Pengelolaan Keuangan buat Pemula (Tips Biar Uang Lo Gak Cepat Habis!)

Summary

TLDRIn this video, the speaker shares practical tips on improving financial management. They emphasize the importance of understanding one’s financial condition, identifying assets, debts, and savings. The speaker suggests setting priorities based on personal needs, tracking expenses regularly, and saving for long-term goals like buying a house or creating an emergency fund. The video also promotes a financial management workshop hosted by 'Satu Persen,' offering in-depth lessons on budgeting, financial planning, and reviewing personal finances. The goal is to help viewers manage their money more effectively and consistently.

Takeaways

- 😀 Start by identifying your current financial situation, including savings, assets, and debts.

- 😀 Set priorities by understanding your monthly needs and focusing on what matters most to you.

- 😀 Track and review your expenses regularly to identify unnecessary spending and make adjustments.

- 😀 Saving for long-term goals is crucial; create specific objectives like emergency funds or home loans.

- 😀 Without a clear purpose for saving, you’re more likely to be impulsive with your spending.

- 😀 Identifying patterns in your spending can help you make smarter financial choices.

- 😀 Be aware of small expenses, like eating out frequently, that could be reduced to save more.

- 😀 Having clear financial goals will make it easier to stay disciplined and focused on saving.

- 😀 A comprehensive financial workshop can provide deeper insights into managing your money effectively.

- 😀 Joining a workshop helps you develop skills to create a personalized financial plan and improve your money management.

- 😀 Taking action on your finances today can lead to more secure and confident financial decisions in the future.

Q & A

What is the meaning behind the saying 'money comes only to go'?

-The saying 'money comes only to go' suggests that money tends to be spent quickly and sometimes without us realizing where it went. It's often used humorously but reflects the reality that managing money can be challenging, and it tends to disappear faster than expected.

What is the first step in managing money better?

-The first step in managing money better is identifying your current financial condition. This involves understanding where you stand with your savings, income, assets, and debts.

How can identifying your financial condition help?

-Identifying your financial condition gives you a clear picture of your financial health, helping you assess whether your current financial situation is stable or requires improvement. It helps you see where your money is going and make informed decisions moving forward.

What is the role of creating a financial priority scale?

-Creating a financial priority scale helps you distinguish between your essential needs and wants. By identifying your monthly needs, you can prioritize spending and make sure the most important expenses are covered first, which helps in managing finances more effectively.

How do personal priorities influence financial management?

-Personal priorities influence financial management by determining which expenses are deemed most important. For example, some people may prioritize food and daily necessities, while others may consider internet bills or subscriptions more critical. Understanding your own priorities allows you to allocate funds more efficiently.

Why is tracking your expenses regularly important?

-Tracking your expenses regularly is crucial because it helps you understand your spending habits. This allows you to identify areas where you might be overspending and make adjustments to improve your financial management. Regular reviews provide insights into whether your spending aligns with your financial goals.

What is the significance of having a long-term savings goal?

-Having a long-term savings goal gives you a clear purpose for saving, making it easier to stay motivated and disciplined in saving money. Without a clear goal, savings can feel aimless, leading to impulsive spending rather than saving for important milestones like buying a home or building an emergency fund.

What is the danger of saving without a clear purpose?

-Saving without a clear purpose is risky because it can lead to indecision and a lack of commitment to saving. If there's no specific goal, it becomes easier to justify spending the saved money on non-essential wants, instead of using it for something more important.

How can a workshop on money management help?

-A workshop on money management can help you gain a deeper understanding of how to handle your finances effectively. It provides tools and strategies for budgeting, setting financial goals, tracking expenses, and making smarter financial decisions. It’s especially beneficial for beginners or those struggling with financial management.

What additional resources are provided in the workshop to help with financial planning?

-The workshop provides additional resources such as worksheets that can help participants track their financial progress, review their spending habits, and set realistic financial goals. These tools are designed to make managing money easier and more structured.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Why NOBODY Wants to Work Anymore

50 Easy Habits That Will Change Your Life Forever

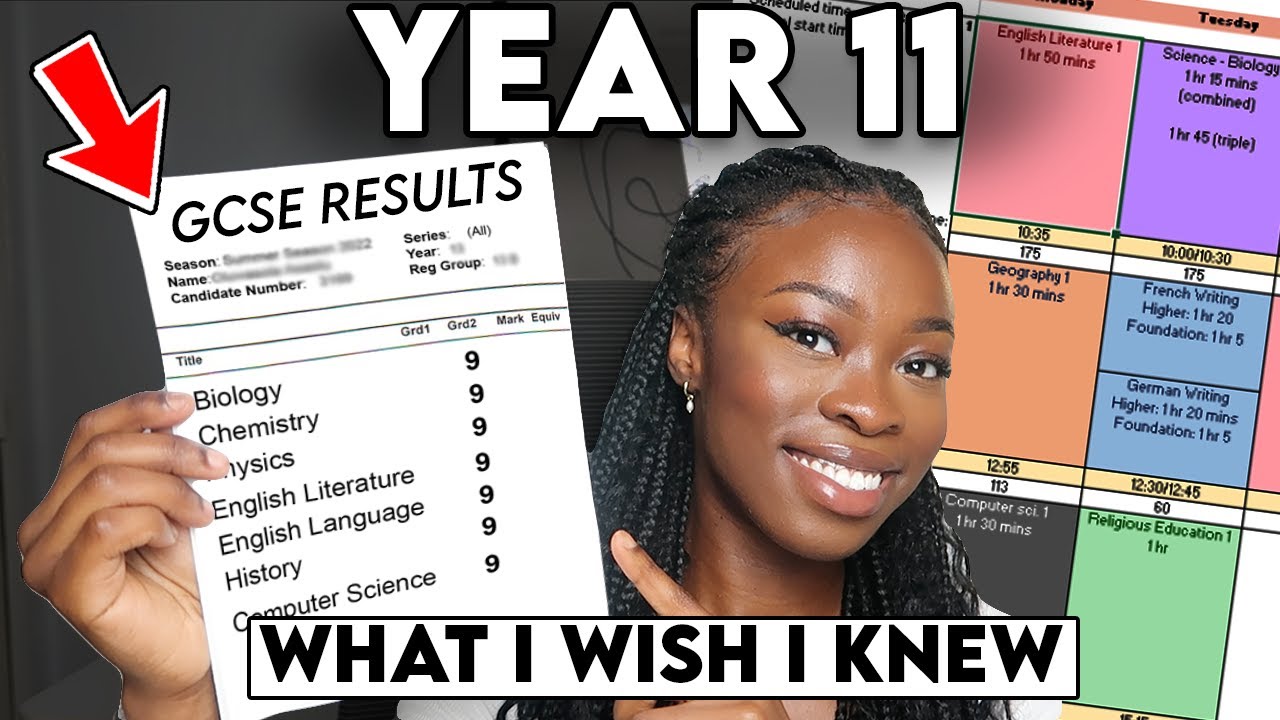

YEAR 11 TIPS | WHAT I WISH I KNEW - GRADE 9 GCSE ADVICE

Apa itu Investasi dan Gimana Cara Menghindari Investasi Bodong? | feat. Mercy Widjaja

ASKING SEAN #283 | SETTLE THE LOAN EARLY TO SAVE ON INTEREST?

Millionaire Investor Explains How to Make $1,000,000 If You’re Broke

5.0 / 5 (0 votes)