How Cryptocurrency ACTUALLY works.

Summary

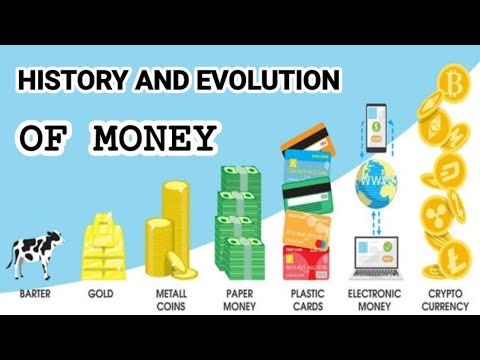

TLDRThis video script offers a comprehensive guide to cryptocurrencies, explaining their evolution from bartering to digital assets. It clarifies the concept of cryptocurrencies as decentralized digital ledgers, highlighting their advantages like security, speed, and low transaction fees. The script also delves into the technology behind cryptocurrencies, particularly blockchain, and discusses the potential for investment while addressing the volatility, limited acceptance, environmental concerns, and regulatory challenges. Additionally, it touches on the peculiar phenomenon of NFTs and the surprising success of Dogecoin, providing a balanced view of the crypto world.

Takeaways

- 🌐 Cryptocurrency is seen as the most convenient era of exchange, known as stage five, where digital assets are transferred without the need for physical coins or paper money.

- 📈 Cryptocurrencies like Bitcoin operate on a decentralized ledger system, which records every transaction made with the currency, enhancing transparency and security.

- 💡 The advantage of cryptocurrencies includes the elimination of banks from transactions, enabling instant international payments with minimal fees and no exchange rate concerns.

- 🔒 Cryptography secures cryptocurrencies through blockchain technology, creating an immutable record of transactions that is resistant to tampering.

- 🚀 The term 'mooning' is used to describe cryptocurrencies that experience a significant increase in value, indicating optimism about their potential.

- 🤔 There are over 4,000 different cryptocurrencies, each with unique properties, which can make choosing an investment a complex decision.

- 📉 The volatility of cryptocurrencies is a significant issue, with prices often influenced by speculation and news cycles, leading to unpredictable value fluctuations.

- 🛒 Limited acceptance as a form of payment is a drawback for cryptocurrencies, as many businesses and institutions have not yet adopted them for transactions.

- ⚡ The environmental impact of cryptocurrencies is a concern due to the high energy consumption required for transaction verification processes.

- 🕵️♂️ While cryptocurrencies are often associated with criminal activity, data suggests that traditional cash transactions have a higher rate of criminal involvement.

- 🎨 NFTs, or non-fungible tokens, represent a novel aspect of blockchain technology, allowing digital ownership of unique assets, even if the physical item is not exclusive.

Q & A

What are the five stages of currency evolution mentioned in the script?

-The five stages are: 1) Bartering (trading goods directly), 2) Introduction of coins made of precious materials like gold and silver, 3) Paper money issued by governments and banks, 4) Online transactions and credit cards, and 5) Cryptocurrency as a decentralized digital asset.

What is a ledger in the context of cryptocurrency?

-A ledger in the context of cryptocurrency is a digital record-keeping system that contains all transactions made using a particular currency. It is essentially a large, shared spreadsheet that is updated and maintained by a network of computers.

How does the decentralization of cryptocurrency work?

-Decentralization in cryptocurrency means that instead of a single entity controlling the transaction records, there are many copies of the ledger distributed across a network of computers. Each participant in the network has a copy of the ledger, which is updated independently and collectively verified.

What is the purpose of cryptocurrency mining?

-Cryptocurrency mining is the process of using computational power to verify and record transactions on the blockchain ledger. Miners who dedicate their computer resources to this process are rewarded with cryptocurrency as compensation.

Why is blockchain technology considered secure?

-Blockchain technology is secure because it organizes transaction data into blocks, each containing a unique identifier (hash) and the hash of the previous block. Any attempt to alter a block's data would invalidate the hashes of all subsequent blocks, making it nearly impossible to fraudulently change the ledger without altering it on the majority of the network's computers.

What are some advantages of using cryptocurrency over traditional banking?

-Advantages of using cryptocurrency include faster international payments, no need for banks, no exchange rate concerns, no interest rates, and minimal transaction fees for some cryptocurrencies.

What is the term used to describe cryptocurrencies that experience a rapid increase in value?

-The term used to describe cryptocurrencies that experience a rapid increase in value is 'mooning' or 'going to the moon'.

How does the script describe the concept of NFTs (Non-Fungible Tokens)?

-NFTs are described as a way to have digital ownership over something, like a JPEG image or a tweet, without stopping others from using or sharing it. They represent a unique identifier on the blockchain that proves ownership of the original asset.

What is the environmental concern associated with cryptocurrency?

-The environmental concern is that the process of verifying transactions through mining requires a significant amount of computing power, which in turn consumes a lot of electricity. Critics argue that this creates an inefficiency and a high carbon footprint.

How does the script address the misconception that cryptocurrencies are used primarily for criminal activities?

-The script clarifies that cryptocurrencies are not anonymous but pseudonymous, meaning that transactions are recorded on a public ledger with unique identifiers. It also cites data showing that a very small percentage of crypto transactions are criminal, compared to a higher percentage of cash transactions.

What is the script's stance on the future of cryptocurrency?

-The script does not explicitly state a stance on the future of cryptocurrency but presents both the advantages and the challenges associated with it. It acknowledges the excitement and potential of cryptocurrencies while also discussing their volatility, acceptance, environmental impact, and regulatory concerns.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Evolution of Money Explained

TIPOS DE CARTEIRA BITCOIN (Saiba onde guardar suas criptomoedas!)

Explain Crypto To COMPLETE Beginners: Coin Bureau Guide!!

History and Evolution of Money - The History

Akademi Hamster: Segala hal yang perlu kamu ketahui tentang blockchain

La storia del BITCOIN e della BLOCKCHAIN

5.0 / 5 (0 votes)