Riba dan Segala Permasalahannya

Summary

TLDRThis educational lecture delves into the concept of 'riba' (usury) in Islam, exploring its definition, various interpretations by scholars, and its prohibition in both the Quran and Hadith. The speaker covers the harmful impacts of riba on individuals, society, and the economy, highlighting the differences between types of riba, such as riba in lending and in trading. The session also discusses the controversy surrounding interest in modern banking, emphasizing Islamic finance's stance against such practices and the need for alternative systems that align with Sharia principles. The lecture provides a comprehensive overview of the theological, economic, and ethical dimensions of riba.

Takeaways

- 😀 Riba, in Islamic terms, refers to any unlawful gain or profit from a loan, typically involving an excessive or unfair interest rate.

- 😀 The term 'riba' originates from Arabic, meaning growth or increase, and is similar to the concepts of 'usury' and 'interest' in English.

- 😀 Riba is considered haram (forbidden) in Islam, with the Quran and Hadith providing clear prohibitions on both lending and borrowing with interest.

- 😀 Riba in the Quran is addressed in several verses, with a gradual progression in the severity of its prohibition, starting from a warning to a complete ban in Surah Al-Baqarah (2:275-279).

- 😀 There are two primary categories of riba: 'riba al-qard' (usury on loans) and 'riba al-bay’' (usury in trade or sales), both of which are prohibited in Islamic finance.

- 😀 The concept of riba is not unique to Islam. It is also condemned in Judaism and Christianity, with similar prohibitions in the Torah and Bible, including in Deuteronomy and Luke.

- 😀 Islamic law classifies two main types of riba: 'riba al-khudd' (a fixed interest added to the loan) and 'riba al-jahiliyyah' (interest on delayed payments in times of non-repayment).

- 😀 The economic consequences of riba include social inequalities, as it can lead to financial exploitation, creating a cycle of debt for borrowers while unjustly enriching lenders.

- 😀 Scholars are divided on the equivalence of interest rates in conventional banking to riba. Some see them as the same, while others argue they can be permissible in certain situations of necessity.

- 😀 Various Islamic scholars and institutions (e.g., Al-Azhar, MUI) have issued fatwas declaring that interest from conventional banking is indeed riba, and hence, is prohibited in Islam.

Q & A

What is the meaning of 'riba' in Islamic finance?

-Riba refers to the unjustified or excessive increase in a loan or debt, which is prohibited in Islam. The term originates from the Arabic root word 'raba', meaning to grow, increase, or expand. In financial terms, riba typically refers to the additional amount charged on a loan beyond the principal.

How do Islamic scholars define riba?

-Different Islamic scholars have varying definitions of riba. According to the Shafi'i school, riba is any loan agreement that involves a time-bound debt with an extra payment. The Hanafi school defines riba as a surplus added to the debt amount on loaned items, which can either be tangible or intangible. Other scholars, such as Sayid Sabiq, describe it as any additional amount, whether large or small, added to a loan.

What does the Quran say about riba?

-The Quran addresses riba in multiple verses, particularly in Surah Al-Baqarah (2:275–279), Surah Al-Imran (3:130–131), and Surah An-Nisa (4:160–161). Initially, riba was condemned in stages, with warnings about its harm followed by complete prohibition. The final ruling in Surah Al-Baqarah declared all forms of riba as unlawful, emphasizing its harmful social and economic effects.

What are the different types of riba mentioned in the script?

-Riba is categorized into two major types: riba related to loans (riba al-qard) and riba related to trade transactions (riba al-bay'). Riba al-qard includes both riba al-jahiliyyah (pre-Islamic usury) and riba al-kard (a fixed interest rate on loans). Riba al-bay' is further divided into riba al-fadl (exchanging goods of the same type but differing in quantity) and riba al-nasi'ah (delaying the exchange of goods for a future date).

How did pre-Islamic Arabian culture practice riba?

-In pre-Islamic Arabia, riba was commonly practiced in the form of loans with added interest. This often led to situations where the borrower could not repay the debt, resulting in further penalties or additional amounts being added to the original debt, which was seen as exploitative and harmful to the borrower.

What is the impact of riba on society and individuals?

-Riba has a detrimental effect both on individuals and society. For individuals, it can lead to moral and psychological corruption, weakening their faith and increasing their materialism. Societal impacts include economic inequality, as riba often exploits the poor and vulnerable, leading to social unrest, increased conflict, and a lack of solidarity among people.

What do the scholars say about the relationship between interest and riba?

-Many scholars agree that interest is a form of riba and is forbidden in Islam because it involves charging extra money on loans without equivalent work or effort. The practice of charging interest is seen as unfairly benefiting the lender at the expense of the borrower, which violates Islamic principles of fairness and justice.

Can Muslims engage in interest-based banking systems?

-Islamic scholars are divided on this issue. Some scholars, like Mustafa Azhar, argue that Muslims may engage with conventional banks in emergencies or when alternatives are not available. However, they emphasize that the ideal solution is to establish banks that operate according to Islamic principles, without interest or riba.

What did other religions and cultures say about riba?

-Other religions, including Judaism and Christianity, also oppose riba. In the Hebrew Bible, riba is forbidden among Jews, especially in intra-community transactions (Exodus 22:25, Deuteronomy 23:19). Christianity similarly condemns riba, as seen in passages like Luke 6:34–35, and early Christian scholars such as Plato and Aristotle also criticized the practice.

How does Islamic finance view the relationship between debt and profit?

-In Islamic finance, profit can only be earned through legitimate trade, where there is a fair exchange of goods or services. Charging interest on loans or debt is prohibited because it involves gaining profit without any real exchange or work being done. Islamic finance encourages profit-making through investment and partnerships, where both parties share the risks and rewards.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

BACA BUKU FIQH : " RIBA " | Kajian Fiqh Sulaiman Rasyid | Part 19

Ustadz. Latief Awaludin | Memahami Esensi Riba Dan Jenis-Jenis Nya

Fikih kelas 9 Tentang Riba

What is Riba, is it same as Interest Money? - Assim al hakeem

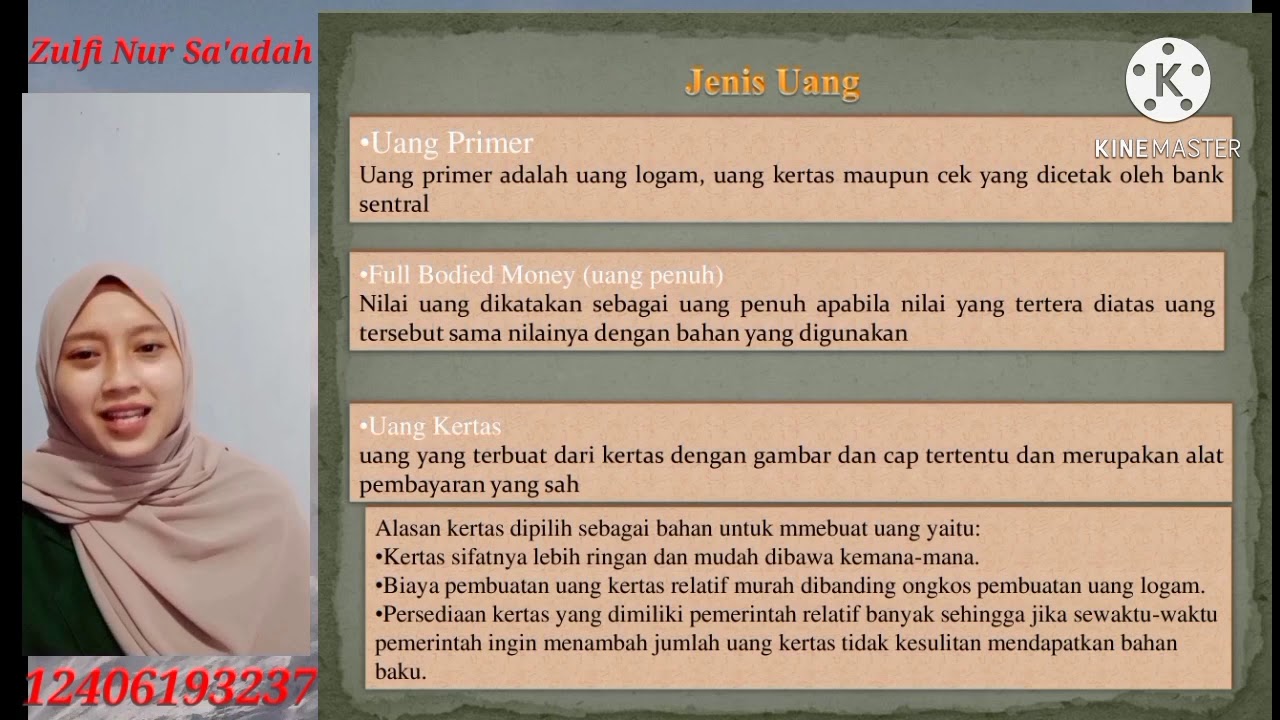

KONSEP UANG DALAM PERSPEKTIF ISLAM || TUGAS UTS || MANAJEMEN KEUANGAN SYARIAH 3F || IAIN TULUNGAGUNG

History of Riba and Why it is Prohibited in Islam

5.0 / 5 (0 votes)