Cara Membuat Bupot PPh 23 Unifikasi Coretax

Summary

TLDRThis tutorial provides a step-by-step guide on how to create a PPh 23 Unified Tax Receipt (Bukti Potong) through the Kortek website. The process includes logging into the Kortek DJP portal, updating the taxpayer profile, and creating the PPh 23 receipt by filling in necessary tax details such as transaction partner's NPWP, tax object, and relevant documents. The video also covers how to confirm the document with a digital signature and download the final tax receipt. The tutorial is aimed at making the process easier for users in the tax community.

Takeaways

- 😀 Access the Kortek DJP website at kortekdjp.pajak.go.id to start the process.

- 😀 Login using the *NIK* of the company’s responsible person as the user ID, along with password and captcha.

- 😀 After logging in, change from the personal account to the company’s tax profile.

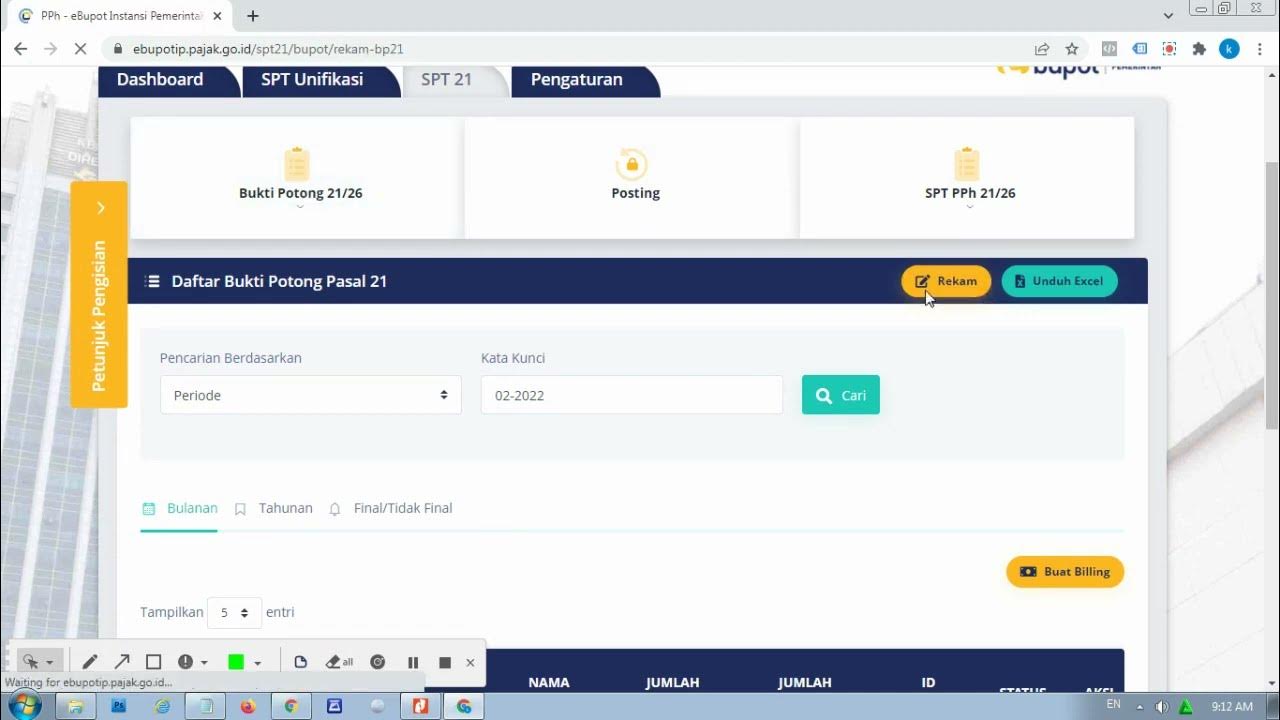

- 😀 Navigate to the IBUPOD BPU section on the dashboard to create a new BPPU (tax receipt).

- 😀 Choose the tax period (e.g., January 2025) and set the status to 'Normal'.

- 😀 Enter the NPWP of the transaction counterparty, which automatically populates the company name.

- 😀 Provide the *NIK* or identity number of the subunit organization receiving the income.

- 😀 Select the tax income type, such as PPh 23, and choose whether the tax has any facilities (e.g., 'Without Facility').

- 😀 Choose the relevant tax object (e.g., 'Jasa Wedding'), and the system automatically shows the corresponding tax code and rate.

- 😀 Fill in the tax base value according to the transaction details and choose the document type for reference (e.g., 'Other Document').

- 😀 Submit the information, then confirm the digital signature with the password of the authorized company owner before issuing the final tax receipt.

Q & A

What is the first step in creating a PPH 23 proof of withholding in Kortek?

-The first step is to access the Kortek DJP website at kortekdjp.pajak.go.id.

What information is required to log in to the Kortek application?

-You need to enter the User ID (which is the taxpayer's NIK), password, and captcha code.

How do you switch from an individual account to a company account in Kortek?

-You need to navigate to the profile section, then change the account type from individual to the company account by selecting the company name listed as a taxpayer.

After logging in, what section do you need to click on to begin creating a PPH 23 proof of withholding?

-You need to click on 'IBUOD' in the top left corner of the menu.

What details must be filled in when creating a PPH 23 proof of withholding?

-You must fill in the tax period, choose the tax status, enter the NPWP number of the transaction partner, and identify the income recipient's subunit organization.

What should you do after selecting the object of tax, such as 'services for a wedding'?

-After selecting the object of tax, you will see the tax type (PPH article 23) with the appropriate tax code and the tax rate, such as 2% for income tax.

What is required when entering the document reference section?

-You need to select the document type, enter the document number from the invoice, and select the invoice date.

What happens after you click 'Submit' on the PPH 23 proof of withholding page?

-After clicking 'Submit,' a success notification appears confirming that the data has been saved.

What is the next step after submitting the PPH 23 proof of withholding?

-The next step is to click 'Publish,' which takes you to the document signing confirmation menu.

How do you confirm the document signing in the Kortek system?

-To confirm the document signing, you must enter the signature password (which is the password of the authorized signatory) and click 'Confirm Signature.'

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

CARA BUAT BUKTI POTONG PPH 21 KARYAWAN DAN LAPOR SPT MASA PPH 21 DI CORETAX MULAI 2025

Cara Lapor eBupot Unifikasi Full Lengkap

PPh Orang Pribadi (Update 2023) - 13. Panduan Pengisian SPT 1770 (Status KK)

PPh Orang Pribadi (Update 2023) - 14. Panduan Pengisian SPT 1770 (Status PH/MT)

Tutorial Pembayaran Pajak Menggunakan e-Billing

Tata Cara input PPh 21 di E-Bupot dan Pelaporannya

5.0 / 5 (0 votes)