GET OUT OF THE MARKET! YOU'RE BEING PLAYED!! Rich Dad Poor Dad Author Robert Kiyosaki and Bitcoin

Summary

TLDRIn this video, the host discusses the current state of cryptocurrency and financial markets, expressing concern over the sideways trading pattern. They highlight an interview with Robert Kiyosaki, author of 'Rich Dad Poor Dad', who warns about the Federal Reserve's influence and the devaluation of fiat currency. Kiyosaki advocates for investing in cryptocurrencies and precious metals as a hedge against the impending economic crisis. The host emphasizes the importance of understanding financial education and the need to transition from traditional investments to digital assets like Bitcoin, as they may offer more stability and opportunity in the evolving information age.

Takeaways

- 😌 The cryptocurrency market is experiencing a sideways movement with not much significant activity, causing a sense of unease as it suggests something might be brewing in the background.

- 📚 Robert Kiyosaki, author of 'Rich Dad Poor Dad', emphasizes the importance of financial education and understanding the difference between knowing and truly understanding the financial systems.

- 💡 Kiyosaki suggests that the current financial system, including the Federal Reserve, is flawed and likens it to The Wizard of Oz, where the public is kept in the dark about its true workings.

- 💸 He warns that quantitative easing and the printing of trillions of dollars could lead to detrimental effects globally, hinting at a potential economic collapse.

- 🏫 The education system has been criticized for not teaching financial literacy, which has left many unprepared for the complexities of modern finance.

- 📉 The speaker predicts a downturn in the economy, suggesting that the current stimulus packages and the devaluation of the dollar will negatively impact savings, pensions, and businesses.

- 💼 Kiyosaki argues that the rich create their own wealth and are better equipped to handle economic downturns, unlike those who are taught to work for money.

- 🔑 The interview highlights the importance of transitioning from traditional financial systems to digital assets like cryptocurrencies, which offer more transparency and efficiency.

- 🌐 The digitalization of the economy is an ongoing trend, and cryptocurrencies are positioned to be a part of this shift towards a more global and interconnected financial system.

- 🚨 A call to action is made for individuals to educate themselves about the financial systems and to consider diversifying into assets like gold, silver, and cryptocurrencies to protect their wealth.

Q & A

What is the general sentiment of the cryptocurrency market on the day the video was recorded?

-The general sentiment of the cryptocurrency market on the day the video was recorded is described as sideways, with not much significant movement, which made the speaker a bit nervous due to the potential of something brewing in the background.

Why did the speaker mention Nance coin in the video?

-The speaker mentioned Nance coin because it was one of the few cryptocurrencies that was showing an increase in value, likely due to an announcement about the introduction of futures and options.

Who is Robert Kiyosaki and what is his significance in the video?

-Robert Kiyosaki is the creator of the 'Rich Dad Poor Dad' series of books and is known for his online empire in financial education. His interview is highlighted in the video as it discusses significant financial concepts and the potential shift towards cryptocurrencies and digital assets.

What is the main message of Robert Kiyosaki's interview that the speaker found impactful?

-The main message of Robert Kiyosaki's interview is a warning about the current financial system, suggesting that there is a need to transition from traditional investments to cryptocurrencies, digital assets, and Bitcoin due to the devaluation of fiat currency.

What historical event is referenced in the video regarding the manipulation of the financial system?

-The video references the formation of the general education board in 1904 by wealthy individuals like Rockefeller and JP Morgan, which led to the exclusion of financial education from the curriculum, allowing them to control the financial system.

What is the speaker's view on the current economic situation and the role of the Federal Reserve?

-The speaker views the current economic situation as dire, with the Federal Reserve being likened to a scam that is leading to the devaluation of the dollar, hyperinflation, and an eventual economic collapse.

What is the speaker's opinion on the recent stimulus packages?

-The speaker believes that the recent stimulus packages, which involve printing large amounts of money, are devaluing the dollar, wiping out savings and pensions, and ultimately hurting the economy.

What does the speaker suggest is the best course of action for individuals given the current financial climate?

-The speaker suggests that individuals should move away from traditional investments and fiat currency and instead invest in cryptocurrencies and digital assets, which are seen as more stable and less susceptible to the devaluation of fiat currency.

What is the speaker's perspective on the role of education in financial literacy?

-The speaker criticizes the current education system for not teaching financial literacy, which he believes is crucial for individuals to understand and navigate the financial system effectively.

How does the speaker describe the current situation for small business owners and workers?

-The speaker describes the current situation for small business owners and workers as grim, with many facing layoffs, business closures, and financial instability due to the economic policies and the handling of the COVID-19 crisis.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

"Bottom is in?" MANTA NETWORK TECHNICAL ANALYSIS AND PRICE PREDICTION

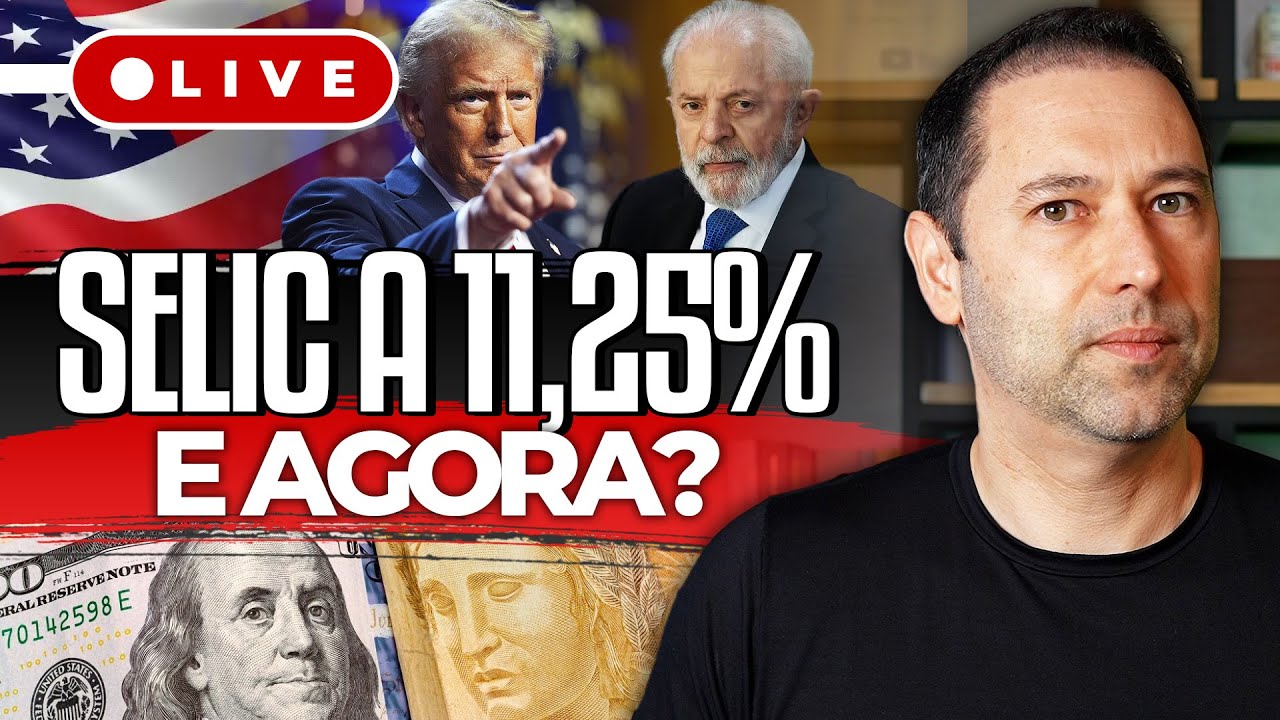

NOVA ALTA NA TAXA SELIC PARA 11,25% | COMO FICAM OS INVESTIMENTOS NO BRASIL + DONALD TRUMP ELEITO

Cripto Bitcoin e Mercati Finanziari: opportunità e rischi in un contesto complesso

Best Liquidity & All Types of Liquidity | Smart Money Concepts

19 NOV Nifty Banknifty market analysis #trading

Binary Options Trading Legal or illegal ? RBI BAN II Deposit & withdrawl II Payout issue

5.0 / 5 (0 votes)