Strategi Scalping 1 Menit yang Mudah Dipelajari - SPPH Mentorship 2024

Summary

TLDRThis video script focuses on the importance of trading without complex indicators, advocating for a simplified approach using price action. The speaker, inspired by Al Brooks' book, explains how traders can analyze charts with minimal tools, emphasizing the significance of swing highs, swing lows, and moving averages. The content delves into specific strategies like first and second entries for both short and long positions, outlining how to identify and execute trades based on price movements and trends. The speaker also advises when to use first or second entry strategies and how to adapt based on market conditions.

Takeaways

- 😀 Traders don't always need complex indicators to trade effectively; a simple, clean chart can suffice.

- 😀 Al Brooks, a renowned price action trader, advocates for trading with minimal tools, focusing on price action and a single moving average.

- 😀 Many beginner traders believe that trading requires complicated math or indicators, but in reality, simplicity can be more profitable.

- 😀 Price action trading involves counting candles (or bars) to identify key market points, such as swing highs and swing lows.

- 😀 Traders should focus on swing lows when prices are below the moving average and swing highs when prices are above it.

- 😀 A pullback in a downtrend can be identified when the price breaks above a previous candle, indicating a potential short entry.

- 😀 In an uptrend, a pullback occurs when the price breaks below a previous swing high, signaling a potential long entry.

- 😀 First entry involves entering the market after a pullback has occurred, and the next candle confirms the move.

- 😀 Second entry is used when the first entry signal fails, or when the market is in a ranging or weakening trend.

- 😀 A trader should avoid entering the market if the price is too close to the moving average or if there's an unfilled price gap, opting instead for a second entry strategy.

Q & A

Why is it important for traders to learn how to trade without indicators?

-Many traders rely on complicated and expensive indicators to make decisions. However, the script emphasizes the importance of trading with a clean chart, using just price action and a simple tool like the Moving Average, to avoid overcomplicating the process and to rely on the price itself.

What inspired the speaker to trade without indicators?

-The speaker was inspired by the book by Al Brooks, a renowned price action trader. The book taught the speaker the importance of simplicity in trading and how price moves can be interpreted without relying on complex indicators.

What key idea from Al Brooks' book does the speaker mention?

-Al Brooks discusses how beginners often believe that trading requires complicated formulas or indicators to be successful. He emphasizes that trading can be simple, relying mainly on price action and minimal tools.

What is the significance of 'swing high' and 'swing low' in trading?

-Swing highs and swing lows are critical points used in price action trading. A swing high is a point where the current candle is higher than the two candles on either side, while a swing low is when the current candle is lower than the surrounding candles. These points are used to calculate market trends and potential entry points.

How does the position of price relative to the Moving Average affect trading focus?

-When the price is above the Moving Average, traders focus on identifying swing highs to spot potential long (buy) trades. When the price is below the Moving Average, the focus shifts to swing lows to identify short (sell) opportunities.

What is the concept of 'pullback' in trading?

-A pullback occurs when the price temporarily moves against the prevailing trend before continuing in the same direction. In a downtrend, a pullback would involve the price briefly rising before falling again, and in an uptrend, a pullback would involve the price briefly declining before continuing to rise.

What are 'first entry' and 'second entry' in trading?

-First entry refers to the initial opportunity to enter a trade after a pullback, while second entry refers to a subsequent opportunity when the price continues in the direction of the trend after the first entry fails or is not triggered.

What are the rules for executing a first entry short trade?

-For a first entry short trade in a downtrend, traders should enter after a pullback when the price breaks below the previous swing low. The entry is triggered when the next candle after the pullback forms, provided the candle opens below the pullback candle.

Why should traders avoid using first entry when the price is near the Moving Average?

-When the price is close to the Moving Average, the pullback may not be strong enough, leading to a weak trade setup. In such cases, the script advises traders to wait for a second entry, as the price may pull back further or fail to maintain its trend.

When should a second entry be used in trading?

-Second entry should be used when the first entry fails, or when the price is too close to or within the Moving Average. It's also ideal when there is a gap that has not yet been filled or when the market is ranging. Second entries allow traders to enter after a deeper pullback and when the price shows signs of continuing the trend.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The 3 step Price Action Trading Strategy ONLY Top 5% use...

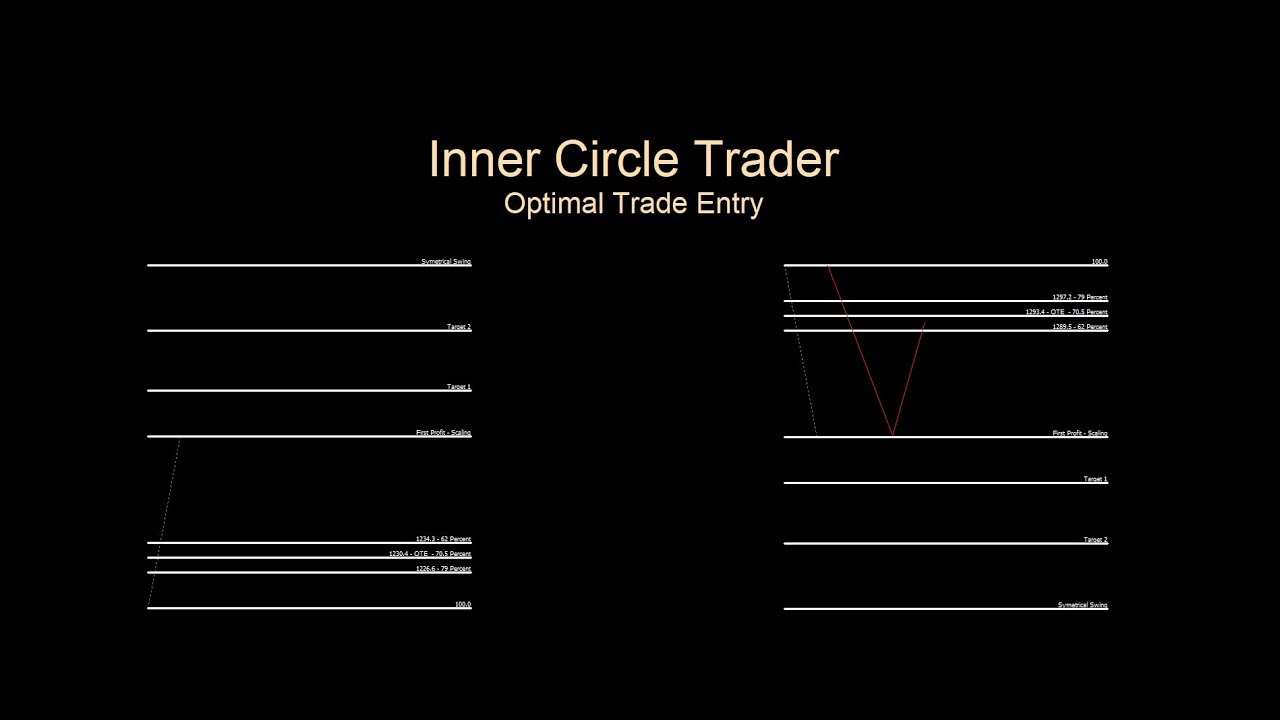

OTE Primer - Intro To ICT Optimal Trade Entry

EASIEST ICT Strategy | No Daily Bias (Previous Day High and Low)

5 Price Action Rules EVERY Trader NEEDS To Know

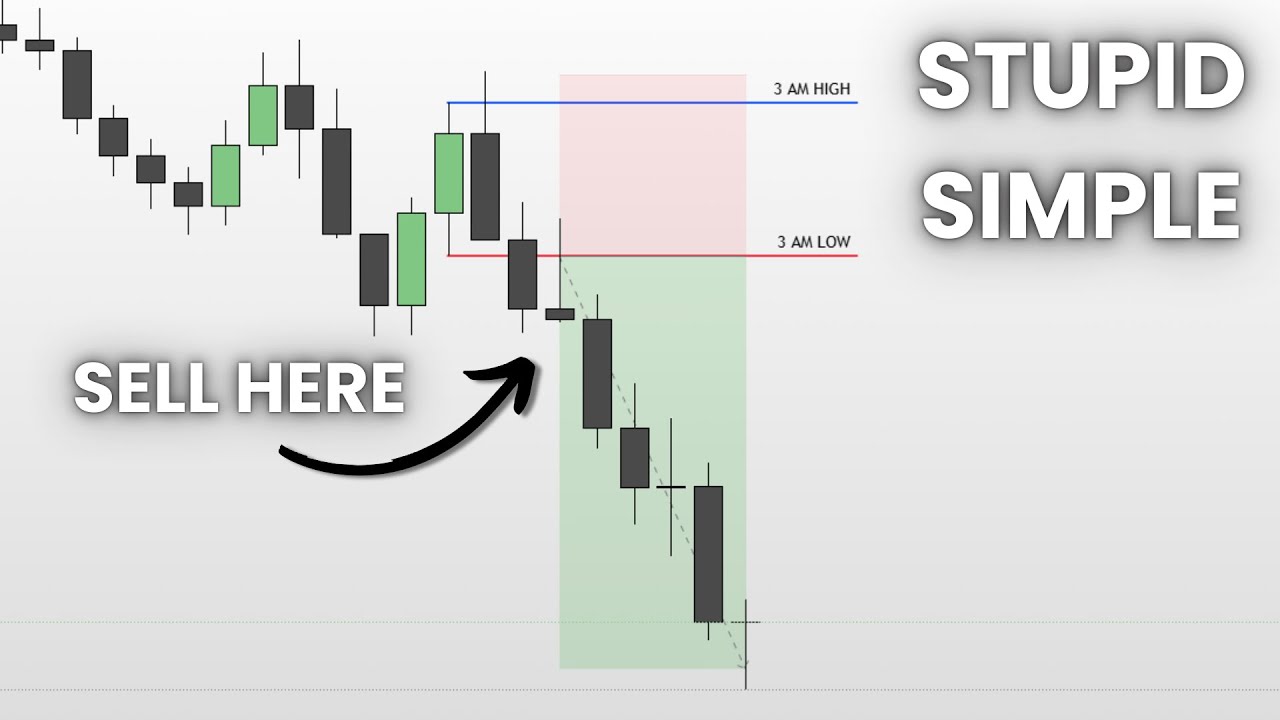

STOP Using ICT & Trade With This Strategy Instead.. (Stupid Simple)

A ÚNICA Estratégia de DayTrading que Você Vai PRECISAR! 🤯

5.0 / 5 (0 votes)