PPh Orang Pribadi (Update 2023) - 3. PTKP

Summary

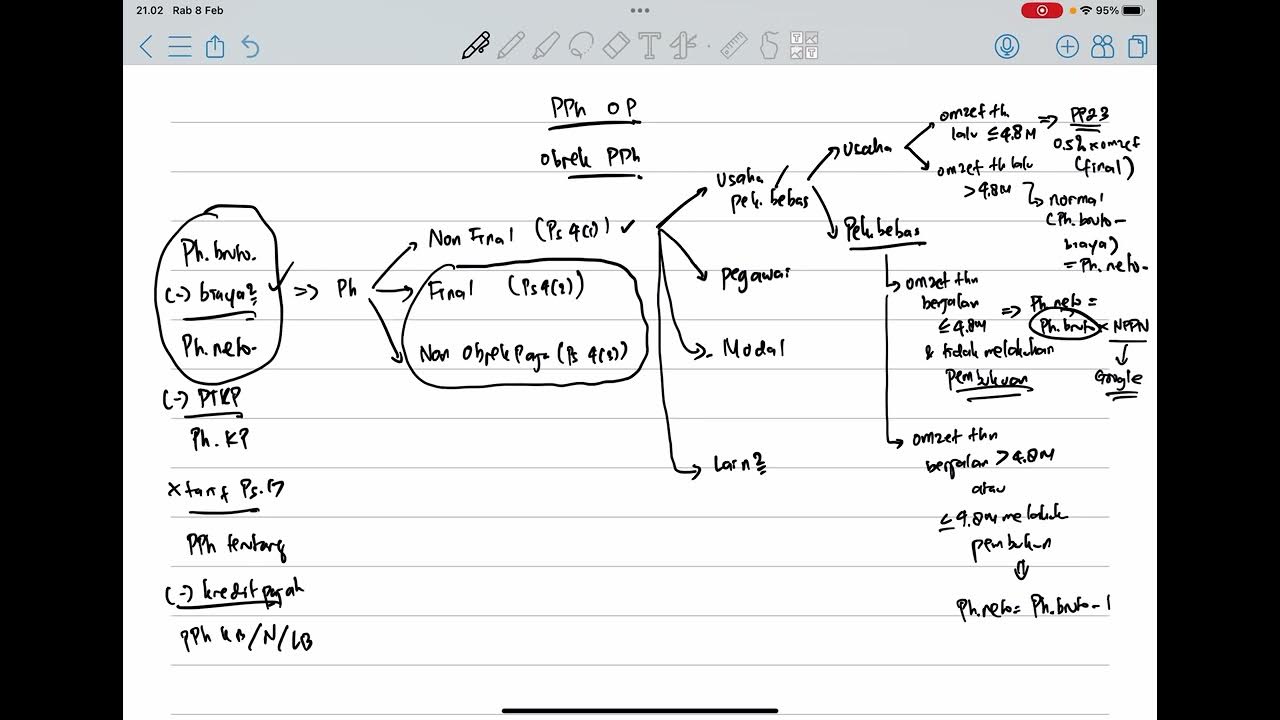

TLDRThis video explains the concept of PTKP (Non-Taxable Income) in Indonesia, which is relevant for individuals when calculating taxable income. The base amount for PTKP is 54 million IDR, with additional deductions for married individuals (4.5 million IDR) and dependents (up to 3, each worth 4.5 million IDR). The video also discusses how these figures change based on marital status and the number of dependents. It covers the calculation method for combined incomes, emphasizing how tax-free income limits increase depending on family status. The tutorial ends with a reminder to subscribe to the YouTube channel for more free training.

Takeaways

- 😀 PTKP (Pajak Penghasilan Tidak Kena Pajak) is the non-taxable income limit for individuals in Indonesia.

- 😀 The base PTKP amount for an individual is 54 million IDR.

- 😀 A married taxpayer receives an additional 4.5 million IDR in PTKP.

- 😀 Each dependent adds an additional 4.5 million IDR to the PTKP, with a maximum of 3 dependents.

- 😀 Dependents can be family members in a direct line of descent, such as children, parents, or grandparents.

- 😀 Dependents can also include in-laws, like the spouse's parents, as long as they are in the direct line of descent.

- 😀 For married couples, if both incomes are combined, the PTKP increases by 54 million IDR.

- 😀 A taxpayer without a spouse and dependents is entitled to 54 million IDR in PTKP, and with a spouse, it increases to 58.5 million IDR.

- 😀 If the individual has one dependent, the PTKP becomes 63 million IDR.

- 😀 The maximum PTKP with three dependents, including a married status, can reach up to 126 million IDR.

Q & A

What is PTKP in relation to taxes?

-PTKP (Penghasilan Tidak Kena Pajak) refers to the income that is exempt from taxation in Indonesia. It is a tax-free income threshold for individuals, meaning that individuals earning up to this amount will not be taxed.

What is the base PTKP amount for an individual?

-The base PTKP amount for an individual is 54 million IDR.

How does marital status affect PTKP?

-If a taxpayer is married, the PTKP is increased by 4.5 million IDR. This is an additional benefit for married individuals.

What is the PTKP adjustment for dependents?

-For each dependent, an additional 4.5 million IDR can be added to the PTKP, with a maximum of three dependents allowed.

Who qualifies as a dependent under the PTKP system?

-Dependents include children (biological, stepchildren, or adopted), spouses, parents, and grandparents, as long as they are in a direct family line (blood or marriage).

What is the maximum number of dependents considered for PTKP?

-The maximum number of dependents that can be considered for PTKP is three.

How does combining spouses' income affect PTKP?

-If a married couple combines their incomes, the PTKP for the couple increases by an additional 54 million IDR, in addition to the benefits from dependents, if applicable.

What is the notation for PTKP calculation when there are dependents?

-The notation is written as 'KI 1', which refers to the base PTKP of 54 million IDR plus additional amounts for each dependent, with a maximum of three dependents.

What is the maximum PTKP for a married individual with three dependents?

-The maximum PTKP for a married individual with three dependents is 126 million IDR, which includes the base 54 million IDR, an additional 54 million IDR for the spouse, and 4.5 million IDR for each of the three dependents.

How does PTKP affect tax liability?

-PTKP reduces the taxable income by excluding the amount up to the PTKP threshold. Individuals whose income is below this threshold are not required to pay taxes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Menghitung Pajak Penghasilan Berdasarkan UU Nomor 7 Tahun 2021 (Part 1)

Menghitung Pajak Penghasilan - PPh

MENGENAL PPH 21 LEBIH DEKAT AGAR TIDAK SALAH PAHAM DENGAN PERUSAHAAN ANDA

Usaha Anda (SCTV) ~ Kenaikan Penghasilan Tidak Kena Pajak (PTKP)

PPH Orang Pribadi (Update 2023) - 2. Objek Pajak

Sesuai PMK 168/2023 Berlaku Januari - Cara Hitung PPH 21 Bukan Pegawai

5.0 / 5 (0 votes)