Payment Reconciliation Meaning & Steps

Summary

TLDRPayment reconciliation is a vital accounting process that ensures internal financial records match external payment data. This helps identify errors, uncashed checks, and potential fraud. The process consists of four steps: record retrieval, matching, reconciliation, and finalization. While traditionally time-consuming, automation through tools like NetSuite streamlines this process, making it faster and more accurate. By automating the matching phase, businesses can quickly address discrepancies, improving financial health and reducing errors.

Takeaways

- 😀 Payment reconciliation is an essential accounting process that compares internal and external financial records.

- 😀 The purpose of payment reconciliation is to ensure accuracy in cash flow and detect errors, uncashed checks, or fraud.

- 😀 Payment reconciliation occurs in four key steps: record retrieval, matching, reconciliation, and finalization.

- 😀 Record retrieval involves gathering all relevant documentation, including internal transaction records and external documents from financial institutions.

- 😀 Matching is the phase where internal transactions are compared with external records, and matching entries are removed from further review.

- 😀 Reconciliation occurs when discrepancies are found, and each transaction is reviewed to identify the cause of the mismatch and fix it.

- 😀 Finalization happens once all discrepancies are addressed, and journal entries are made to adjust the general ledger.

- 😀 Manual payment reconciliation can be tedious, error-prone, and time-consuming.

- 😀 NetSuite automates the matching process by importing external data from banks and credit cards, saving time and effort.

- 😀 Automation in payment reconciliation allows businesses to quickly identify discrepancies and ensure financial records are up-to-date and accurate.

Q & A

What is payment reconciliation?

-Payment reconciliation is an accounting process that compares internal financial records, such as the general ledger, with external payment records from financial institutions to ensure the entries match.

Why is payment reconciliation important for businesses?

-Payment reconciliation is important because it provides an accurate view of a company's cash on hand, helps identify errors, uncashed checks, and even instances of fraud, ensuring the financial health of the business.

What are the four steps involved in payment reconciliation?

-The four steps in payment reconciliation are: 1) Record retrieval, 2) Matching, 3) Reconciliation, and 4) Finalization.

What is the first step of payment reconciliation?

-The first step is record retrieval, which involves gathering all relevant documentation, such as internal transaction records and external payment documents, to reconcile the payment.

How does the matching phase work in payment reconciliation?

-During the matching phase, each recorded transaction is compared to external documents. If they match, they are removed from further review; otherwise, they move on to the reconciliation phase.

What happens during the reconciliation phase?

-In the reconciliation phase, transactions that failed to match are further investigated to identify the cause of discrepancies and rectify them.

What is involved in the finalization step of payment reconciliation?

-In the finalization step, once all transactions are reconciled, journal entries are made to correct errors and adjust the general ledger accounts.

Why can payment reconciliation be tedious and error-prone?

-Payment reconciliation can be tedious and error-prone when done manually due to the time-consuming process of matching internal and external records.

How does automation improve the payment reconciliation process?

-Automation improves payment reconciliation by automating the matching process. External data from banks and credit cards is automatically imported and compared to internal records, reducing time and effort spent on manual matching and improving accuracy.

What role does NetSuite play in payment reconciliation?

-NetSuite automates the payment reconciliation process, allowing external data from financial institutions to be automatically imported and matched with internal records, making the process faster and more accurate.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

materi AP 2 Rekonsiliasi bank

What is Batch Payment in Odoo 17 Accounting | How to Group Payments Into a Single Batch in Odoo 17

Zaggle introduces Zoyer!

Order-to-Cash Process in SAP SD – Step by Step (Full Beginner Guide 2025)

FINANCIAL vs MANAGERIAL Accounting

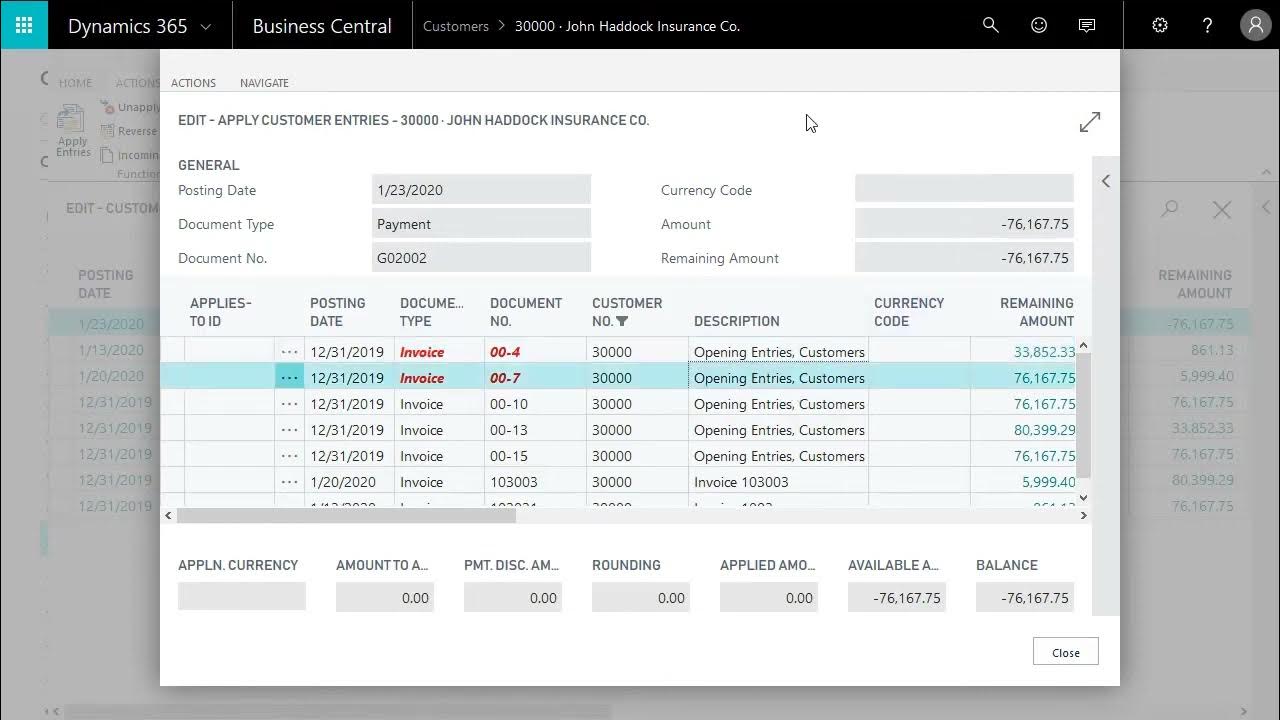

12 - Dynamics 365 Business Central - How to Apply Payments

5.0 / 5 (0 votes)