Jurnal Penyesuaian Perusahaan Dagang

Summary

TLDRThis educational video explains the concept of adjustment journals in accounting, specifically for trading companies. It covers essential processes such as inventory adjustments using two methods: Income Summary and Cost of Goods Sold. The video also explores various types of adjustments like depreciation, accruals for unpaid expenses and revenues, prepaid expenses, and unearned income. Practical examples with journal entries are provided to illustrate how these adjustments are recorded, ensuring accurate financial reporting at the end of each accounting period. The content is designed to help viewers understand the intricacies of adjustment journals in a straightforward manner.

Takeaways

- 😀 Adjustment journals are essential for businesses to ensure financial statements reflect accurate asset, liability, equity, revenue, and expense accounts at the end of each period.

- 😀 Trading companies are required to make adjustment entries for inventory, which is not necessary for service companies.

- 😀 There are two methods for recording inventory: the gross profit method and the cost of goods sold (COGS) method.

- 😀 The gross profit method involves adjusting the opening and closing inventory using a journal entry that credits and debits the inventory account and the profit summary account.

- 😀 The COGS method involves a more detailed adjustment, using additional accounts like purchases, purchase returns, and freight costs to calculate the cost of goods sold.

- 😀 The beginning inventory balance is taken from the trial balance, while the ending inventory is based on a physical count of unsold goods at the end of the period.

- 😀 Depreciation of fixed assets, such as buildings and vehicles, must be adjusted at the end of the period, with journal entries to reflect accumulated depreciation.

- 😀 Prepaid expenses, like insurance, must be adjusted to show the portion that has been used up, with an entry transferring the expense to the appropriate period.

- 😀 Unpaid expenses, such as wages, and unrecognized revenue, like interest income, require adjustment to ensure the financial statements reflect accurate liabilities and receivables.

- 😀 Example journal entries for adjustment include adjusting prepaid insurance, wages payable, and unrecorded interest revenue, ensuring accurate representation of the financial position.

Q & A

What is the purpose of making adjusting journal entries in accounting?

-The purpose of adjusting journal entries is to update the account balances so that they accurately reflect the true financial condition of assets, liabilities, equity, revenue, and expenses at the end of an accounting period.

What are the two methods for inventory adjustment in a trading company?

-The two methods for inventory adjustment in a trading company are the Gross Profit Method and the Cost of Goods Sold (HPP) Method.

How does the Gross Profit Method work in adjusting inventory?

-In the Gross Profit Method, the adjusting entry involves debiting the 'Gross Profit Summary' account and adjusting the inventory accounts to match the physical count of inventory at the end of the period.

What is the Cost of Goods Sold (HPP) Method used for in adjusting inventory?

-The Cost of Goods Sold (HPP) Method is used to adjust inventory by accounting for purchases, purchase returns, transportation costs, and ending inventory. This method results in adjusting the 'Cost of Goods Sold' account.

What is the formula to calculate the Cost of Goods Sold (HPP)?

-The formula to calculate HPP is: Beginning Inventory + Purchases + Transportation Costs - Purchase Returns - Purchase Discounts - Ending Inventory.

What is the process for adjusting for depreciation on fixed assets?

-To adjust for depreciation, the depreciation expense is calculated based on a predetermined percentage (e.g., 10% for store equipment or 15% for buildings and vehicles), and the corresponding journal entries are made to debit 'Depreciation Expense' and credit 'Accumulated Depreciation'.

How is prepaid insurance treated in adjusting journal entries?

-Prepaid insurance is treated by adjusting the prepaid amount based on the time elapsed. The portion of the insurance that has been used up is expensed, while the remaining prepaid portion is recorded as an asset.

What journal entry is made for unpaid wages at the end of an accounting period?

-For unpaid wages, the journal entry is to debit 'Wage Expense' and credit 'Wages Payable' to recognize the liability for the wages that employees have earned but not yet been paid.

How are earned but unpaid interest revenues adjusted in journal entries?

-For earned but unpaid interest revenues, the adjustment involves debiting 'Interest Receivable' and crediting 'Interest Revenue' to recognize the income that has been earned but not yet received.

How are journal entries made for prepaid expenses like insurance or supplies?

-For prepaid expenses, such as insurance or supplies, the used portion is recorded as an expense, and the unexpired portion remains as an asset. The journal entry debits the expense account and credits the asset account, or vice versa, depending on the usage.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Menyusun Jurnal Penyesuaian

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

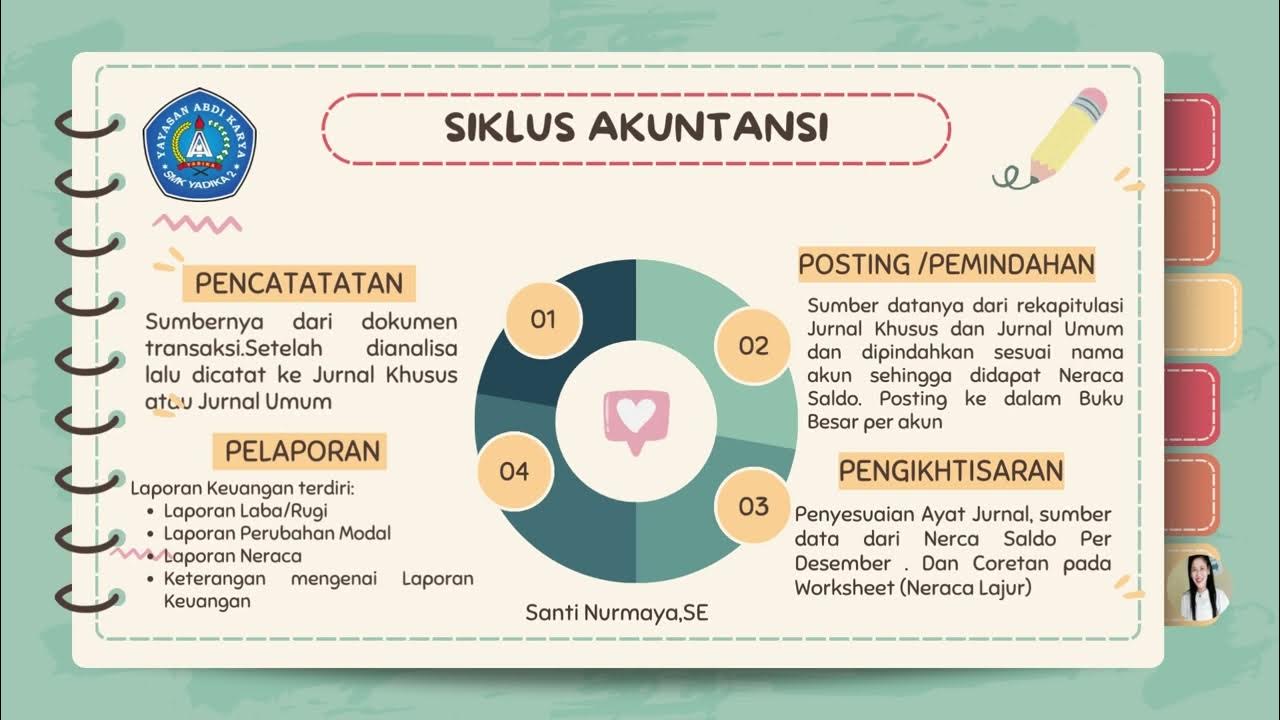

"CARA MUDAH MEMAHAMI SIKLUS AKUNTANSI PERUSAHAAN DAGANG "

Siklus Akuntansi Perusahaan Dagang Edisi Sinema-2

2 Konsep Dasar Akuntansi Keuangan 1

Video Pembelajaran Akuntansi : Jurnal Penyesuaian (Perusahaan Dagang)

5.0 / 5 (0 votes)