Money Market Funds: Are they the best short term investment?

Summary

TLDRThis video explains money market funds, which are short-term debt funds that invest in highly liquid instruments like treasury bills, certificates of deposit, and commercial papers. These funds offer higher returns and liquidity than savings accounts and are considered low-risk investments. However, investors should be aware of the fund manager’s choices, as they may sometimes take on higher risks to boost returns. The video also covers the tax implications of these funds, including short-term and long-term capital gains taxes. Money market funds are a good option for short-term investment with better returns than traditional savings accounts.

Takeaways

- 😀 Money market funds are low-risk investment instruments that offer high liquidity and returns.

- 😀 These funds invest in short-term debt instruments with maturities of less than 12 months.

- 😀 The primary instruments in money market funds include treasury bills (T-bills), certificates of deposit (CDs), and commercial papers.

- 😀 Treasury bills are issued by the Government of India for up to 365 days and are considered safe but offer lower returns than corporate bonds.

- 😀 Certificates of deposit (CDs) are term deposits offered by banks, with higher interest rates compared to fixed deposits.

- 😀 Commercial papers (CPs) are unsecured loans offered by companies and are generally safe if issued by highly rated companies.

- 😀 Money market funds typically offer returns that are better than savings accounts or fixed deposits while being low-risk.

- 😀 The taxation on money market funds follows the same laws as other debt funds, with short-term capital gains tax for investments held under 3 years and long-term capital gains tax for investments held over 3 years.

- 😀 Money market funds are a good alternative to savings accounts for investing extra cash for up to a year, offering better returns.

- 😀 It is crucial to conduct your own research before investing in money market funds, as fund managers may sometimes invest in higher-risk instruments to boost NAV or returns.

Q & A

What are money market funds?

-Money market funds are short-term debt funds that invest in highly liquid instruments with a maturity of less than 12 months. These instruments mainly include treasury bills, certificates of deposit, and commercial papers.

What types of instruments do money market funds invest in?

-Money market funds typically invest in treasury bills (T-bills), certificates of deposit (CDs), and commercial papers (CPs). These instruments are considered safe and liquid.

How are treasury bills (T-bills) characterized in money market funds?

-Treasury bills are issued by the government of India against loans they take up for a period up to 365 days. They are considered safe investments but offer returns lower than corporate bonds.

What are certificates of deposit (CDs) and how do they relate to money market funds?

-Certificates of deposit are term deposits offered by banks with a lock-in period. They usually offer higher interest rates than fixed deposits and are a part of the instruments that money market funds may invest in.

What are commercial papers (CPs), and how do they fit into money market funds?

-Commercial papers are unsecured promissory notes issued by companies to raise short-term loans. Money market funds invest in CPs from highly-rated companies, which are considered safe investments.

How do the returns from money market funds compare to fixed deposits (FDs)?

-The returns from money market funds are typically better than those of fixed deposits, making them a more attractive option for short-term investments.

What taxation laws apply to money market funds?

-Money market funds are subject to the same taxation laws as other debt funds. Short-term capital gains tax applies to holding periods of less than three years, while long-term capital gains tax applies to investments held for longer than three years.

What is the advantage of investing in money market funds compared to keeping cash in a savings account?

-Money market funds offer better returns than a savings bank account while maintaining high liquidity. They are an attractive option for investors who have extra cash and want to earn a higher return over a short-term period.

Why is it important to do your own research before investing in money market funds?

-It is important to research because sometimes fund managers may invest in high-risk instruments to boost the Net Asset Value (NAV) or returns, which may not align with a low-risk investment strategy.

What should investors be cautious about when investing in money market funds?

-Investors should be cautious about the potential for fund managers to invest in riskier assets in an attempt to increase returns, which could expose the investment to higher risk than expected.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

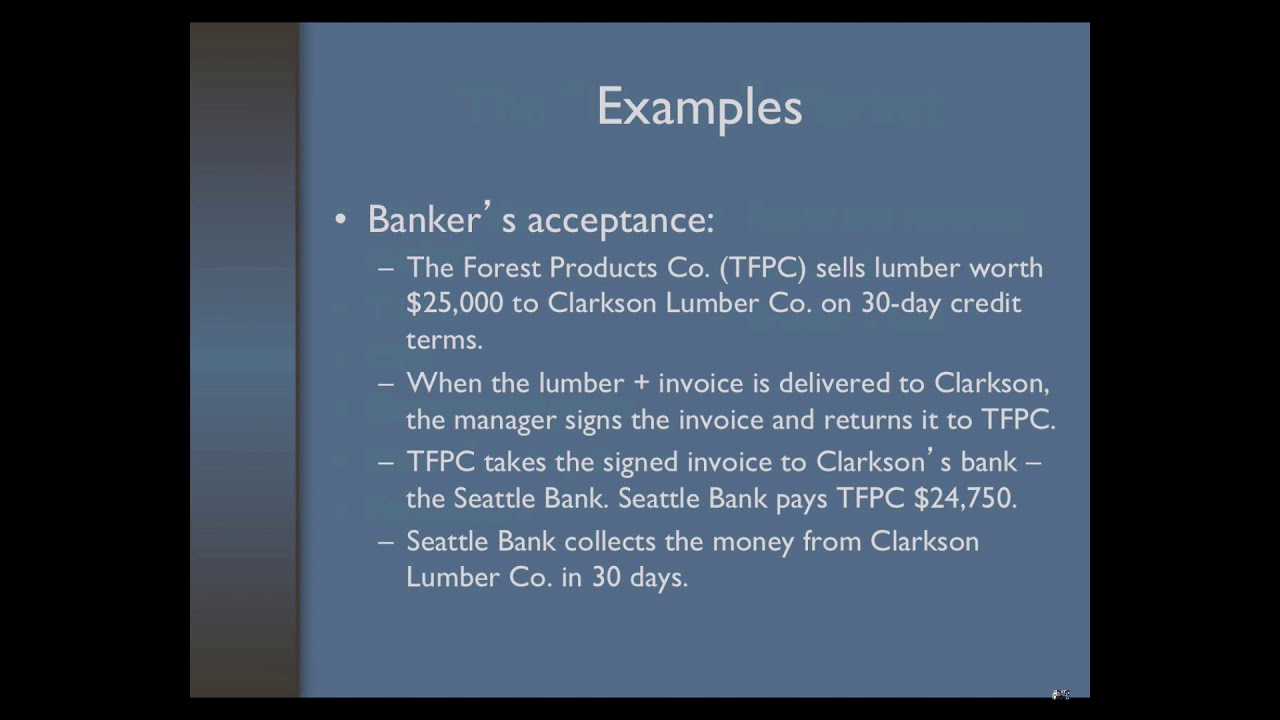

Money Market Securities, Money Market Instruments, Investment Analysis and Portfolio Management mba

What are Money Markets?

PASAR UANG DAN PASAR MODAL - EKONOMI - MATERI SMA DAN UJIAN MANDIRI | PART 1

Money Market Explained | Money Market Instruments in India | Money Market Kya hai in Hindi

What Are Money Market Funds?

Global Financial Instruments I

5.0 / 5 (0 votes)