Forecast menggunakan Orange Data Mining

Summary

TLDRThis video script presents a tutorial on how to use the Orange application for forecasting, specifically for predicting gold prices. The presenters explain how to upload historical data, select relevant variables, and apply time series forecasting models such as VAR and ARIMA. They demonstrate how to visualize the predictions with line charts, including predictions for the next three days. The script emphasizes the differences between the two models, highlighting their respective forecasts for closing prices, opening prices, and highs/lows, providing viewers with a practical approach to making accurate predictions using Orange.

Takeaways

- 😀 The group is presenting a method of forecasting using the Orange application, with members Novi Sadora, Saomi Dewi, and Putri Pramudya.

- 😀 The process begins by importing data related to gold price history, including variables such as volume, transaction date, opening price, highest price, and lowest price.

- 😀 The target variable for forecasting is chosen as 'change' (perubahan), which represents the change in gold prices.

- 😀 The forecasting process requires a time series, which must be installed in the Orange application through the Time Series add-on.

- 😀 Two forecasting methods are tested: the VAR (Vector Autoregression) model and the ARIMA (AutoRegressive Integrated Moving Average) model.

- 😀 Both VAR and ARIMA models are connected to the imported data to generate forecasts.

- 😀 The forecast is visualized using a line chart to compare the predicted outcomes of both models.

- 😀 The forecast covers the next three days and shows variations in the forecasted prices (closing price, opening price, highest price).

- 😀 The VAR model provides forecasts with a tolerance range, indicating potential variations in the predicted values.

- 😀 The ARIMA model provides direct forecasted values without a tolerance range, showing more specific predictions for each day.

- 😀 The forecast predictions help understand the possible price trends in the coming days, useful for analyzing market behavior and decision-making.

Q & A

What is the primary purpose of the presentation?

-The primary purpose of the presentation is to explain how to perform forecasting using the Orange application, focusing on time series forecasting and the use of models like ARIMA and VAR.

Which file is being used in the demonstration for forecasting?

-The file being used contains historical data related to gold purchases, including variables like price changes, volume, transaction dates, and opening, closing, highest, and lowest values.

What is the target variable chosen for forecasting in the demonstration?

-The target variable chosen for forecasting is the 'change in price' (perubahan), which represents the fluctuation in the price of gold.

How do you start the forecasting process in the Orange application?

-To start the forecasting process, you first upload the file, select the target variable (price change), and ensure the time series add-on is installed in Orange to proceed with time series forecasting.

What are the two forecasting models used in the demonstration?

-The two forecasting models used in the demonstration are the VAR (Vector Autoregression) model and the ARIMA (AutoRegressive Integrated Moving Average) model.

How do you visualize the forecast results in Orange?

-The forecast results are visualized using a line chart in Orange, which shows the forecasted values over time, allowing users to compare the results from different models.

What is the significance of the tolerance area shown in the VAR model forecast?

-The tolerance area in the VAR model forecast represents the range of uncertainty around the predicted values. It shows the expected variation (plus or minus) from the forecasted values.

What is the expected outcome when forecasting the closing price using the VAR model?

-When forecasting the closing price using the VAR model, the forecast indicates a decrease followed by a slight increase and then another decrease in the closing price for the following days.

What is the key difference between the VAR and ARIMA models in the demonstration?

-The key difference is that the VAR model includes a tolerance range (uncertainty around the forecast), while the ARIMA model directly provides point forecasts without any uncertainty or tolerance range.

Why is the forecast limited to a 3-day period in the demonstration?

-The forecast is limited to a 3-day period to prevent the predictions from becoming too inaccurate or diverging significantly over longer periods. Shorter time frames offer more reliable forecasts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Praktikum Double Exponential Smoothing

Silver Slingshot Update: "I Believe a $10 Move Is Coming Quickly" | Mike Maloney

Central Bank and Investor Demand Are Driving Gold Prices Higher

Praktikum Ekonometrika II - Analisis ARIMA di EViews

Predict Water Quality with Random Forests Coding Tutorial

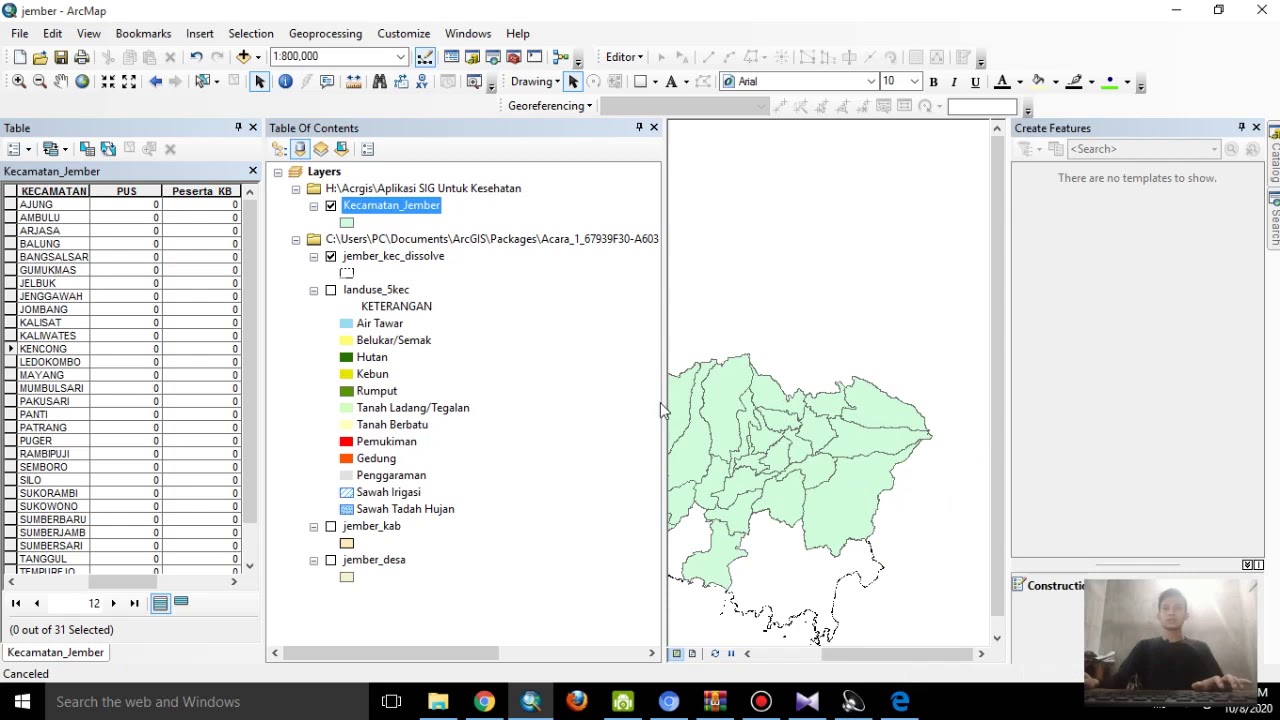

Aplikasi SIG Untuk Kesehatan Part 1 | CARA INPUT DATA KESEHATAN

5.0 / 5 (0 votes)