Change In State Of Delivery [CISD] - Orderblock Formation - ICT Concepts

Summary

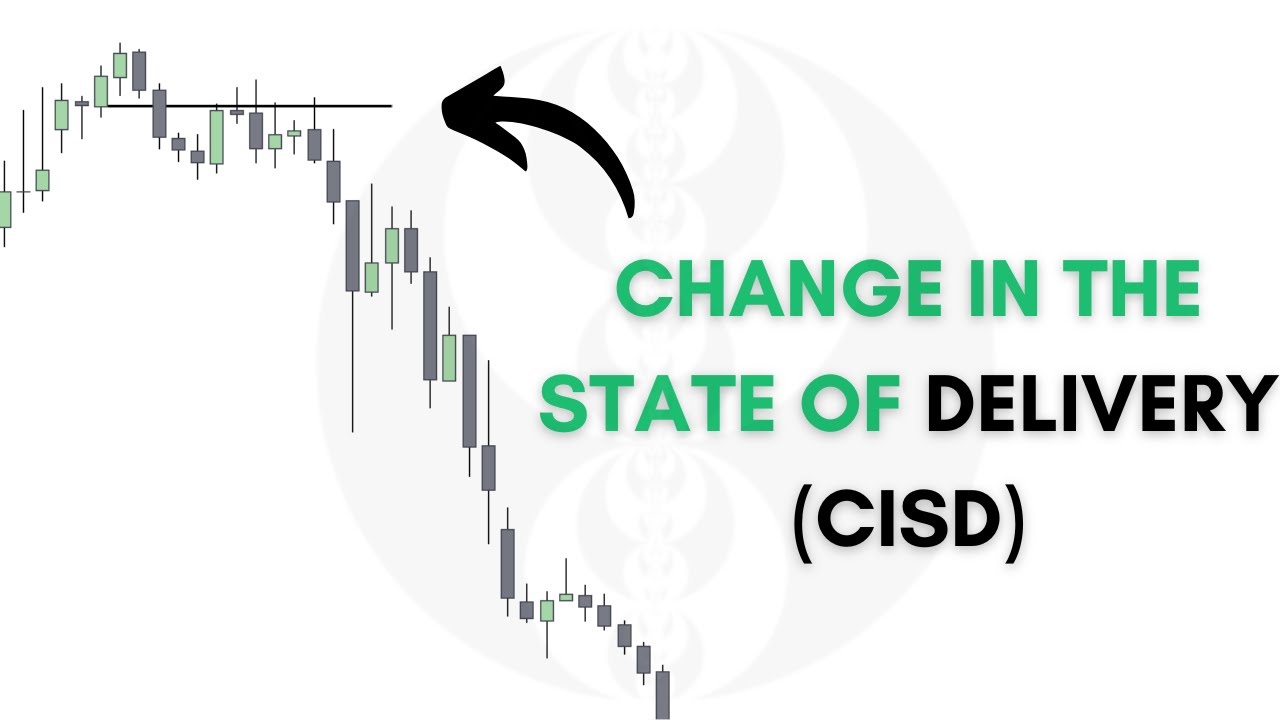

TLDRThis video explains the concept of 'Change in State of Delivery' in trading, which occurs when price shifts between bullish and bearish states. The presenter walks through several examples, demonstrating how to identify these changes using price action and candle closures. By incorporating standard deviations and AMD techniques, the video shows how to create effective entry models for trading. It covers using manipulation, order blocks, and fair value gaps as key tools for identifying potential trade setups. Viewers also learn to combine these strategies to make informed trading decisions based on multiple timeframes.

Takeaways

- 😀 The 'change in state of delivery' occurs when price transitions from bullish to bearish or vice versa.

- 😀 The key indicator for identifying a change in state of delivery is when a price close occurs below or above a series of up-close or down-close candles.

- 😀 Price action at important levels, such as higher time frame PD arrays, can signal a change in market direction.

- 😀 A lower time frame sweep after a displacement of price is a common signal for a change in state of delivery.

- 😀 After identifying a change in state of delivery, traders can anticipate price to trade in the opposite direction, targeting areas like previous lows or highs.

- 😀 Standard deviation projections can be used to set targets for trades after the state of delivery change has been confirmed.

- 😀 When applying change in state of delivery, it is crucial to combine it with order blocks and fair value gaps to strengthen the trade setup.

- 😀 Multiple time frame analysis (daily, hourly, and lower time frames) helps to confirm the bias and entry point for trades based on state of delivery.

- 😀 The 'Box setup' is a trading strategy that uses a range, manipulation, and order block formation to identify potential trades.

- 😀 Using the 'Box setup', traders should wait for a change in state of delivery or an order block formation before entering a trade.

- 😀 The script emphasizes the importance of confirmation using a close above or below a specific candle to validate entry points and target liquidity levels.

Q & A

What is the Change in State of Delivery in trading?

-The Change in State of Delivery refers to the shift in market direction, where price transitions from bullish to bearish or vice versa. It occurs when the price breaks below or above significant levels, often marked by a series of up-close or down-close candles.

How can you identify a Change in State of Delivery using candles?

-A Change in State of Delivery can be identified when the price breaks below a series of up-close candles (in a bullish trend) or above a series of down-close candles (in a bearish trend). The break confirms a potential reversal or shift in market sentiment.

What role do order blocks and fair value gaps play in this strategy?

-Order blocks and fair value gaps are used to support the price action after the Change in State of Delivery. They act as key levels where price may react, and traders use them for entry points, aiming to enter trades that align with the projected price movement.

How does standard deviation come into play in the entry model?

-Standard deviation is used to project potential price levels. By projecting the manipulation leg and applying standard deviation levels (-2 to -2.5 or -4), traders set targets for price movements, helping them refine entry and exit points.

How do you combine the Change in State of Delivery with a lower time frame entry model?

-After identifying the Change in State of Delivery on a higher time frame, you can zoom into a lower time frame to refine your entry. Look for further confirmation of the state change, such as a close below/above key candles, and then use order blocks or fair value gaps for potential entry points.

What is the significance of liquidity in this trading strategy?

-Liquidity plays a crucial role in identifying key levels for entry and exit. Liquidity zones, such as previous highs or lows, are where price manipulation can occur. Traders use these levels to anticipate potential price reactions and target areas with sufficient liquidity.

What is the importance of the 'manipulation leg' in this strategy?

-The manipulation leg refers to the price movement that breaks a key level before returning into the range. This leg provides valuable information for projecting future price movements, allowing traders to estimate where price might go next based on past price actions.

How can a trader use the hourly chart in this strategy?

-The hourly chart is used to confirm the bias established on higher time frames. By analyzing price action on the hourly chart, traders can spot the Change in State of Delivery, helping to refine entry points and confirm the overall market direction.

What is a Box Setup, and how does it fit into the overall strategy?

-A Box Setup involves identifying a range or accumulation zone where price consolidates. After the manipulation occurs, the trader looks for a retest of the highs or lows, typically using an order block or Change in State of Delivery to validate entry. The Box Setup helps to set up potential entries in a clear, structured manner.

What is the role of stops and targets in this strategy?

-Stops are placed above or below key levels (such as manipulation highs or lows), while targets are set based on projected price levels using standard deviation projections or liquidity zones. The stop placement ensures risk management, and the targets help in setting realistic expectations for price movement.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Change In The State Of Delivery (CISD) - Reversal Confirmation

Change in State of Delivery (CISD) - Understanding Reversals

ICT Mentorship Core Content - Month 04 - ICT Breaker Block

The Truth Behind PD Arrays (Understand Balanced Price Ranges)

Market Structure Shift vs Change In State Of Delivery - ICT

Predict Market Reversals Before Everyone Else - CISD

5.0 / 5 (0 votes)