PENYUSUNAN PROGRAM AUDIT UNTUK PENGUJIAN PENGENDALIAN

Summary

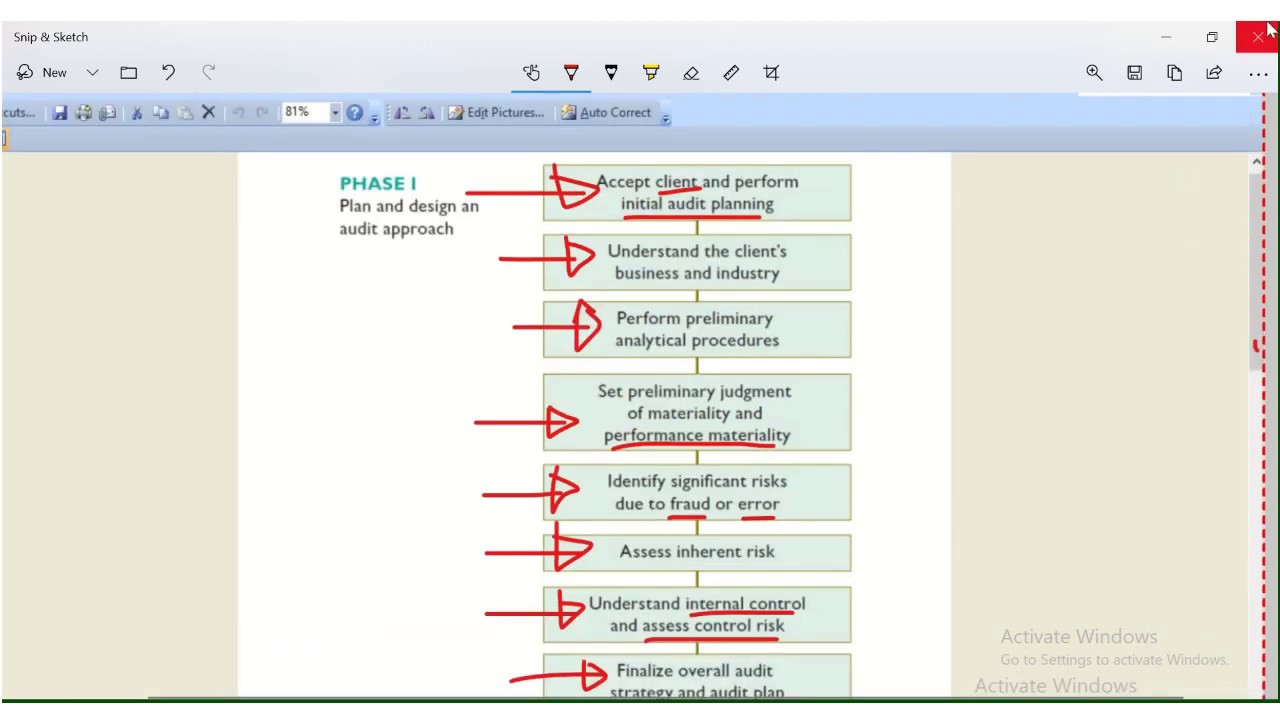

TLDRThis presentation focuses on the audit control testing process, outlining key concepts like control testing types, procedures, and risk determination. The team explores how audits evaluate the effectiveness of client procedures to prevent material misstatements in financial reports. Topics discussed include control testing procedures (e.g., employee interviews, document inspections), the scope of control testing, and the identification of potential misstatements in transaction processes. The presentation also highlights the importance of planning audits, defining auditor-client responsibilities, and ensuring transparency through clear agreements and written confirmations.

Takeaways

- 😀 The presentation focuses on audit procedures and control testing to assess the effectiveness of financial reporting controls.

- 😀 Control testing involves evaluating the design and operation of policies or procedures intended to prevent or detect material misstatements in financial statements.

- 😀 There are two main types of control testing: concurrent testing (performed alongside other audit procedures) and supplementary testing (carried out during fieldwork).

- 😀 The procedures for performing control tests include asking client employees questions, observing their tasks, inspecting documents, and re-performing control activities.

- 😀 The scope of control testing is influenced by the control risk determined by the auditor, with more evidence required when control risk is low.

- 😀 The timing of control tests can vary, with the ideal approach being to test controls throughout the entire audit period, especially near year-end.

- 😀 Identifying potential misstatements is essential for determining control risk, and auditors need to gather sufficient evidence to assess control design and operation effectiveness.

- 😀 Control activities, such as authorization, documentation, and independent checks, are critical for preventing and detecting misstatements in transactions.

- 😀 Auditors must also assess the inherent risks of potential misstatements at each transaction stage, such as unauthorized sales or improper handling of payments.

- 😀 A formal engagement letter is important for both the client and auditor to clarify the objectives, scope, responsibilities, and reporting expectations of the audit.

Q & A

What is the purpose of control testing in an audit?

-Control testing is performed to evaluate the design and operation of a client's internal control policies and procedures. It aims to detect and prevent material misstatements in financial statement assertions.

What are the three main considerations in control testing?

-The three main considerations in control testing are: 1) How the controls are applied, 2) Whether the controls are applied consistently throughout the year, and 3) Who applies the controls.

What are the two types of control testing?

-The two types of control testing are: 1) Concurrent tests of controls, which are conducted alongside other audit procedures to understand the client's internal control system, and 2) Supplementary control tests, which are conducted during the fieldwork phase of the audit.

What are the four procedures for performing control testing?

-The four procedures for performing control testing include: 1) Asking questions to client employees, 2) Observing client employees performing their tasks, 3) Inspecting documents, records, and reports, and 4) Reperforming the controls.

How does the scope of control testing relate to control risk?

-The scope of control testing is directly influenced by the level of control risk established by the auditor. Lower control risks require more evidence to be gathered, while higher control risks reduce the amount of evidence needed.

When should control testing be performed during the audit process?

-Control testing can be performed at two points during the audit: 1) During fieldwork, or 2) Closer to the end of the year, with a preference for testing near the end of the year to cover the entire audit period.

What factors should be considered when determining control risk?

-To determine control risk, the auditor should consider the potential misstatements that could occur for each assertion, identify controls that could prevent or detect such misstatements, gather evidence about the design and operation of these controls, evaluate the collected evidence, and ultimately assess the control risk.

What are the key control activities needed to detect and prevent material misstatements?

-Key control activities include: 1) Authorization of transactions, 2) Documentation and record-keeping, 3) Independent checks, 4) Segregation of duties, 5) Physical control over assets, and 6) Performance reviews.

What should auditors assess when evaluating the potential for material misstatements during a transaction?

-Auditors should assess the likelihood of material misstatements in each phase of a transaction, such as unauthorized sales, premature delivery of goods, misuse of cash receipts, and other inherent risks in the transaction process.

What is the purpose of a letter of engagement in auditing?

-The letter of engagement outlines the auditor’s responsibilities and the scope of the audit, providing clarity on the objectives, timing, and reporting format, as well as confirming the understanding between the auditor and the client.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)