How Banks Create Money

Summary

TLDRThis video explains how banks create money through fractional reserve banking, where only a fraction of deposited money is kept in reserve while the rest is loaned out. It highlights how deposits and loans are intertwined, with loans effectively creating deposits. The video discusses the limits on bank lending, such as profitability and capital requirements, as well as the role of the Federal Deposit Insurance Corporation (FDIC) in protecting your money. It provides an insightful look at how money circulates and how banks make profits while ensuring the safety of your deposits.

Takeaways

- 😀 Banks create money by lending out a large portion of the deposits they receive.

- 😀 The difference between the interest rates charged on loans and paid on deposits is how banks make profits.

- 😀 Banks use fractional reserve banking, keeping only a fraction (typically 10%) of deposits and lending the rest.

- 😀 When a bank lends money, it doesn't reduce the money supply but instead creates new money through additional deposits.

- 😀 Deposits and loans are interrelated, as loans often create new deposits in the banking system.

- 😀 Fractional reserve requirements do not significantly limit banks' ability to lend, as they often find ways to meet these requirements later.

- 😀 Banks balance profitability and risks when making loans, considering operational costs and the risk of borrower default.

- 😀 Capital requirements force banks to keep a certain percentage of profits as reserves to cover potential losses from loans.

- 😀 While banks can create new loans, their lending practices are generally regulated to avoid financial instability.

- 😀 The FDIC (Federal Deposit Insurance Corporation) insures up to $250,000 of deposits, ensuring customers' funds are safe.

Q & A

What happens to the money you deposit at your bank?

-When you deposit money in a bank, the bank uses it to lend to other customers while paying you a small interest. The bank earns a profit from the difference between the interest they charge on loans and the interest they pay you.

Why do banks pay you interest on your deposits?

-Banks pay you interest on your deposits to attract more funds. They lend this money to others at a higher interest rate and make a profit from the difference.

How do banks make a profit from lending money?

-Banks lend the money deposited by customers at a higher interest rate than they pay on deposits. The difference in these rates is how banks make a profit.

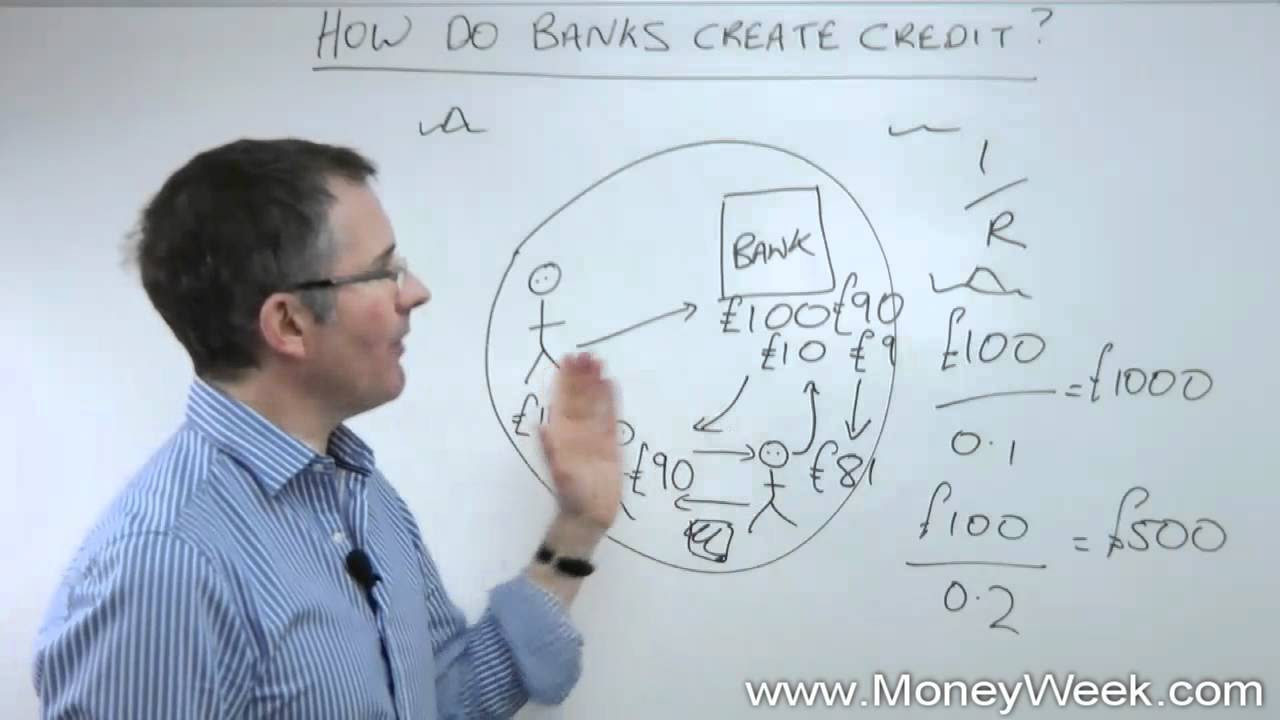

What is fractional reserve banking?

-Fractional reserve banking is a system where banks only need to keep a fraction of their deposits in cash (typically around 10%) and can lend out the rest.

How does fractional reserve banking work?

-If you deposit $10,000, the bank must keep $1,000 as a reserve and can lend out the remaining $9,000. The $9,000 gets deposited elsewhere, and the process continues, effectively creating more money.

How does fractional reserve banking increase the money supply?

-Fractional reserve banking increases the money supply because banks lend out most of the deposits, which are then redeposited and loaned out again, multiplying the total money in circulation without needing more physical cash.

Do loans create deposits or deposits create loans?

-While it seems that deposits create loans, the reality is that loans often create deposits. When a bank lends money, it creates a deposit in the borrower's account, thus increasing the money supply.

Do reserve requirements limit how much money a bank can lend?

-Reserve requirements don't significantly limit lending. Banks often create loans first and then meet the reserve requirements by attracting more deposits or borrowing from other banks.

What are the limitations on bank lending?

-The main limitations on bank lending are profitability and capital requirements. Banks need to ensure the loan is profitable and that they maintain a required amount of capital to avoid failures.

Is the money you deposit at a bank safe?

-Yes, most banks are insured by the Federal Deposit Insurance Corporation (FDIC), which protects up to $250,000 of your deposits in case the bank fails.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Fractional Reserve Banking Explained in One Minute

How banks create credit - MoneyWeek Investment Tutorials

Sistem Uang Berbahaya: Fractional Reserve Banking System

TM 4 determinant money supply ch 16 part 4 of 4 (Catatan Prof Kameel)

How MONEY & BANKING Really works - Part 1 (2 of 5)

El proceso de creación de dinero

5.0 / 5 (0 votes)