REGULASI : STANDAR AKUNTANSI PEMERINTAH

Summary

TLDRThis video dives into the principles and regulations of public sector accounting, with a focus on Government Accounting Standards (SAP) in Indonesia, as outlined in Government Regulation No. 71 of 2010. It explains key concepts such as the accrual basis of accounting, the independence and responsibility of entities, and the core financial statements required for government reporting. The presenter also highlights essential accounting principles, qualitative characteristics of financial reports, and the importance of materiality in financial decision-making. Ultimately, the video offers a detailed exploration of how public sector accounting operates within regulatory frameworks.

Takeaways

- 😀 The script discusses the key concepts of public sector accounting and the related regulations in Indonesia, specifically referring to Government Regulation No. 71/2010.

- 😀 It introduces the perspective of regulation and highlights the importance of standards in public sector accounting, with a particular focus on government accounting standards (SAP).

- 😀 The script explains the definition of government accounting, which includes identifying, recording, measuring, classifying, summarizing, and presenting financial transactions and events.

- 😀 SAP (Standards of Government Accounting) is based on accrual accounting, meaning it recognizes revenue, expenses, assets, liabilities, and equity in financial reporting.

- 😀 Government Regulation No. 71/2010 provides detailed information on the financial reports that governments must prepare, including reports such as the budget realization report, operational reports, cash flow reports, and more.

- 😀 The script emphasizes the assumption that financial reporting in the public sector is accepted as a truth without requiring proof, ensuring that standards are applied consistently.

- 😀 There are three key assumptions for public sector financial reporting: entity independence, entity continuity, and monetary measurement.

- 😀 The character of financial reporting in the public sector focuses on qualitative characteristics such as relevance, reliability, comparability, and understandability.

- 😀 The principles of government accounting and financial reporting are explained, such as the historical cost principle, the realization principle, the substance-over-form principle, and the periodization principle.

- 😀 The concept of materiality is emphasized, stating that financial reports should only include information that could influence economic decisions, and that smaller errors or omissions that do not affect decisions are not considered material.

- 😀 Lastly, the balance between cost-benefit and the qualitative characteristics of financial reporting, like relevance and reliability, is crucial to ensuring that government financial statements remain useful and accurate.

Q & A

What is the focus of this tutorial on public sector accounting?

-The tutorial focuses on explaining the principles and regulations surrounding public sector accounting in Indonesia, particularly the Government Regulation No. 71/2010, which sets the standards for government accounting.

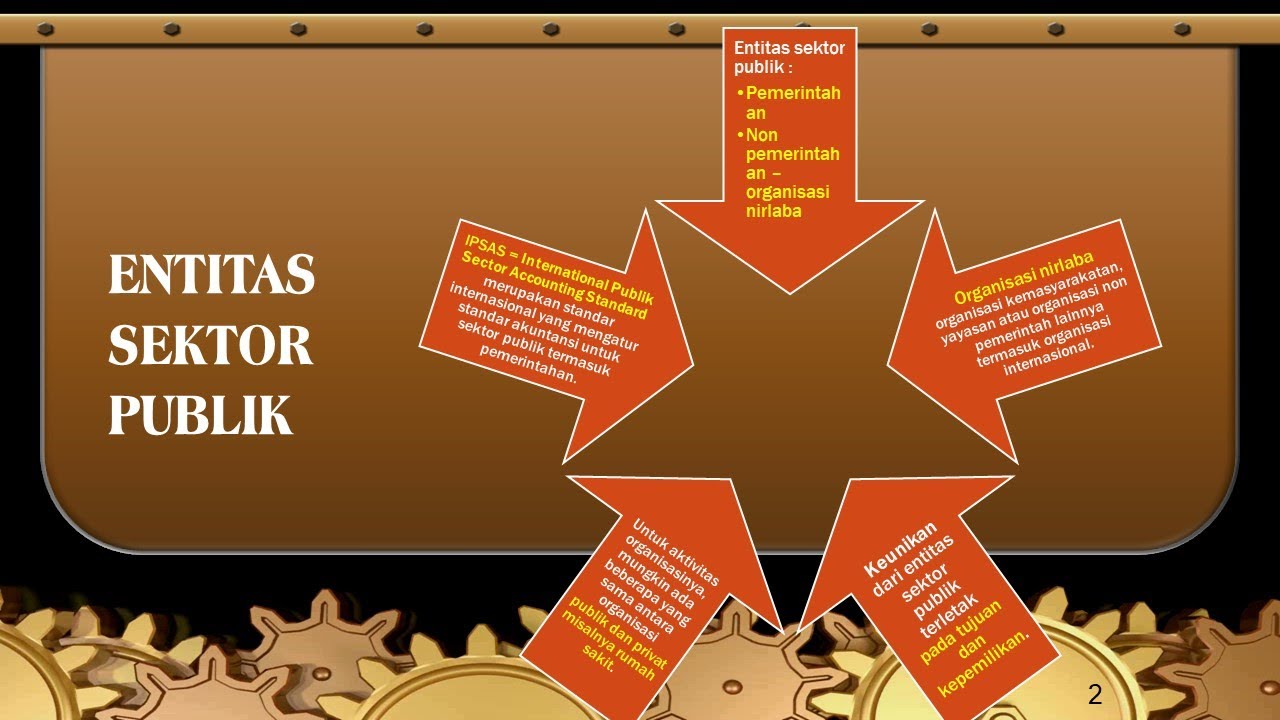

How does the public sector accounting differ from private sector accounting?

-Public sector accounting is primarily concerned with managing public funds responsibly, adhering to government regulations and standards, whereas private sector accounting focuses on the financial interests of individual businesses or corporations, often aimed at profitability.

What is the definition of government accounting according to the script?

-Government accounting is the process of identifying, recording, measuring, classifying, summarizing, and presenting financial transactions and events, followed by interpreting the results to create financial reports.

What is the significance of accrual-based accounting in public sector accounting?

-Accrual-based accounting recognizes revenues, expenses, assets, liabilities, and equity in financial reports. It ensures that financial statements reflect the actual financial situation of the government, including its income and obligations, even if the cash flow has not yet occurred.

What are the assumptions underlying government financial reporting?

-The assumptions include: 1) Independence of entities in the government, 2) Continuity of the entity, and 3) Measurement in monetary units (Rupiah). These assumptions help maintain consistency and reliability in reporting.

Can you explain the concept of materiality in government accounting?

-Materiality refers to whether the omission or misstatement of information would influence decisions made based on the financial report. If the impact is significant enough to affect economic decisions, it is considered material and must be reported.

What are the key characteristics of government financial reports?

-The key characteristics are: relevance (including feedback and predictive value), reliability (accuracy, neutrality, comparability), and understandability. These characteristics ensure that reports provide useful, accurate, and clear financial information to stakeholders.

How does the government regulation (PP 71/2010) guide financial reporting?

-PP 71/2010 defines the standards and principles for preparing government financial statements, including formats for reports such as the budget realization report, balance sheet, operational report, and cash flow statement, among others. It also emphasizes accrual accounting and financial accountability.

Why is there a focus on responsibility and accountability in government accounting?

-Government accounting involves managing public funds, which are derived from taxes and other public sources. Therefore, responsibility and accountability are critical to ensure that these funds are used effectively and efficiently, without mismanagement or misuse.

What challenges might arise when balancing relevance and reliability in government financial reporting?

-The challenge lies in ensuring that financial reports are both relevant and reliable. For example, a report might be highly relevant if it reflects current data, but less reliable if it is based on uncertain or unverified sources. Striking a balance between providing timely, accurate data and maintaining dependability in reports is essential.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)