China Balas Perang Dagang Trump, Kenaikan Tarif 125 Persen Picu Penarikan Aset AS

Summary

TLDRThe trade war between China and the United States has intensified, with China raising tariffs on U.S. imports to 125% in retaliation to President Trump’s decision to increase tariffs on Chinese goods by 145%. This escalating conflict is causing significant market volatility, with U.S. stocks fluctuating and gold prices reaching record highs. U.S. consumer inflation concerns have surged, reaching the highest levels since 1981. Financial institutions predict a rising risk of recession, and U.S. government bonds have seen sharp sell-offs. Amid this turmoil, China has signaled that it does not intend to raise tariffs above 125%, despite the ongoing trade battle.

Takeaways

- 😀 China raised tariffs on US imports to 125% on April 11, 2025, in retaliation for the US's 145% tariff hike on Chinese goods.

- 😀 The tariff increase heightens tensions in the ongoing trade war between the world's two largest economies.

- 😀 This move is seen as a response to US President Donald Trump's tariff decisions, which have caused significant market volatility.

- 😀 The trade war is affecting global supply chains and contributing to market fluctuations, especially in US stocks.

- 😀 Gold, as a safe-haven asset, reached record highs in response to the tariff increases.

- 😀 A US consumer survey indicated growing inflation concerns, marking the highest levels since 1981.

- 😀 Financial institutions are increasingly forecasting a higher risk of recession in the US due to the escalating trade tensions.

- 😀 US government bonds worth $29 trillion experienced sharp sell-offs following Trump's tariff announcement.

- 😀 The yield on 10-year US government bonds experienced its largest weekly rise in over two decades.

- 😀 There are growing concerns that China might reduce its holdings of US government bonds as a consequence of the tariff hike.

Q & A

What is the recent development in the trade war between China and the United States?

-On April 11, 2025, China raised tariffs on imports from the United States to 125% as a response to the U.S. imposing a 145% tariff on Chinese goods.

How did the tariff increase affect the global supply chain?

-The tariff hikes have escalated tensions between the two largest economies, threatening the stability of the global supply chain.

What impact did the tariff changes have on U.S. stock markets?

-The U.S. stock market experienced significant volatility due to the escalating trade war between China and the United States.

How did the price of gold react to the tariff increases?

-The price of gold reached record highs following the tariff hikes, acting as a 'safe haven' asset in response to market uncertainty.

What did a consumer survey in the U.S. reveal about inflation concerns?

-A consumer survey in the U.S. showed that inflation concerns had risen to the highest levels since 1981.

What is the expected risk for the U.S. economy as a result of the trade tensions?

-Financial institutions have increasingly forecast a growing risk of recession due to the escalating trade war.

What happened to U.S. government bonds after the tariff hike announcement?

-There was a sharp sell-off in U.S. government bonds, with the yield on 10-year bonds increasing at the fastest weekly pace in over two decades.

What concern arose regarding China's holdings of U.S. bonds?

-The significant trading volume and bond market volatility led to concerns that China might reduce its holdings of U.S. government bonds.

How did China justify not raising its tariffs above 125%?

-China indicated that there was no point in further escalating the trade conflict, signaling that it would not increase tariffs beyond 125%.

What are the implications of the U.S.-China trade war for the global economy?

-The trade war between the U.S. and China poses risks to global economic stability, influencing markets, inflation concerns, and the potential for a global recession.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

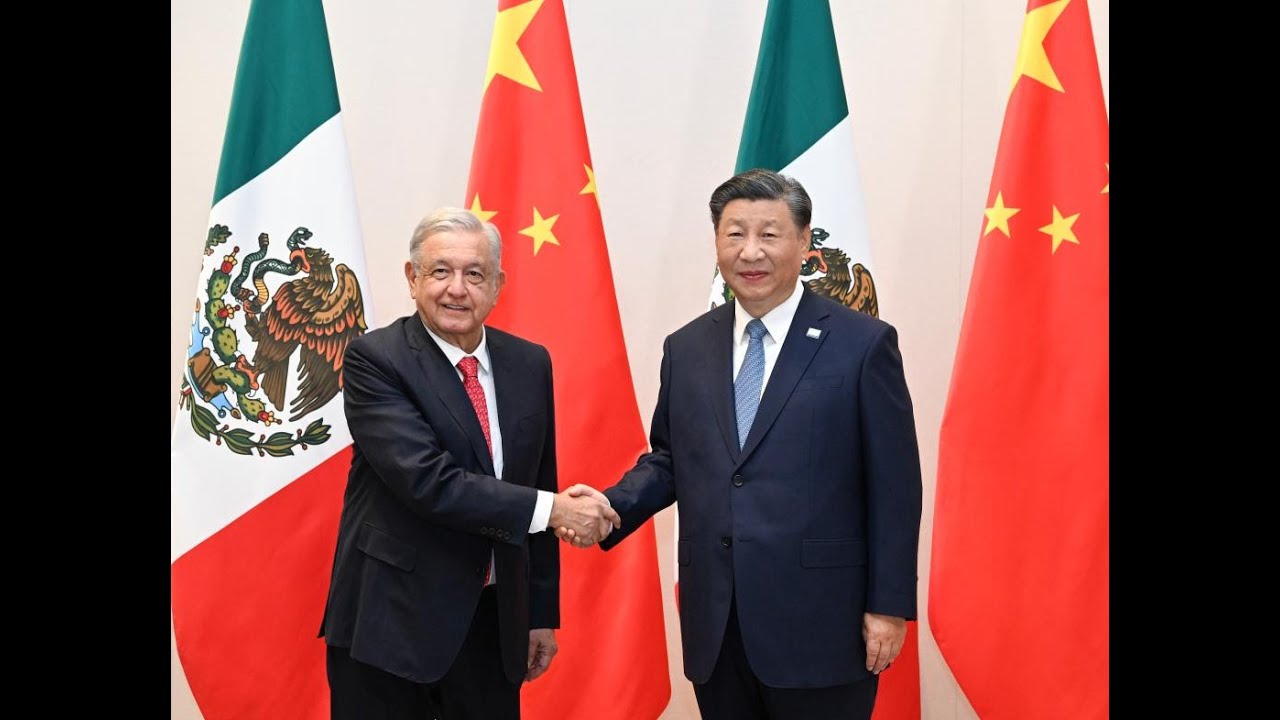

Perang Dagang China Vs AS, Trump atau Xi Jinping yang Akan Menyerah Lebih Dulu?

Linimasa Adu Balas Perang Dagang China Vs Amerika

Apa Pengaruh Perang Dagang AS Vs China terhadap Perekonomian Dunia?

Makin Panas! China Hajar AS dengan Kenaikan Tarif Impor 125 Persen

Nyali China "Berjuang Sampai Akhir" Lawan Berapa Pun Tarif Trump

China Just Hit America Where It Hurts Most—Cuts Off the Lifeline For U.S. Industries

5.0 / 5 (0 votes)