Master These PULLBACK SECRETS | WIN MORE TRADES

Summary

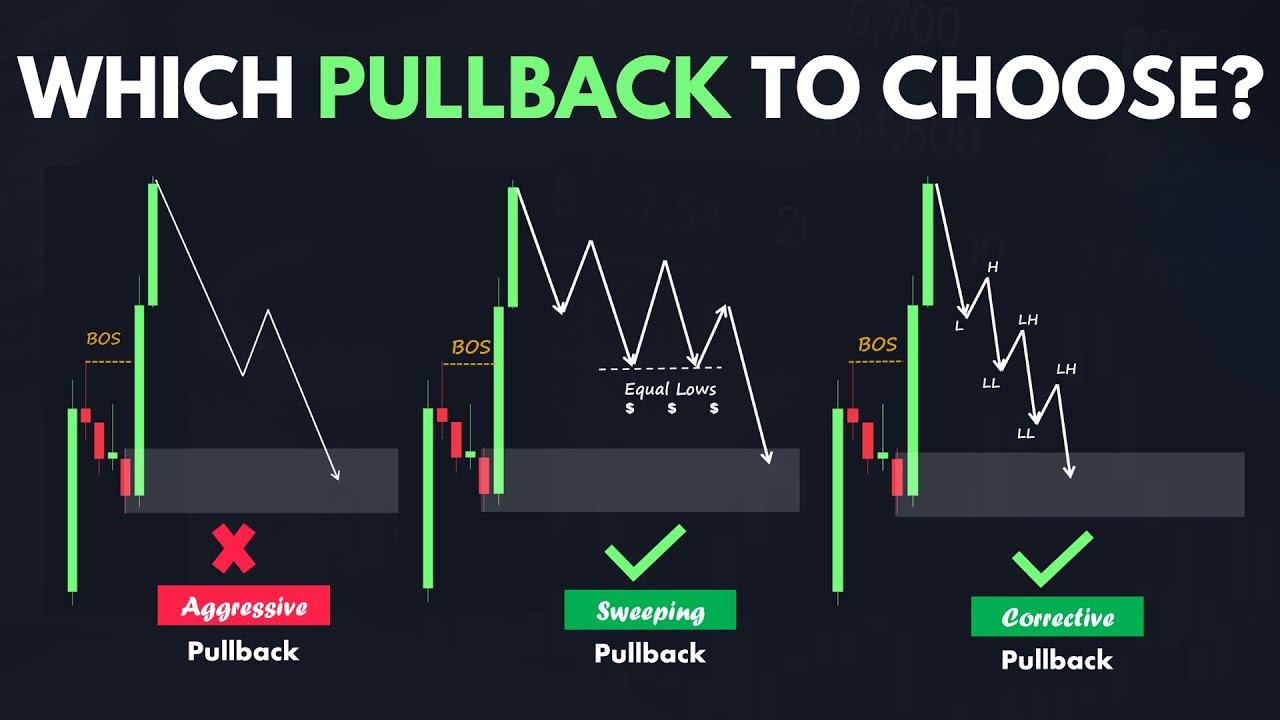

TLDRIn this video, the importance of identifying valid pullbacks in trading is explored. A pullback is a temporary price retracement against the main trend, which can offer lucrative entry points. The video highlights the distinction between valid and invalid pullbacks through detailed examples, emphasizing how breaks in price structure help determine potential Points of Interest (POI) for trades. By mastering pullbacks, traders can better position themselves for successful market entries, whether in bullish or bearish trends. The video also includes practical chart examples for clear visualization of these concepts.

Takeaways

- 😀 Not every pullback is a valid pullback. Understanding this concept is essential for effective trading.

- 😀 Price moves in cycles of higher highs and higher lows or lower highs and lower lows, depending on market trends. This applies universally to all markets, including crypto, forex, and indices.

- 😀 Identifying valid pullbacks involves careful analysis of each candle’s high and low to determine if price has broken key levels.

- 😀 Invalid pullbacks are marked by candles that do not break structure significantly. These are considered 'inside bars' and are not suitable for drawing OBs (Order Blocks).

- 😀 A valid pullback must show a clear break in price direction. If price fails to break structure or moves in a small range, it is likely a trap and not a good entry point.

- 😀 When marking valid pullbacks, always check if the high or low of a candle has been broken. A break above or below a key level confirms the pullback as valid.

- 😀 The concept of pullbacks is vital in helping traders identify entry points in trending markets. Understanding pullbacks can improve the quality of your trade setups.

- 😀 Pullbacks should be used to mark Points of Interest (POIs) for possible trades. Only valid pullbacks should be considered for marking OBs.

- 😀 A pullback should show a clear change in price direction (Chalk - Change of Character). This indicates that the market is likely to continue in the new direction.

- 😀 For effective trading, use higher timeframes (1-hour or 4-hour) to identify trends and lower timeframes (like 5-minute charts) for precise entries based on valid pullbacks.

Q & A

What is a pullback in trading?

-A pullback in trading refers to a temporary reversal in the direction of a trend, where the price moves against the prevailing trend before continuing in the original direction. It is important for traders to identify valid pullbacks as they provide opportunities for entry.

Why is it important to understand the concept of a pullback?

-Understanding pullbacks is crucial because they impact the quality of other blocks you trade from. A valid pullback signals potential entry points in the market, while an invalid pullback could lead to a failed trade and losses.

What is the significance of 'higher highs' and 'higher lows' in pullback analysis?

-The concepts of 'higher highs' and 'higher lows' are crucial in an uptrend, as they help identify the overall market direction. Pullbacks occur when the price temporarily moves against this trend, and understanding these patterns helps traders spot valid pullbacks for better entry points.

What makes a pullback valid or invalid?

-A pullback is considered valid when the price breaks certain key levels, such as the high or low of a previous candle, and follows the market trend. An invalid pullback, on the other hand, does not exhibit these key characteristics and is often a trap for traders.

How can traders identify a valid pullback on the chart?

-Traders can identify a valid pullback by marking the high and low of key candles and watching for price action that breaks these levels, indicating a reversal. A valid pullback will show a clear break in price movement and can be used to mark key points of interest (POIs) for potential entries.

What role does 'smart money' play in identifying pullbacks?

-'Smart money' refers to the informed and strategic actions of experienced traders or institutions. Understanding pullbacks and valid POIs helps traders avoid smart money traps, where the market appears to offer opportunities but fails to sustain the reversal.

What is the purpose of using a box tool in pullback analysis?

-The box tool is used to mark the high and low of a particular candle. It helps traders track whether these levels are broken, which is an indication of a valid pullback. The tool aids in visualizing price movement and potential entry points.

How does price breaking above or below a candle contribute to identifying pullbacks?

-When price breaks above the high or below the low of a candle, it indicates a change in direction, signaling that a pullback has occurred. This helps traders determine whether the pullback is valid and if they should take a position in the market.

What is meant by 'imbalances' in the context of pullback trading?

-Imbalances refer to areas on the chart where the price has moved quickly in one direction, creating gaps or inefficiencies in the market. While imbalances are important for confirming valid pullbacks, this video focuses specifically on recognizing pullbacks without considering imbalances.

What is a 'change of character' (COC) and how is it related to pullbacks?

-A Change of Character (COC) refers to a shift in market structure, where the trend changes direction or shows signs of reversal. Pullbacks often lead to a COC, as they provide the necessary retracement before the market continues in the original trend direction. Identifying a COC after a valid pullback confirms the trade setup.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Best Pullback Trading Strategies In Forex - The Pullback Mastery Guide

Day Trading Stock and Swing Trading Options Trades

The Pullback Secret That No One Tells You About: Smart Money Trading Concepts

Smart Money Concepts: Market Direction

Why The LEPPYRD Model is So Successful

Key Trade Setups for the Week: Top Entry & Exit Strategies

5.0 / 5 (0 votes)