Akuntansi Kliring (Part 1)

Summary

TLDRThe transcript discusses the process of clearing transactions, highlighting the differences between debit and credit entries. It explains how transactions involving significant outflows can cause a negative balance, leading to clearing issues. The video also covers the accounting aspect of clearing, such as when a bank submits a Giro check to a partner bank, resulting in successful clearing. Key journal entries for this process, such as 'General Clearing' and 'Giro Account,' are explained, providing insight into financial transaction management and the role of clearing in banking.

Takeaways

- 😀 Kliring is a settlement process used to reconcile payments between banks and clearing agents.

- 😀 The primary concept of a clearing house is to ensure smooth financial transactions between multiple parties.

- 😀 In this specific case, 300 and 400 represent smaller values on the credit side because there are more outgoing transactions than incoming ones, leading to a deficit.

- 😀 If a bank experiences a higher volume of outgoing transactions, it could result in a deficit in its clearing account.

- 😀 In clearing, if a transaction is unsuccessful, it may be marked as 'kliring kalah' (failed clearing).

- 😀 One specific example is the clearing deposit where an individual (referred to as Rudi) deposits a cheque worth 15 million into a partner bank's clearing account.

- 😀 The successful transaction means the clearing account is credited with the deposit amount of 15 million.

- 😀 The transaction is recorded in the accounting journal as a debit to the general clearing account and a credit to the customer's giro account.

- 😀 The clearing process ensures that money is transferred efficiently across different banks, facilitating smooth financial transactions.

- 😀 Proper accounting of clearing transactions is crucial for maintaining accurate financial records and ensuring transparency.

Q & A

What is the primary role of Bank Indonesia in the banking sector?

-Bank Indonesia is responsible for managing the monetary policy, regulating the payment system, and overseeing the financial institutions in the country.

What are the three main tasks of Bank Indonesia according to the 1999 Law No. 23?

-The three main tasks of Bank Indonesia are: managing monetary policy, ensuring the smooth operation of the payment system, and regulating and supervising financial institutions.

What types of financial instruments are commonly used in the clearing process?

-Common financial instruments in the clearing process include checks, giro (bank transfers), bilyet giro (bank order), wesel (a transfer medium), and nota debet (a debt note).

How does the clearing system work in a manual process?

-In a manual clearing process, transactions are prepared and calculated manually, with physical verification of the financial instruments. Banks process these transactions manually by calculating clearing balances and ensuring funds are available.

What is the difference between debet and kredit transactions in clearing?

-In a debet transaction, the bank deducts funds from a customer's account, while in a kredit transaction, the bank adds funds to a customer's account.

How is a clearing failure handled when a bank does not have sufficient funds?

-If a bank does not have enough funds in its giro account at Bank Indonesia, the bank will fail the clearing transaction and will need to top up the missing funds to continue in the system.

What happens when a customer deposits a bilyet giro worth 15 million into their account?

-When a customer deposits a bilyet giro worth 15 million, it results in an increase in their giro account balance, which is then recorded in the bank's accounting system.

What are the stages of the clearing process that banks undergo?

-The stages include: preparing the clearing transactions (manual or semi-automated), verifying the funds, calculating balances, and finalizing the settlement through the clearinghouse, with Bank Indonesia overseeing the process.

How do automated clearing systems differ from manual systems?

-Automated clearing systems streamline the process by using technology to automatically handle transactions, calculations, and settlements, while manual systems rely on human intervention for these tasks.

What is the importance of clearing for the banking system?

-Clearing is crucial as it ensures the efficient and accurate transfer of funds between banks, maintaining liquidity in the financial system, and enabling smooth business and consumer transactions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

TIPOS DE LANÇAMENTOS CONTÁBEIS | ENTENDA A DIFERENÇA ENTRE SIMPLES, COMPOSTOS E COMPLEXOS

SIKLUS AKUNTANSI PERBANKAN SYARIAH: JURNAL UMUM (2)

Accounting Cycle Step 1: Analyze Transactions

Pendalaman Siklus Akuntansi Perusahaan Part 2

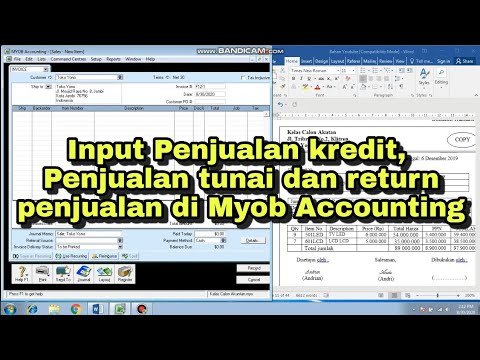

CARA INPUT TRANSAKSI PENJUALAN KREDIT, PENJUALAN TUNAI DAN RETURN PENJUALAN DI MYOB ACCOUNTING

Debit and Credit | Odoo Accounting

5.0 / 5 (0 votes)