Fasilitas dan Dukungan Pemerintah dalam Skema KPBU (Public-Private Partnership)

Summary

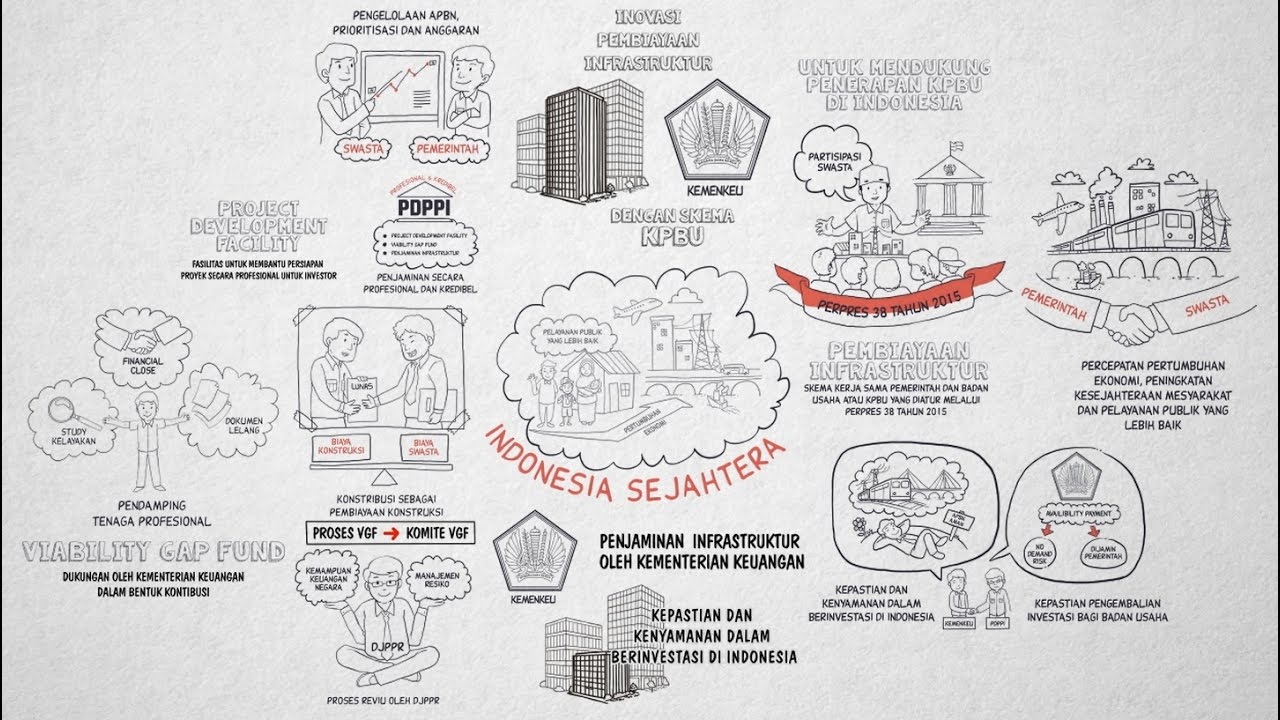

TLDRThe Indonesian government is accelerating infrastructure development to boost economic growth and public services, focusing on public-private partnerships (KPBIs) as a key financing mechanism. By leveraging schemes such as the Project Development Facility (PDF), the Vijf contribution for construction costs, and infrastructure guarantees, the government reduces financial risks for investors. Additionally, the Availability Payment (AP) model ensures predictable returns, fostering investment in critical infrastructure. These initiatives aim to overcome funding challenges while enhancing public welfare and fostering sustainable economic growth.

Takeaways

- 😀 Infrastructure development is essential for accelerating economic growth and improving public welfare, as well as providing better public services amidst governmental limitations.

- 😀 The government offers alternative financing models that involve private sector participation to meet infrastructure funding needs.

- 😀 The Government and Business Entity Cooperation (KPBI) model, regulated by Presidential Regulation No. 38 of 2015, supports the implementation of infrastructure projects in Indonesia.

- 😀 The Ministry of Finance has introduced innovative financing methods, including fiscal support for infrastructure projects under the KPBI scheme.

- 😀 Project Development Security (PDS) helps prepare infrastructure projects professionally to attract investors and secure financial backing from banks and financing institutions.

- 😀 The Ministry of Finance provides Vijf, a support mechanism that reduces the financial burden on private parties by covering part of the construction costs to make projects financially viable.

- 😀 The Vijf proposal submitted by project cooperation leaders (PJPK) is processed by a committee for evaluation, considering national financial capabilities and risk management principles.

- 😀 Infrastructure guarantees, provided by the Ministry of Finance, offer financial security to businesses, ensuring investment certainty and protection against financial liabilities in public-private partnership projects.

- 😀 Infrastructure guarantees are executed under strict financial risk management principles to protect the state budget (APBN) and maintain long-term sustainability.

- 😀 The Availability Payment (AP) scheme, introduced in 2015, ensures the return on investment through payments based on service availability, without demand risks for businesses, and political risks are covered by government guarantees.

Q & A

What is the main goal of infrastructure development in Indonesia according to the transcript?

-The main goal of infrastructure development in Indonesia is to accelerate economic growth, improve public welfare, and provide better public services, despite the government's financial constraints.

What is the alternative financing model introduced for infrastructure projects in Indonesia?

-The alternative financing model introduced for infrastructure projects is the Public-Private Partnership (PPP) model, which involves private sector participation to meet the funding needs for infrastructure development.

How is the PPP model regulated in Indonesia?

-The PPP model is regulated through Presidential Regulation No. 38 of 2015, which governs the implementation of infrastructure development through partnerships between the government and private entities.

What role does the Ministry of Finance play in infrastructure financing?

-The Ministry of Finance plays a crucial role in providing various fiscal facilities and support for infrastructure projects, including creating financing innovations and offering support for PPP implementation.

What is the purpose of the Project Development Facility (PDF)?

-The Project Development Facility (PDF) is designed to assist in the preparation of infrastructure projects, helping project sponsors prepare feasibility studies, tender documents, and manage transactions, ultimately attracting investor interest.

What is the purpose of the Vijf facility, and how does it contribute to infrastructure projects?

-The Vijf facility is a financial support mechanism that contributes a portion of construction costs in cash to projects that do not yet meet financial feasibility. This helps lower the costs borne by the private sector, improving financial viability and providing affordable service rates for the public.

How does the process of Vijf support requests work?

-Requests for Vijf support are submitted by Project Executing Agencies (PJPK) and processed by the Vijf Committee, which evaluates them based on the country's financial capacity and risk management principles.

What is infrastructure guarantee, and how does it work in Indonesia?

-Infrastructure guarantee is a facility provided by the Ministry of Finance to give assurance and comfort to private investors in Indonesia. It involves providing guarantees for the financial obligations of project sponsors involved in PPPs, managed by PT Penjaminan Infrastruktur Indonesia (PTPI).

What happens when the need for guarantees exceeds PTPI's capacity?

-When the guarantee needs exceed PTPI's capacity, joint guarantees are provided by the Ministry of Finance and PTPI, ensuring that infrastructure projects continue smoothly.

What is the 'Availability Payment' (AP) scheme, and how does it support infrastructure projects?

-The Availability Payment (AP) scheme is an investment recovery mechanism where payments are made based on the availability of services, not demand. It guarantees investors the return on their investments, covering political risks that can be guaranteed by the Ministry of Finance through various financial facilities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Fasilitas dan Dukungan Pemerintah dalam Skema KPBU

AGRA Philippine PPP 101 ( Private Public Partnership )

Kerjasama Pemerintah dan Swasta: Solusi Pembangunan Infrastruktur?

A quick introduction to Public-Private Partnership

KPBU - Kerjasama Pemerintah Badan Usaha

Fundamentos da Gestão Pública - Aula 03 - Pós EAD

5.0 / 5 (0 votes)