¿Cuánto cuesta un empleado en Panamá?

Summary

TLDRThis video script explains the costs involved in employing a worker in Panama, breaking down both employee deductions and employer expenses. It details how an employee with a monthly salary of 1,000 faces deductions for social security, educational insurance, and income tax, leaving them with a take-home of 866.92. For the employer, additional costs include vacation pay, 13th-month pay, seniority premiums, indemnity (optional), and various employer contributions, such as social security and insurance. The total cost for the employer can rise to 1,400.17, representing a 41.74% increase over the base salary, or 1,300.51 without indemnity.

Takeaways

- 😀 An employee in Panama earning 1000 USD per month pays 9.75% for social security and 1.25% for educational insurance.

- 😀 After deductions for social security and educational insurance, the employee's take-home salary is 866.92 USD.

- 😀 The employer incurs additional costs beyond the employee's salary, including vacation and the 13th month payment.

- 😀 Vacation is a mandatory right, and its calculation is based on the total salary divided by 11.

- 😀 The 13th month is a mandatory payment, calculated by dividing the total salary by 12.

- 😀 Seniority bonuses are mandatory for indefinite contracts, and they are calculated by dividing the total salary by 52.

- 😀 Indemnification is not mandatory but may be paid under certain conditions. Some organizations only reserve a percentage for this.

- 😀 The cost of indemnification is calculated as the seniority bonus multiplied by 3.4.

- 😀 The employer's contributions include 12.25% for social security, 1.50% for educational insurance, and 2.10% for professional risks.

- 😀 The total additional employer cost is 417.36 USD, representing 41.74% of the employee's salary.

- 😀 In total, an employee earning 1000 USD per month costs the employer 1400.17 USD, including all employer contributions.

- 😀 If indemnification is excluded, the additional employer cost is 35.20% of the salary, making the total cost 1300.51 USD.

Q & A

What is the gross salary of the employee in the example?

-The employee's gross salary is 1,000 USD per month.

What are the deductions made from the employee's salary?

-The employee's salary is reduced by 9.75% for social security, 1.25% for educational insurance, and other income tax deductions, leaving the employee with 866.92 USD.

What additional costs must the employer cover beyond the employee's salary?

-The employer must cover additional costs like vacation, 13th month salary, seniority premium, indemnification (optional), social security, educational insurance, and professional risk insurance.

How is the vacation cost calculated?

-The vacation cost is calculated by dividing the total salary by 11.

What is the 13th month salary and how is it calculated?

-The 13th month salary is mandatory and is calculated by dividing the total salary by 12.

How is the seniority premium calculated, and who is eligible for it?

-The seniority premium is calculated by dividing the total salary by 52 and is mandatory for employees with indefinite contracts.

Is indemnification mandatory for employers to pay?

-No, indemnification is not mandatory. It is paid under certain conditions, and some organizations may not make provisions for it.

How is the indemnification calculated if it is applicable?

-If indemnification is applicable, it is calculated as the value of the seniority premium multiplied by 3.4.

What is the employer's contribution to social security and educational insurance?

-The employer must contribute 12.25% for social security and 1.5% for educational insurance, both based on the total salary.

How is the professional risk insurance calculated?

-The professional risk insurance is calculated based on a percentage defined by the social security, which varies for each organization. In this example, it is assumed to be 2.10%.

What is the total cost of the employee to the employer, including all contributions?

-The total cost to the employer, including all contributions, is 1,400.17 USD, which is 41.74% more than the employee's gross salary.

How much does the employee cost the employer if indemnification is excluded?

-Without indemnification, the total cost to the employer would be 1,300.51 USD, which represents 35.2% more than the employee's gross salary.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Biaya Tenaga Kerja Dlm Akuntansi Biaya

Understanding Your Paycheck

PART 10 | TUTORIAL E-BUPOT 21/26 | Perbedaan Perhitungan PPh Pasal 21 Nett, Gross, dan Gross Up

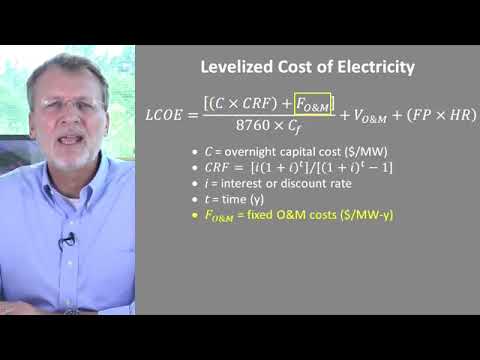

Levelized Cost of Electricity - Energy Consulting #energy #infrastructure #ehicorp

3 CORE AMP, Payroll & ACCTG Portal Part 2

Tax Credits vs Tax Deductions: What is the Difference and Which is Better?

5.0 / 5 (0 votes)