Money Market Securities, Money Market Instruments, Investment Analysis and Portfolio Management mba

Summary

TLDRThe script delves into the intricacies of the money market, focusing on short-term financial instruments and transactions. It explains the roles of various market participants, including the RBI, commercial banks, and financial institutions, and how they engage in borrowing and lending to meet their short-term funding requirements. The discussion covers instruments like call money, certificates of deposit, commercial papers, and treasury bills, highlighting their liquidity and significance in the market. The script also touches on the organized and unorganized sectors of the Indian money market, providing insights into its structure and functioning.

Takeaways

- 🏦 The money market is a platform for short-term borrowing and lending of funds, typically involving financial instruments with high liquidity.

- 💼 The Reserve Bank of India (RBI) and commercial banks are key players in the money market, providing and receiving loans to meet short-term funding requirements.

- 📈 The instruments traded in the money market include government securities, treasury bills, commercial papers, and certificates of deposit, which are short-term in nature.

- 🔍 The maturity period of these instruments is short, ranging from overnight to a maximum of two weeks or even up to a year, depending on the type of instrument.

- 💵 High liquidity in the money market means that these financial instruments can be easily converted to cash, which is crucial for businesses and banks needing quick access to funds.

- 🏢 Commercial banks require short-term funds to meet their reserve requirements set by the RBI, such as the cash reserve ratio (CRR) and statutory liquidity ratio (SLR).

- 📊 Certificates of deposit (CDs) are negotiable instruments that allow banks to raise funds from investors, offering a fixed return over a specified maturity period.

- 💵 Treasury bills are government-issued securities that do not pay interest but are sold at a discount, providing a profit to investors when they are redeemed at face value.

- 📝 The script explains the concept of 'bill of exchange' and 'promissory note', which are used for credit transactions, allowing businesses to defer payment without immediate cash outflow.

- 🌐 The money market structure in India is divided into the organized sector, regulated by the RBI, and the unorganized sector, which includes various financial institutions and non-banking participants.

Q & A

What is the term 'Money Market' referring to in the context of the script?

-The 'Money Market' in the script refers to a financial market where short-term funds are exchanged. It involves transactions in financial instruments with high liquidity and short-term maturities, such as treasury bills, commercial papers, and certificates of deposit.

What are the two types of sectors mentioned in the Indian Money Market?

-The two types of sectors mentioned are the Organized Sector and the Unorganized Sector. The Organized Sector is controlled by the Reserve Bank of India (RBI), while the Unorganized Sector is not under the direct control of the RBI.

Who are the lenders and borrowers in the Money Market according to the script?

-The lenders in the Money Market include commercial banks, financial institutions, non-banking financial companies (NBFCs), and others. The borrowers can be central or state governments, local bodies, businesses, exporters, importers, and the general public.

What is 'Call Money' as mentioned in the script?

-'Call Money' refers to short-term loans given by banks to other banks or financial institutions on an overnight or very short-term basis, typically for one or two weeks.

What are the characteristics of financial instruments dealt in the Money Market?

-The financial instruments in the Money Market are characterized by their short-term nature, high liquidity, and typically have maturities ranging from overnight to one year.

What is the significance of 'Certificates of Deposit' (CDs) in the Money Market?

-Certificates of Deposit (CDs) are negotiable certificates issued by banks to investors as a receipt for the deposit of a specified sum of money for a fixed period. They are used as a tool for raising short-term funds and are considered a part of the Money Market.

How do 'Treasury Bills' function in the Money Market as per the script?

-Treasury Bills are government securities with maturities ranging from 91 days to 364 days. They are issued at a discount to their face value, and the difference between the issue price and the face value at maturity represents the profit to the investor.

What is the role of the Reserve Bank of India (RBI) in the Money Market?

-The Reserve Bank of India (RBI) plays a regulatory role in the Organized Money Market sector. It controls the interest rates, manages liquidity, and oversees the operations of banks and financial institutions in the market.

Why are 'Commercial Papers' important in the Money Market?

-Commercial Papers are short-term unsecured promissory notes issued by companies to raise funds. They are significant in the Money Market because they provide an alternative source of short-term financing for businesses and offer investors a high degree of liquidity.

What is the purpose of 'Repurchase Agreements' in the Money Market?

-Repurchase Agreements (Repo) are used in the Money Market to raise short-term funds. They involve the sale of securities with an agreement to repurchase them at a predetermined price on a specified future date, effectively acting as collateralized loans.

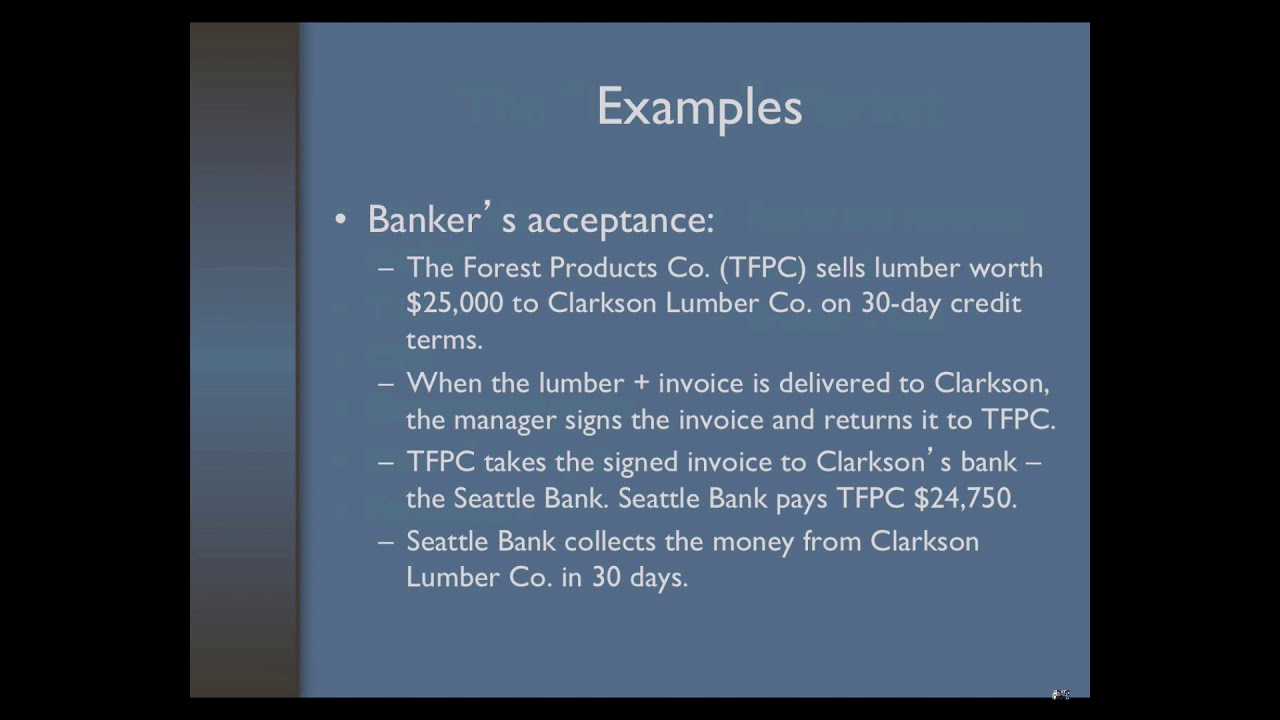

How do 'Bills of Exchange' operate within the Money Market as described in the script?

-Bills of Exchange are financial instruments used in the Money Market for credit transactions. They are essentially a written order used to transfer money from one party to another, typically used for trade financing or as a means to obtain short-term credit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

PASAR UANG DAN PASAR MODAL - EKONOMI - MATERI SMA DAN UJIAN MANDIRI | PART 1

Key Roles for Financial Markets I A Level and IB Economics

Money Market Explained | Money Market Instruments in India | Money Market Kya hai in Hindi

Global Financial Instruments I

UMN MMT TFC VHD M05 P01 240223 V01 UP

IIMFC201T116-V007500

5.0 / 5 (0 votes)