Over 5 MILLION Tests PROVE This Trading Strategy Works!

Summary

TLDRThis video introduces a robust trade management strategy that focuses on keeping positions open for long periods to capture rare, large market trends. The approach involves scaling stop losses on progressively higher timeframes, which allows traders to weather short-term volatility and potentially reap significant profits. The speaker shares a proven track record with statistical backing, emphasizing the importance of psychological discipline and adaptability in using the strategy effectively. While most trades result in small losses or break-even, the occasional large trend can lead to substantial gains, making this a powerful method for experienced traders.

Takeaways

- 😀 Scaling to higher timeframes increases the stop loss, allowing trades to stay open longer without being stopped out by short-term noise.

- 😀 By using wider stop losses, trades can capture larger market trends and potentially yield significant profits, such as 93% unrealized gains on a single trade.

- 😀 A strategy that works over time doesn't rely on consistent small wins but on occasionally hitting large trends that generate substantial returns.

- 😀 The key to success in trading is not in seeking small profits every day but in being patient and letting profitable trades run longer.

- 😀 Testing the strategy over 5,000 trials across 28 currency pairs and 20 years of data showed a solid edge with 76% of trials returning positive results.

- 😀 The edge in the strategy comes from making numerous small attempts to enter the market, knowing that most will fail but a few will catch large trends.

- 😀 The long-term approach, which keeps trades open to capture occasional non-random moves, is the core principle of this strategy.

- 😀 A solid trading strategy is adaptable and flexible, allowing the trader to use various methods like ATR, moving averages, or discretion to manage trades.

- 😀 This strategy is not about having a rigid set of rules but about maintaining a robust, flexible foundation that works across different market conditions.

- 😀 Successful trading depends more on the trader's ability to make good decisions and manage emotions rather than the specific strategy or system used.

- 😀 Trading psychology plays a crucial role in success—improving decision-making and managing emotions should come before implementing a specific trading strategy.

Q & A

What is the main strategy discussed in the video?

-The strategy discussed revolves around entering trades with tight stop losses on short time frames and then scaling up to higher time frames, allowing positions to remain open for longer periods and capturing larger market movements while avoiding short-term noise.

How does scaling up to higher time frames affect stop losses?

-As the trader scales up to higher time frames, the stop loss becomes wider, accommodating larger fluctuations in the market. For example, on the daily chart, the stop loss could be as large as 500 pips, allowing the trade to remain open for months without concern for random short-term noise.

What is the benefit of allowing trades to stay open for a longer period?

-Allowing trades to stay open for longer periods enables the trader to capture non-random, significant market movements, leading to larger profits. While most trades may result in small losses or break-even points, occasional big trends can yield substantial returns, such as 1000 pips in a single trade.

How much profit did the trader make on a trade two weeks ago?

-Two weeks ago, the trader entered a position with an 8-pip stop loss. The price has since moved 750 pips in their favor, resulting in an unrealized profit of 93%. The trailing stop has locked in over 300 pips, which is a 40% return.

What percentage of trades in this strategy are expected to be profitable?

-In the strategy, only a minority of trades are expected to be profitable. Most trades will either make no money or result in small wins and losses that cancel each other out. However, occasional large market moves yield substantial profits.

How was the effectiveness of this strategy tested?

-The strategy was tested on over 5,000 trial series, using random entries every 15 minutes across 28 currency pairs with 20 years of historical chart data. 76% of the trials returned positive results, demonstrating a statistically robust edge.

What is the advantage of this strategy compared to trying to make small profits consistently?

-The advantage is that it is easier to make a large profit (e.g., 1000 pips) in a single trade than to consistently make small profits (e.g., 10 pips every day for 100 days). This strategy focuses on capturing large, non-random trends that lead to significant returns.

How is the strategy's edge explained?

-The strategy's edge lies in making numerous small, low-cost attempts to enter the market, with the understanding that most will fail. However, when a large trend does occur, the position is held long enough to accumulate significant profits from these non-random market movements.

How flexible is this trading strategy?

-The strategy is highly flexible. It allows for different methods of trade management, such as using ATR, moving averages, or discretionary judgment based on swing points. This flexibility ensures the strategy can adapt to various market conditions.

What is the most important factor for success with this strategy?

-The most important factor for success with this strategy is the trader's ability to manage their decision-making and psychology. The strategy itself is a tool, but the trader’s skill and mindset ultimately determine the success of the trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Are Stocks Set Up For A Crash Landing?

Best "Scalping" STRATEGY in 10 MINUTES l $500/day l Stocks Futures Options Crypto Forex (FULL GUIDE)

Hệ Thống Scalping Trên Chart 5 Phút Của Kathy Lien - Nhật Hoài Trader

🔴 (100% SNIPER Entries) - This "MACD-STOCHASTIC-RSI" Strategy Will Make You Filthy RICH

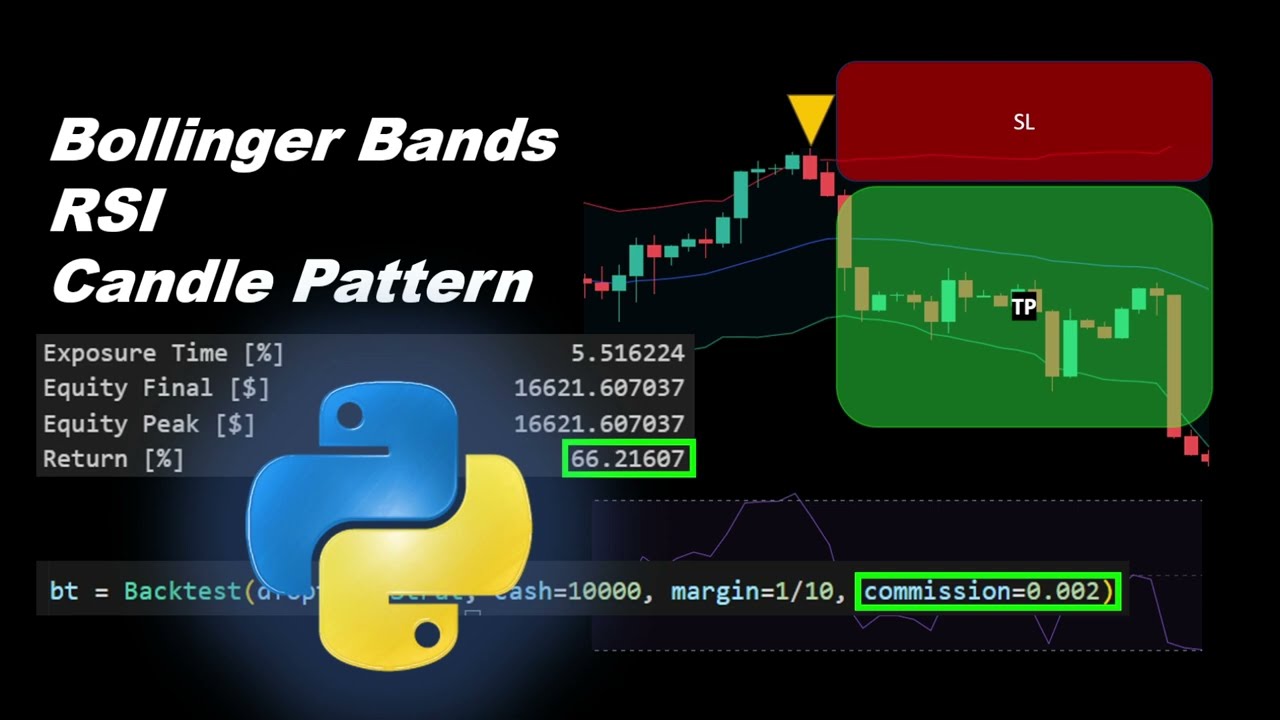

Profitable Strategy Using Bollinger Bands and RSI Automated in Python

Make a Better Strategy If You Want to Succeed

5.0 / 5 (0 votes)