Manajemen Resiko Bisnis dan Mitigasi dalam Bank Syariah Indonesia (BSI)

Summary

TLDRThis video explores the essential role of risk management in Islamic business, particularly in Islamic banking. It outlines various types of risks, such as market, liquidity, operational, credit, and reputational risks, and highlights the importance of mitigating these risks to ensure business sustainability. Drawing from Islamic teachings, such as the story of Prophet Yusuf, the video emphasizes the significance of anticipating and addressing uncertainties. It also covers practical examples, including Bank Syariah Indonesia’s approach to managing operational risks and cybersecurity, offering valuable insights for businesses aiming to protect their assets and improve decision-making.

Takeaways

- 😀 Risk management is crucial for business sustainability, as it helps identify, analyze, and control potential risks to minimize their impact.

- 😀 In Islamic teachings, risk management is reflected in the story of Prophet Yusuf (Joseph), where anticipation and strategy are emphasized to face uncertainties like drought.

- 😀 There are various types of risks for Shariah-compliant banks, including market risk, liquidity risk, operational risk, credit risk, and reputational risk.

- 😀 Risk mitigation aims to protect organizations from negative impacts, ensuring stability and smooth operations while fostering a safer environment for stakeholders.

- 😀 Effective risk mitigation improves business continuity by preparing businesses for potential threats and supporting sound decision-making processes.

- 😀 Mitigating risks helps reduce financial losses by anticipating and managing risks that could affect assets, income, or operational costs.

- 😀 Bank Syariah Indonesia (BSI) was established in February 2021 through the merger of three major Shariah banks and is committed to supporting Indonesia's economic development.

- 😀 BSI’s services include Shariah-compliant banking products such as savings, investment, financing, and various banking services, ensuring adherence to Islamic principles.

- 😀 One of the key risks faced by BSI is operational risk, which can arise from internal process failures, human error, system malfunctions, or external events such as cyberattacks.

- 😀 A notable cyberattack on BSI in May 2023 caused system failures and data breaches, highlighting the need for improved cybersecurity measures and infrastructure to mitigate such risks in the future.

Q & A

What is the primary focus of the video?

-The video focuses on the concept of risk management in Islamic business, specifically in the context of Shariah-compliant business practices and how risk management is applied in Islamic banking and finance.

How does risk management benefit businesses?

-Risk management helps businesses identify, analyze, and control potential risks, minimizing negative impacts, enhancing decision-making, and increasing operational stability. It also supports financial protection and overall organizational sustainability.

What are the types of risks identified in Islamic banking?

-The types of risks identified in Islamic banking include market risk, liquidity risk, operational risk, credit risk, and reputational risk.

What role does risk management play in Shariah-compliant businesses?

-In Shariah-compliant businesses, risk management ensures that potential risks are mitigated in accordance with Islamic principles. This includes anticipating and addressing uncertainties in business operations, as seen in the story of Prophet Yusuf in Surah Yusuf, which emphasizes strategy and foresight in the face of adversity.

What does risk mitigation aim to achieve?

-Risk mitigation aims to protect an organization from the negative impact of potential risks, create a safer environment for stakeholders, and ensure smoother operations. It helps in preventing unwanted disruptions and minimizing financial losses.

How does risk mitigation enhance decision-making?

-Risk mitigation supports better decision-making by providing valuable insights into possible future challenges. This allows businesses to assess risks in advance and make informed choices that align with organizational goals.

What specific operational risks were faced by Bank Syariah Indonesia (BSI)?

-In May 2023, Bank Syariah Indonesia faced operational risks due to a system failure that caused a data breach. This incident highlighted the need for improved cyber security measures and infrastructure readiness.

What measures are being taken by BSI to address operational risks and cyber threats?

-BSI has taken steps to enhance its cyber security by implementing 24-hour monitoring, conducting penetration testing, and performing system checks to prevent future cyber attacks. They also advised customers to enhance their online banking security.

What is the importance of risk management in maintaining business continuity?

-Risk management is crucial for maintaining business continuity as it prepares organizations to handle potential threats, ensuring that operations remain stable even during unforeseen circumstances or crises.

What are the main products and services offered by Bank Syariah Indonesia?

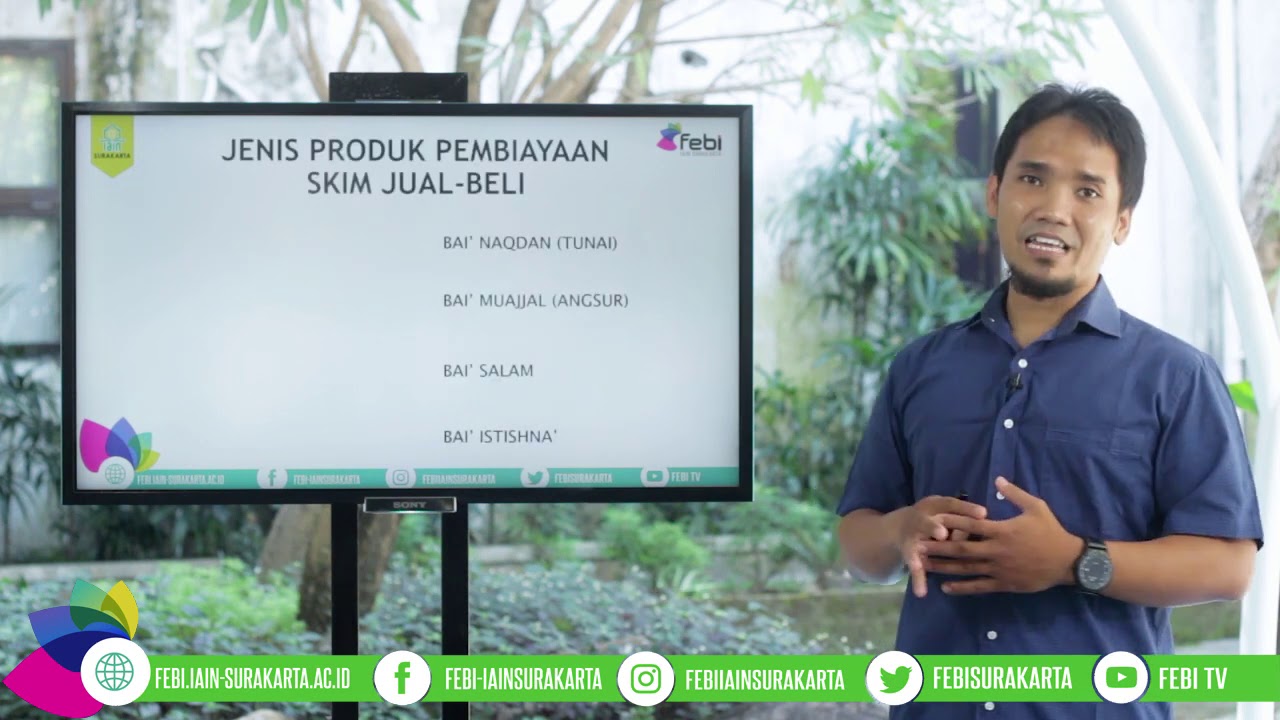

-Bank Syariah Indonesia offers a wide range of products and services, including savings, investment services, and financing options under Shariah-compliant contracts such as mudarabah, musyarakah, and ijarah. They also provide digital banking services and products like mobile banking and debit cards.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

MANAJEMEN RISIKO KEUANGAN || TUGAS SESI 1|| SHARLA TWO DILLA

Strategi dan Inovasi dalam Memperkuat Branding Produk Keuangan Syariah

SELAYANG PANDANG ANALISIS PEMBIAYAAN PERBANKAN SYARIAH : PRODUK DAN RESIKO / BASIC ANALITICS

Kuliah Bank dan Lembaga Keuangan - Ep. 10 Bank Syariah

Keuntungan Bank Syariah Lebih Besar dari Bank Konvensional

5.0 / 5 (0 votes)