This Will Make You More Profit Than 99% Of Businesses

Summary

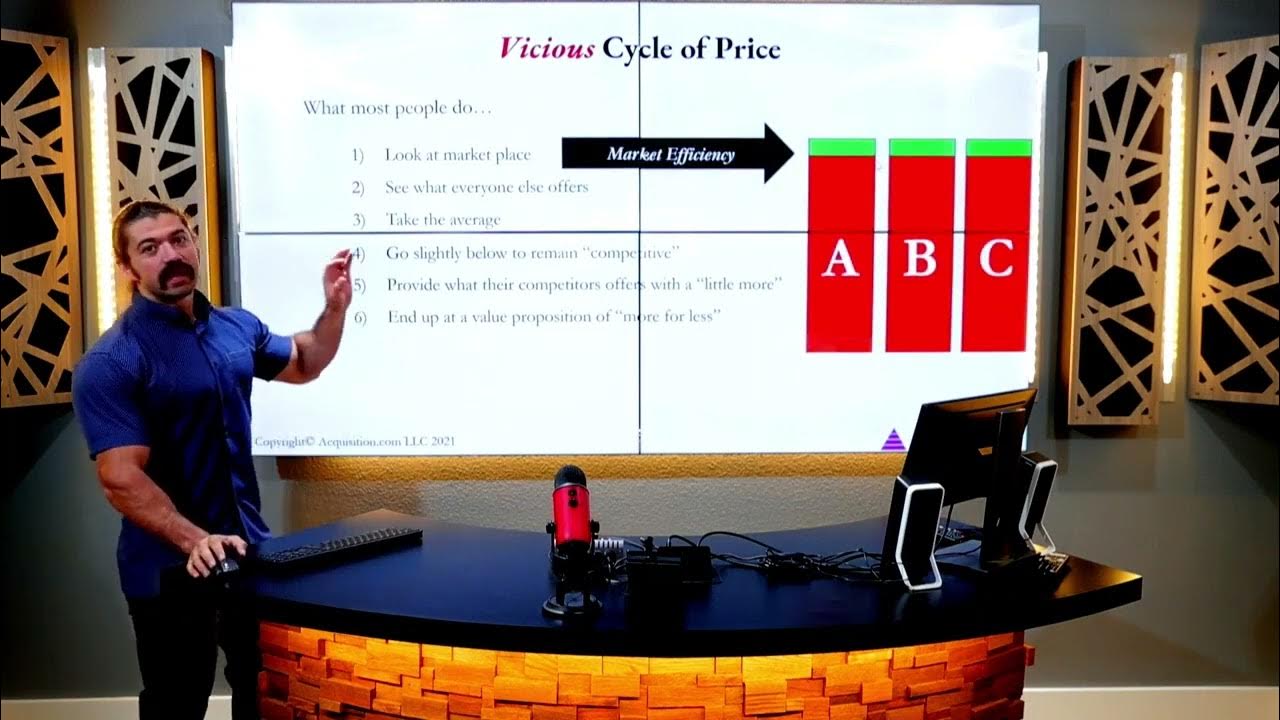

TLDRIn this video, Alex Rosi emphasizes the importance of strategic pricing for business profitability, asserting it has a six times stronger impact than customer acquisition. He introduces the concept of 'price to value discrepancy' and explains how to differentiate between one-time and consumable value in pricing. Rosi also discusses the benefits of annual billing over monthly or quarterly, highlighting its lower churn rate and higher lifetime value (LTV) for customers. He concludes with advice on finding business models where customers are less likely to cancel, advocating for a focus on cumulative value and quality over aggressive sales tactics.

Takeaways

- 📈 Optimizing pricing is crucial for business profitability, with a stronger impact than acquiring more customers or reducing churn.

- 🔢 Businesses often neglect the use of mathematical analysis in pricing strategies, which is a significant lever for increasing profits.

- 💰 Understanding the value delivered to customers is key, and differentiating between one-time and consumable value can lead to better pricing models.

- 📉 The price-value discrepancy can lead to customer churn, especially when the perceived value drops post-purchase.

- 💡 Introducing a startup or one-time fee for high-value, one-time products or services, alongside a lower recurring fee for consumable value, can improve customer retention and LTV (Lifetime Value).

- 📆 Billing frequency has a substantial impact on churn rates, with annual billing resulting in significantly lower churn compared to monthly or quarterly billing.

- 💼 The 'look back window' concept suggests that customers are more likely to renew if they perceive value over an extended period, which is influenced by the billing cycle.

- 🚀 Focusing on products or services with a naturally high customer retention rate can lead to a more stable and compounding business growth.

- 💹 It's essential to find the right balance between price and conversion rate to maximize revenue and ensure long-term customer retention.

- 🔄 Contracts can provide a sense of security for long-term customer relationships, but their effectiveness varies based on cultural and consumer behaviors towards commitments.

- 📊 Reporting cumulative value over time can help in extending the lookback period for customers, potentially increasing the perception of value and renewal rates.

Q & A

Why is pricing considered the most significant lever for increasing profitability in a business?

-Pricing is considered the most significant lever for profitability because optimizing pricing has a six times stronger increase on profitability than getting more customers and two times stronger increase than decreasing churn or getting people to buy more times.

Who is Alex Rosi and what is his role in the video?

-Alex Rosi is the owner of Acquisition, a portfolio of companies generating over $200 million a year. In the video, he shares his expertise to help viewers understand how to make their businesses more profitable through strategic pricing.

What is the 'Price to Value Discrepancy' concept mentioned by Alex Rosi?

-The 'Price to Value Discrepancy' concept refers to the difference between the value a customer perceives they are getting from a product or service and the price they pay. Ideally, businesses want to have a high value proposition with a price that is high relative to costs, leaving room for customer surplus or goodwill.

What is the difference between one-time value and consumable value in the context of pricing?

-One-time value refers to products or services that deliver value only once, like a course where the value diminishes to zero after consumption. Consumable value, on the other hand, refers to products or services that provide recurring value over time, such as a subscription to a community or software service.

Why is it important for businesses to differentiate between one-time and consumable value when pricing?

-Differentiating between one-time and consumable value is important because it helps businesses to price their offerings appropriately, reflecting the ongoing or diminishing value to the customer. This differentiation can lead to better customer retention and higher lifetime value (LTV).

What is the 'Big Head Long Tail' pricing model and how does it work?

-The 'Big Head Long Tail' pricing model involves charging a one-time fee for the initial high-value product or service and then a lower recurring fee for the ongoing consumable value. This model aims to match the price to the perceived value discrepancy over time, potentially reducing churn and increasing customer lifetime value.

How does billing frequency impact customer churn rates?

-Billing frequency significantly impacts customer churn rates. Monthly billing has the highest churn rate, while quarterly and annual billing reduce churn rates to about 5% and 2% respectively. This suggests that less frequent billing can lead to better customer retention.

What is the 'Look Back Window' concept and how does it affect customer renewal decisions?

-The 'Look Back Window' refers to the period a customer considers when evaluating the value they have received from a service since their last payment. Extending this window can increase the likelihood of renewal as customers consider the cumulative value over a longer period, rather than the value received in the most recent billing cycle.

Why is it beneficial for a business to focus on services that people don't often cancel?

-Focusing on services that people don't often cancel can lead to a more stable and recurring revenue stream. This approach reduces the need for constant customer acquisition and allows the business to benefit from compounding growth as long-term customers continue to pay over time.

How can a business use the concept of 'cumulative value' to improve customer retention?

-A business can use the concept of 'cumulative value' by reporting the total value delivered to customers over an extended period. This approach can help to frame the service's value positively, even if there are fluctuations in the value delivered from month to month, and can encourage customer renewal.

What are some strategies for raising prices in a way that maximizes profitability and maintains customer retention?

-Strategies for raising prices include testing different price points to find the optimal balance between conversion rate and price, ensuring that the total revenue per customer interaction is maximized. It's also recommended to raise prices gradually and to provide clear communication and value justification to customers when prices increase.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)