Apa yang Terjadi Jika Minyak Bumi Habis? Seperti ini Dampak Mengerikan yang Akan Terjadi...

Summary

TLDRThe video script discusses the significant increase in fuel prices in Indonesia, which rose by 23.5% due to rising subsidy costs. Despite having substantial oil reserves, Indonesia imports fuel from Singapore due to technological limitations. The global oil situation is also alarming, with dwindling reserves and reliance on fossil fuels. The script further explores the potential consequences of running out of oil, such as disruptions in transportation, energy, and even military sectors. It calls for a shift to renewable energy sources, highlighting the need to reduce reliance on oil to avoid political and humanitarian crises, such as those in Sudan.

Takeaways

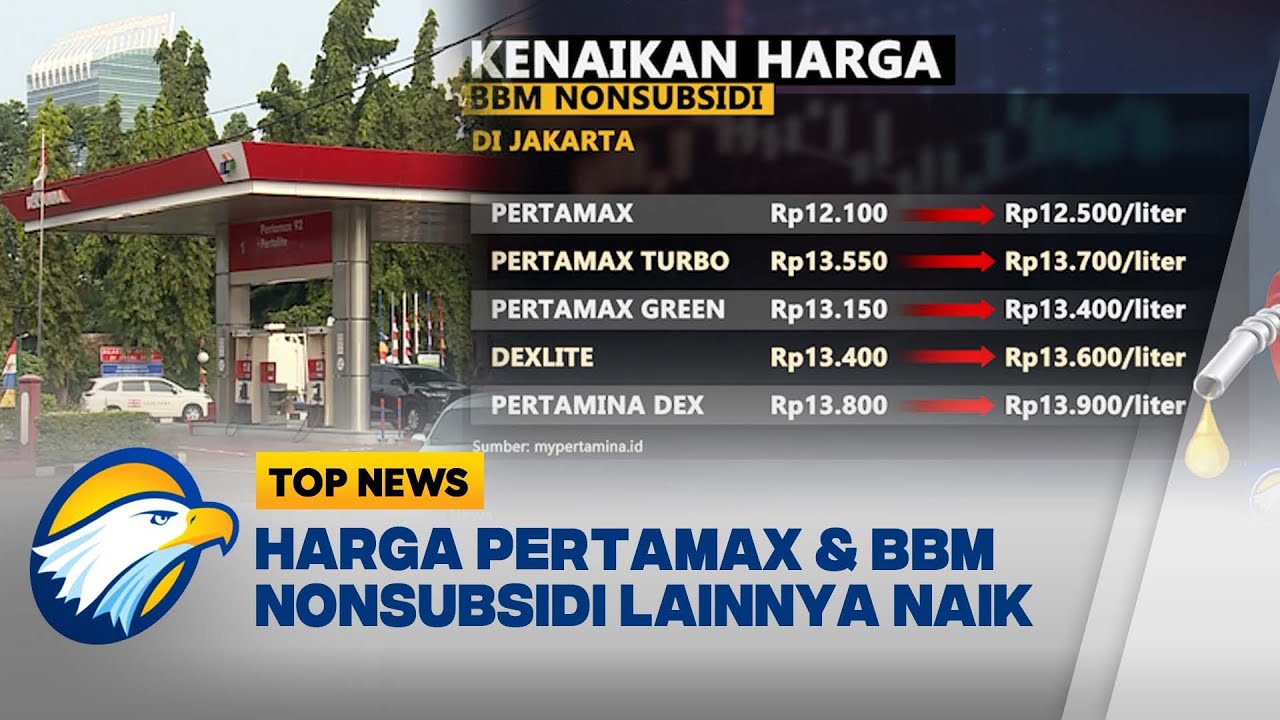

- 😀 The Indonesian government raised fuel prices by 23.5% due to rising subsidy costs, despite falling global oil prices.

- 😀 Indonesia is the 27th largest country in terms of oil reserves, with 3.6 billion barrels of oil, but still imports fuel from Singapore.

- 😀 Indonesia exports raw materials to Singapore, which refines them using advanced technology and then sells them back to Indonesia.

- 😀 The global oil supply is shrinking, with the world’s remaining oil estimated at 1.65 trillion barrels, and predictions show it will be exhausted by 2052.

- 😀 Venezuela holds the largest oil reserves in the world, yet it remains one of the poorest countries due to poor governance and economic mismanagement.

- 😀 The global dependency on fossil fuels, particularly oil, is leading to concerns over the depletion of resources in the near future.

- 😀 The depletion of oil could lead to major changes in sectors like transportation, with an increase in electric vehicles, but 80% of electricity still relies on fossil fuels.

- 😀 The transition away from oil may cause societal shifts, with urban populations migrating to rural areas due to rising food costs and energy shortages.

- 😀 Countries heavily dependent on oil exports, such as Saudi Arabia and Venezuela, could face long-term economic crises when oil reserves run out.

- 😀 The military sector will face significant changes if oil is depleted, with potential shifts toward nuclear-powered vehicles and greater military dominance by countries like the U.S. and Russia.

Q & A

Why did the Indonesian government decide to raise the price of subsidized fuel on September 3rd?

-The government decided to raise fuel prices because fuel subsidies were becoming increasingly expensive, even though global oil prices were decreasing. The fuel price hike was aimed at managing this rising subsidy burden.

How much was the fuel price increase in Indonesia on September 3rd?

-The fuel price increase on September 3rd was significant, reaching up to 23.5%, as announced by the Minister of Finance, Sri Mulyani.

What impact will the fuel price increase have on Indonesia's economy?

-The increase in fuel prices will have widespread effects, leading to higher prices for basic goods, transportation costs, and an overall rise in the cost of living.

What is the current state of Indonesia's oil reserves?

-Indonesia ranks 27th globally in terms of oil reserves, with approximately 3.6 billion barrels of oil. However, despite these reserves, Indonesia imports fuel from Singapore.

Why does Indonesia import fuel from Singapore despite having significant oil reserves?

-Indonesia imports fuel from Singapore due to a lack of advanced oil refining technology. Singapore's ExxonMobil Jurong Island refinery is one of the largest in the world, allowing Singapore to process raw materials, including those from Indonesia.

How much does Indonesia spend annually on importing fuel from Singapore?

-Indonesia spends approximately 15.415 billion US dollars (about 229 trillion IDR) annually on importing fuel from Singapore, despite exporting raw materials to the country.

What is the global oil situation, and how does it affect countries dependent on oil?

-Globally, oil reserves are depleting, with only 1.65 trillion barrels of oil left. Countries like the United States, Japan, and China are major consumers, while oil-rich nations like Venezuela, Saudi Arabia, and Nigeria face potential long-term crises as oil becomes scarcer.

What predictions have been made about the depletion of fossil fuels?

-Reports predict that crude oil could be depleted by 2052, natural gas by 2060, and coal by 2090, highlighting the urgency for transitioning away from fossil fuels.

What will happen to transportation and electricity if oil runs out?

-If oil runs out, transportation systems relying on gasoline and diesel will be disrupted. However, even electricity generation still depends on fossil fuels, with 80% of electricity production reliant on them, including 33% from oil.

How might the depletion of oil affect global military forces?

-If oil is depleted, military vehicles like tanks, jet planes, and warships will need to transition to alternative energy sources. Countries with nuclear-powered submarines, such as the US and Russia, may lead in military dominance, potentially collaborating to control global military power.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)