ICT Charter Price Action Model 1

Summary

TLDRThis video introduces the first of 12 intraday scalping models focused on trading around previous day's high and low. It emphasizes using the Optimal Trade Entry pattern during the New York session, targeting price movements based on the last 20 days' range. The tutorial covers both buy and sell programs, detailing entry points, stop-loss placements, and scaling out strategies. The aim is to help traders with a short-term focus engage in rule-based trading, enhancing their decision-making and trading efficiency.

Takeaways

- 📈 The script introduces the first of 12 price action models designed for intraday scalping, focusing on the New York trading session and aiming for short-term profits.

- 🎓 It is a prerequisite to have watched the 'Mastering High Probability Scalping' tutorials before engaging with this model.

- 🤔 The model assumes a hypothetical trader profile who prefers frequent setups, is not willing to hold long-term positions, and likes to limit focus to short-term trades.

- 📊 The model uses the 20-day intraday price action (IPA) data range to define the premium and discount levels for trade entry points.

- 💡 Traders are advised to buy during bullish optimal trade entries in the New York session, anticipating a rally to the previous day's high, and to short during bearish entries, anticipating a decline to the previous day's low.

- 📉 The script emphasizes the importance of not being confused by the term 'previous day'; it refers to any day within the last 20 days of the IPA data range, not just the calendar day before.

- 🚫 It is crucial to avoid forcing trades if stopped out and to wait for another opportunity in the New York session, as it may indicate weakening momentum.

- 📍 The model suggests using a 62% Fibonacci retracement level plus or minus five pips for entry and stop-loss placement, depending on whether it's a buy or sell program.

- 🔄 The script details a process for scaling out of positions, locking in profits, and adjusting stop-losses as the trade progresses.

- 📉 On the sell side, the model focuses on shorting when the daily range has taken out a swing low within the last 20 days and is not in a discount.

- 📈 On the buy side, the model focuses on buying when the daily range has taken out a swing high within the last 20 days and is not in a premium.

- 🌐 The script provides examples and explanations of how price movements and patterns can be analyzed and traded within the context of the model.

Q & A

What is the main focus of the first price action model discussed in the script?

-The first price action model focuses on intraday scalping, specifically dealing with the previous day's high and low, and is designed for traders who prefer frequent setups and are not willing to hold long-term or overnight positions.

What prerequisite knowledge is assumed for this tutorial?

-The tutorial assumes that viewers have already watched the 'Mastering High Probability Scalping Volume 1 through 3' tutorials, which were made public and are available for free on the instructor's website and YouTube channel.

What is the trader profile used for this model like?

-The trader profile for this model is hypothetical and is characterized by someone who is opinionated, prefers frequent setups, has a basket of markets to sift through, and likes to limit their focus to select short-term strikes. They are not interested in long-term or overnight trades.

How does the model define the 'previous day' in the context of trading?

-In this model, 'previous day' is not limited to the calendar day before the current trading day but refers to any previous day within the current 20-day intraday price action (IPA) data range.

What is the significance of the 20-day IPA data range in this model?

-The 20-day IPA data range is used to form a basis for identifying key support and resistance levels, as well as to define the liquidity pool and potential trade entry points based on previous daily ranges.

What is the optimal trade entry pattern used in the New York Kill Zone?

-The optimal trade entry pattern involves buying intraday during the New York session bullish optimal trade entries while anticipating a rally to the previous day's high, and shorting during bearish optimal trade entries while anticipating a decline to the previous day's low.

What is the significance of the 62% retracement level in the buy entry process?

-The 62% retracement level is used as a key level to identify potential buy entry points. Traders add five pips to this level for entry to account for the spread, aiming for a retracement lower against the London session momentum.

How should a trader manage their stop loss in this model?

-The stop loss should be placed at the low between 7:00 a.m. and 10:00 a.m. New York time for long positions, or at the high for short positions, with adjustments made only after 20 pips have been scaled out of the position or when the price moves past certain thresholds.

What is the recommended approach for taking profit in this model?

-Profits should be taken in stages, with the first scaling off just before returning to the initial high or low of the day, and further scaling off at target one and two on the Fibonacci tool. If a symmetrical price swing is reached, especially with news due out late in the New York session, all positions should be closed.

How should a trader adjust their strategy if they are stopped out of a trade?

-If a trade is stopped out, it suggests that momentum is weakening, and it is better to wait for another day to enter rather than forcing another trade. The daily liquidity pool should not be fought against, as banks and large institutions will capitalize on all PD arrays formed in the New York session.

What is the importance of the 'symmetrical price swing' concept in this model?

-The symmetrical price swing is a key concept used to identify potential reversal points in the market. It helps traders to anticipate and capitalize on price movements that mirror previous swings within the defined time frame.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Intraday Scalping: A Guide to Consistent Profits for Small Accounts | Scalping Strategy

ICT - Mastering High Probability Scalping Vol. 1 of 3

ICT Charter Price Action Model 6 - Universal Trading Model

ICT Daily Bias - The Only Video You Will Ever Need!

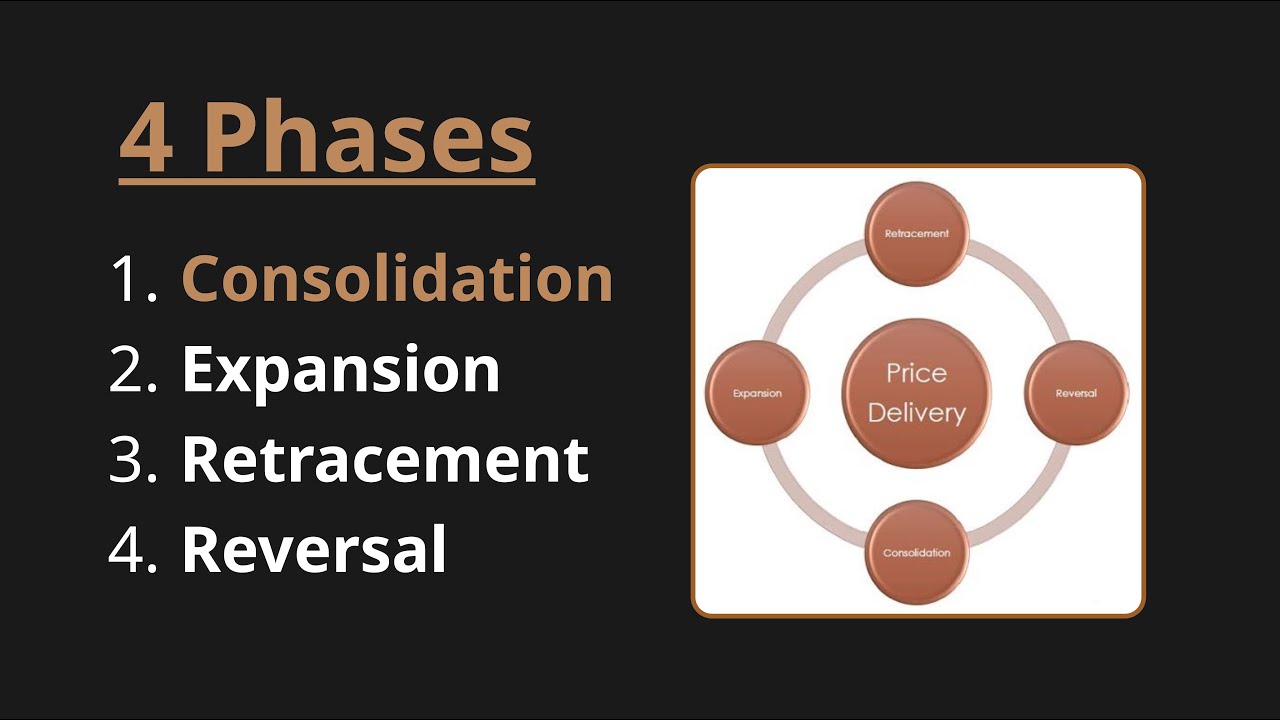

Anticipating Expansions From Consolidations - Episode 1

ICT Forex - Essentials To Trading The Daily Bias

5.0 / 5 (0 votes)