MATERIALITAS DALAM AUDIT | KASUS PT KAI 2005

Summary

TLDRThis video explains the concept of materiality in auditing, emphasizing its significance in assessing financial misstatements. It covers the steps auditors follow to determine materiality, including setting overall materiality, defining performance materiality, and estimating aggregate misstatements. Using the case of PT KAI's financial misstatement in 2005, the video illustrates the consequences of failing to apply materiality correctly. The speaker highlights how materiality is a subjective and relative concept, requiring auditors to use professional judgment based on company size and industry standards. The importance of accurate auditing and transparency is also discussed.

Takeaways

- 😀 Materiality in auditing refers to the threshold above which misstatements in financial statements could influence the decisions of users relying on those reports.

- 😀 Materiality is critical for the proper application of auditing standards, especially in determining audit procedures and reporting requirements.

- 😀 According to auditing standards, materiality is defined by the potential impact that errors or omissions in financial information may have on decision-making.

- 😀 A key example of materiality is when a company misreports its profits due to incorrect accounting treatment, misleading investors and stakeholders.

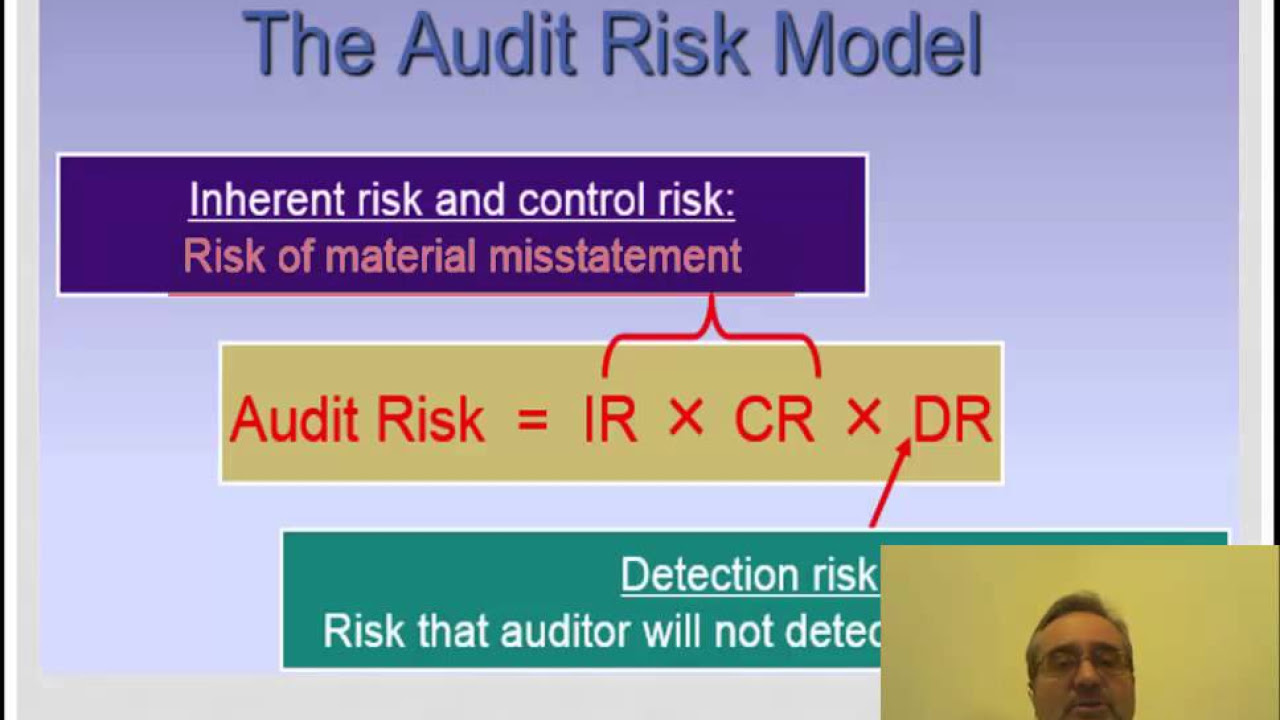

- 😀 There are five steps in applying materiality in auditing: 1) setting overall materiality, 2) determining performance materiality, 3) estimating misstatements, 4) comparing misstatements to materiality, and 5) revising materiality estimates as needed.

- 😀 Performance materiality is often set lower than overall financial reporting materiality to reduce the risk of undetected misstatements.

- 😀 Initial materiality is often revised during the audit based on new information or adjustments made during the audit process, referred to as revised materiality.

- 😀 Auditors distinguish between 'known' misstatements (those that can be directly measured) and 'possible' misstatements (which are based on estimates and projections).

- 😀 Projections or estimates of possible misstatements can be made from sampling, where the auditor extrapolates findings from a sample to the entire population.

- 😀 The case of PT KAI in 2005 demonstrates how material misstatements (such as unrecorded expenses or incorrect valuations) can significantly distort financial statements and decision-making.

- 😀 Materiality is inherently subjective and varies between companies. What may be material for a smaller company may not be material for a larger one, requiring professional judgment by auditors.

Q & A

What is materiality in the context of auditing?

-Materiality in auditing refers to the significance of an omission or misstatement in financial information that could influence the decision-making of users of the financial statements. It is a fundamental concept used to determine whether an item is considered large enough to affect financial decision-making.

Why is materiality important in auditing?

-Materiality is important because it helps auditors focus on the areas of financial statements that could significantly affect users' decisions. By applying materiality, auditors can prioritize their efforts on the most important aspects of the financial statements.

How is materiality defined according to the script?

-Materiality is defined as the magnitude of an omission or misstatement in financial information that, if considered in context, could influence or change the judgment of users who rely on that information for decision-making.

What are the steps involved in applying materiality in auditing?

-The steps in applying materiality include: 1) setting materiality for the financial statements as a whole, 2) setting performance materiality, 3) estimating the combined misstatement, and 4) comparing the estimated misstatements with the initial or revised materiality considerations.

What is the difference between materiality for the financial statements and performance materiality?

-Materiality for the financial statements refers to the overall significance of misstatements in the entire financial report, while performance materiality is set at a lower threshold to reduce the risk of undetected misstatements within specific segments of the audit.

What is meant by 'revised materiality' in auditing?

-Revised materiality refers to adjustments made to materiality thresholds during the course of an audit. These revisions occur as the auditor gathers more evidence and re-evaluates the financial data.

What are the two types of misstatements in auditing?

-The two types of misstatements are: 1) Known misstatements, which are quantifiable errors identified during the audit, and 2) Likely misstatements, which include errors estimated based on sampling or judgmental differences between management's and the auditor's estimates.

Can you explain the concept of 'projection misstatements' as discussed in the script?

-Projection misstatements refer to estimated misstatements in a population based on audit sample results. For instance, if an auditor identifies misstatements in a sample, they extrapolate these findings to the entire population to estimate the potential total misstatement.

How does materiality affect the detection of misstatements during an audit?

-Materiality affects how auditors plan their work and what areas of the financial statements they focus on. The lower the materiality threshold, the more likely it is that auditors will detect smaller misstatements. Conversely, a higher materiality threshold means fewer misstatements are considered significant.

What is an example of a material misstatement from the PT KAI case?

-An example from the PT KAI case is the misstatement of their financial results, where the company reported a profit of 6.9 billion, but after further analysis, it was revealed that PT KAI had actually incurred a loss of 63 billion. This discrepancy was due to unadjusted misstatements such as unaccounted for VAT and uncorrected inventory valuations.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)