Micro 6.3 Public Goods (Rival vs Non-rival and Excludable vs Non-excludable goods)

Summary

TLDRThis video explains the concept of public goods and their role in market failures. It covers the differences between rival and non-rival goods, as well as excludable and non-excludable goods. The video explores how these classifications affect market outcomes, with a focus on the free rider problem and the underproduction of non-excludable goods. Examples such as streaming services, public fireworks displays, and national defense illustrate key concepts. It also addresses the government’s role in providing public goods to correct market inefficiencies and ensure optimal production.

Takeaways

- 😀 Rival goods are consumed and diminished as they are used, meaning fewer goods are available for future consumers (e.g., a donut).

- 😀 Non-rival goods can be consumed by many people without diminishing their availability to others (e.g., streaming music services).

- 😀 The marginal cost of production for non-rival goods is often zero, as one person's consumption does not reduce availability for others.

- 😀 Excludable goods can prevent people from using them if they don't pay for it (e.g., concert tickets).

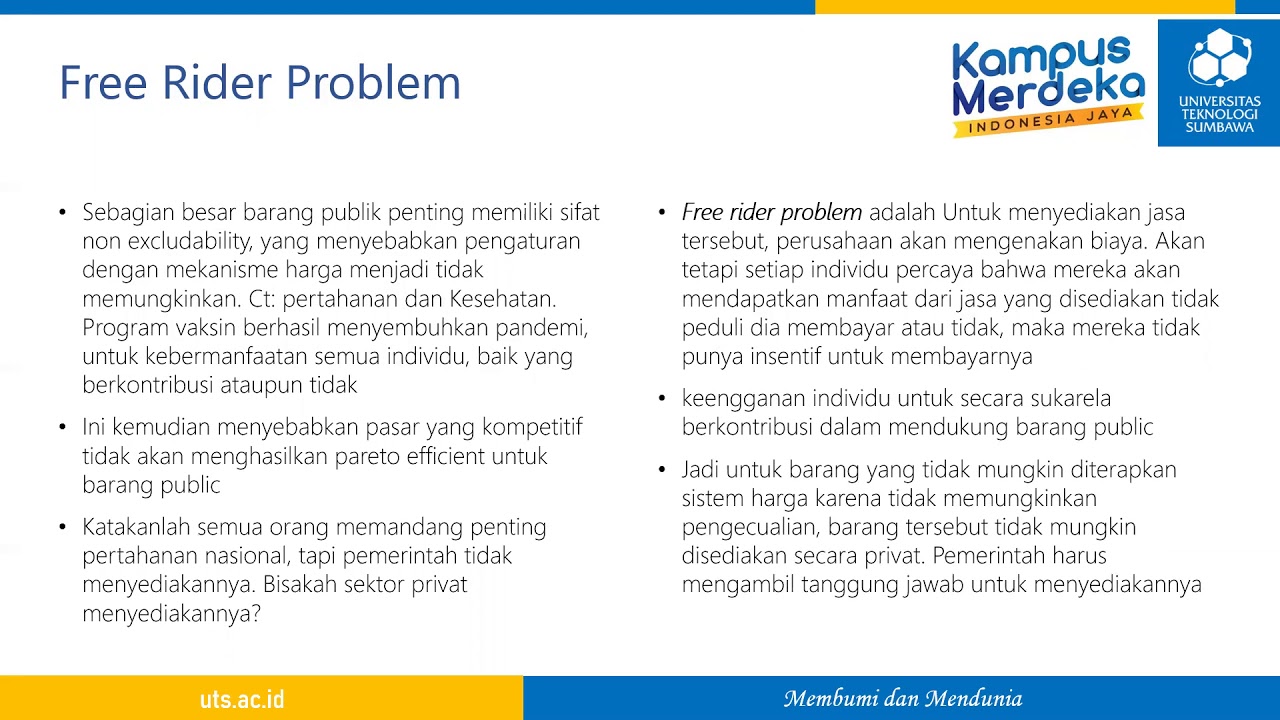

- 😀 Non-excludable goods can be used by anyone without payment (e.g., public fireworks displays), which leads to the Free Rider Problem.

- 😀 The Free Rider Problem causes underproduction of non-excludable goods since there's no incentive for individuals to pay for something they can enjoy for free.

- 😀 Underproduction of non-excludable goods creates deadweight loss because the demand for the product is lower than the marginal social benefit.

- 😀 Private goods are both rival and excludable, meaning they can be used up and restricted to those who pay for them (e.g., a cell phone).

- 😀 Natural monopoly goods (or Club Goods) are non-rival but excludable, where the cost of production is zero but access is restricted (e.g., streaming services).

- 😀 Public resources are rival and non-excludable, which can lead to overuse or exploitation if not regulated (e.g., fish in oceans).

- 😀 Public goods are non-rival and non-excludable, meaning they face the Free Rider Problem and are often funded and provided by the government (e.g., national defense or tsunami warning sirens).

Q & A

What is the definition of a rival good?

-A rival good is a good that gets used up as it is consumed. As one person uses the good, there is less available for others. An example is a donut, where once one person eats it, it is no longer available for anyone else.

What is the definition of a non-rival good?

-A non-rival good is a good that does not diminish in quantity as it is consumed by others. Multiple people can use or enjoy the good simultaneously without affecting its availability to others. An example is streaming music services like Spotify, where everyone can listen at the same time without affecting each other's experience.

Why is the marginal cost of production for non-rival goods typically zero?

-The marginal cost of production for non-rival goods is zero because the good can be consumed by multiple people without diminishing its supply. Once the good is produced, there is no additional cost to allow more people to consume it, such as streaming a song to an additional listener.

What is a deadweight loss, and how does it relate to non-rival goods?

-Deadweight loss refers to the loss of economic efficiency that occurs when a market does not produce the socially optimal quantity of a good. For non-rival goods, there is typically deadweight loss because the firm producing the good does not produce enough of it to meet the socially optimal demand, leading to underproduction and inefficiency.

What is the difference between excludable and non-excludable goods?

-Excludable goods are those where it is possible or practical to prevent people from using the good if they haven't paid for it. Non-excludable goods, on the other hand, can be enjoyed by anyone, regardless of whether they paid for them. An example of an excludable good is a concert ticket, while an example of a non-excludable good is a public fireworks display.

What is the free rider problem, and how does it affect non-excludable goods?

-The free rider problem occurs when people enjoy the benefits of a good without paying for it. This problem is common with non-excludable goods, as individuals can benefit without contributing financially, leading to underproduction of the good because there's little incentive for people to pay for it.

How does the free rider problem cause underproduction of non-excludable goods?

-The free rider problem causes underproduction because individuals who can consume a good without paying for it have less incentive to buy the product. As a result, demand for the good is lower than the socially optimal level, which leads to a shortage of the good in the market.

What are private goods, and how are they classified in terms of rivalry and excludability?

-Private goods are both rival and excludable. This means that using the good reduces its availability for others, and it is possible to prevent people from using the good without paying for it. Examples include a wireless phone and a bean burrito from a restaurant.

What are natural monopoly goods, and how do they differ from other goods in terms of rivalry and excludability?

-Natural monopoly goods are non-rival and excludable. This means that multiple people can consume the good without affecting its availability, but it is still possible to prevent access if someone does not pay for it. Examples include video streaming services and internet service providers.

What are public goods, and what are their key characteristics?

-Public goods are both non-rival and non-excludable. This means that consumption by one person does not reduce availability for others, and it is not practical to prevent people from enjoying the good if they haven’t paid for it. Examples include national defense and tsunami warning sirens.

How does the government address the free rider problem associated with public goods?

-The government typically provides public goods and finances them through taxes, ensuring that everyone can benefit from the good, regardless of whether they paid for it. This intervention helps avoid underproduction of the good, which would occur if left to the free market.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Y1 25) Merit and De-Merit Goods - Imperfect Information

Ekonomi Sektor Publik: Barang Publik

Ekonomi Publik Islam || Konsep & Ruang Lingkup Ekonomi Publik

Ekonomi Lingkungan - Mekanisme harga pasar dan kegagalan pasar

The Failure Of The Free Market! What Should The Government Do?

Materi 2 Pengantar Ekonomi Sektor Publik Adna Fisipol

5.0 / 5 (0 votes)