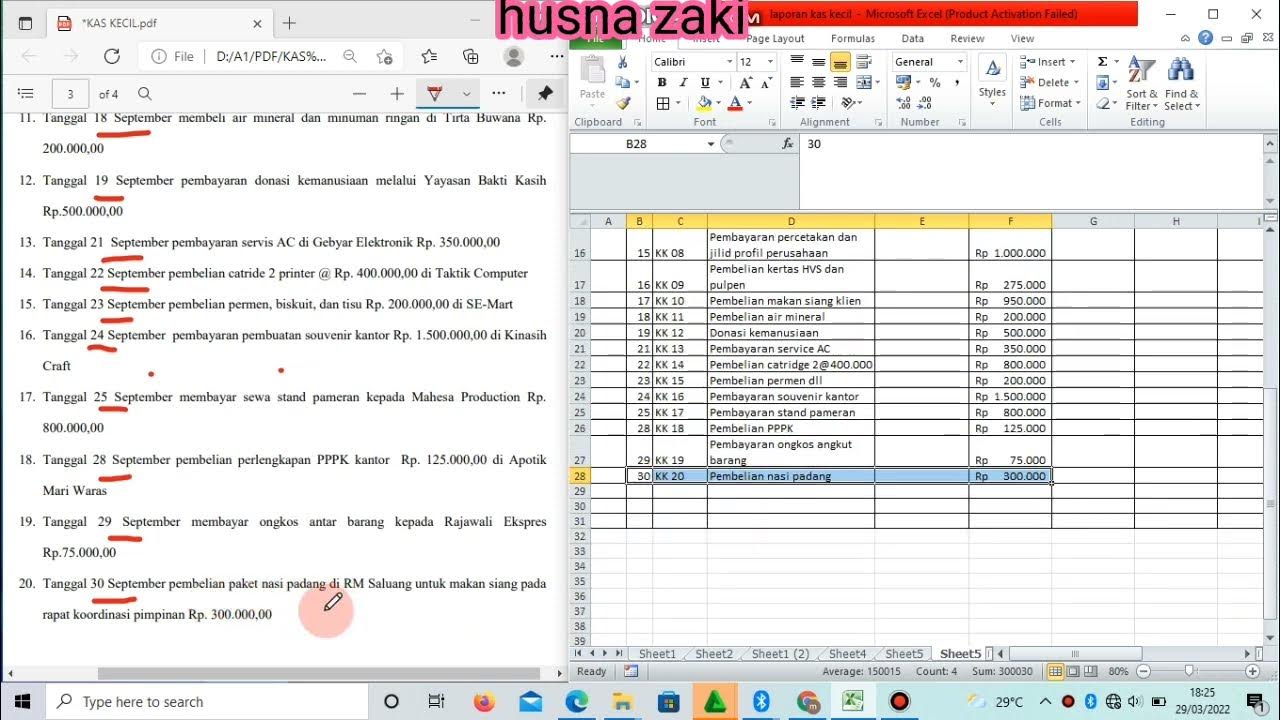

PENGANTAR AKUNTANSI 1 - JURNAL

Paytm और Phonepe से नहीं कर पाएंगे UPI Payment? | GST Notice in Karnataka

VIDEO PEMBELAJARAN KEGIATAN TRANSAKSI KAS & NONKAS - PENGELOLAAN KEUANGAN SEDERHANA XII MPLB

How UPI's Bold Business STRATEGY will KILL VISA and MASTERCARD? : UPI CREDIT LINKING EXPLAINED

Good News for Rupay Credit Cards | NPCI Says: Give More Rewards and Cashback on UPI

Mengelola Kas Kecil-UKK OTKP 2022

5.0 / 5 (0 votes)