【突發】美股美債已撐不到2025年了,打游擊戰賺完就跑真爽?無論升息還是降息,美股都會上漲的絕密真相?想打折抄底買房,買股票的,應該怎麼佈局手上的錢?

Summary

TLDRThe video explores the complexities of the U.S. financial system, focusing on the manipulation of U.S. Treasuries, the role of major investors like George Soros, and the speculative nature of U.S. stocks. The speaker predicts a financial crisis after Trump’s potential return to power, drawing parallels to the 2008 crash. Emphasizing a flexible, system-based investment approach, they share their strategies of short-term trading, holding cash, and investing in assets like Bitcoin and gold. The key takeaway is the importance of adapting to market volatility and using calculated strategies to profit in uncertain times.

Takeaways

- 😀 The U.S. dollar has defied expectations by continuing to appreciate, attracting more money into the U.S. despite predictions of depreciation.

- 😀 George Soros' group is short-selling U.S. Treasury bonds, a move that could trigger financial instability, similar to the Asian financial crisis of the 1990s.

- 😀 The U.S. stock market may face a major downturn, with large players cashing out at high prices while smaller investors are left holding assets during the collapse.

- 😀 The 2008 financial crisis is likely to repeat itself, with big capitalists benefiting from asset buyouts at a steep discount during a crash.

- 😀 The speaker prefers short-term trading strategies, focusing on quick profits rather than long-term holdings, using flexible and tactical moves.

- 😀 Cash is considered the most important asset for short-term trading, with the speaker holding a significant portion of their portfolio in cash for flexibility.

- 😀 Gold is used as a safe-haven asset, especially during times of war or economic instability, while Bitcoin is traded more actively for short-term gains.

- 😀 Successful investing relies on a systematic approach to stock picking, rather than relying on intuition or emotions when selecting stocks.

- 😀 The speaker stresses the importance of market timing, particularly in buying low and selling high, with specific entry points for Bitcoin being a key focus.

- 😀 The speaker predicts that the financial crises will intensify after Trump takes office, but their investment strategy remains unaffected by these potential risks.

Q & A

What was the speaker's initial expectation regarding the US dollar and how did the reality differ?

-The speaker initially expected the US dollar to depreciate, but in reality, the US dollar continued to appreciate. This unexpected outcome led to more money flowing into the United States instead of out, contrary to their prediction.

How does the speaker compare the current state of US assets to a team in a game?

-The speaker compares the current situation of US assets to a group of players in a game, where normally players stick to their assigned roles (top lane, middle lane, jungle), but now all are gathered together, possibly preparing for a 'team battle.' This symbolizes the unusual, collective investment strategies in play within the US markets.

What role does George Soros play in the speaker's prediction for US asset performance?

-The speaker predicts that Soros's short-selling group is targeting US Treasury bonds, similar to how they shorted other countries' assets in the past. This action is seen as a precursor to potential market collapse, with Soros representing 'Old Money' capitalists who dislike Trump.

Why does the speaker believe that shorting US Treasury bonds could lead to a financial crisis?

-The speaker suggests that if US Treasury bonds continue to be shorted, it could lead to significant losses for banks that hold long-term US debt. This situation might trigger failures similar to the Silicon Valley Bank collapse, creating a broader financial crisis.

How does the speaker explain the behavior of US stocks during recent market fluctuations?

-The speaker observes that US stocks have been rising without much buying activity, implying that investors aren't buying actively, but rather, are holding onto stocks. When the market drops, the selling volume increases, suggesting that large investors are unloading stocks. This behavior is seen as a sign of a potential market crash.

What does the speaker predict will happen after a potential collapse of US stocks and bonds?

-The speaker predicts that if US stocks and bonds collapse, the only recourse for the government will be to expand the Federal Reserve's balance sheet and print more money. This would allow capitalists to buy back assets at a low price, repeating the cycle of wealth transfer that occurred during the 2008 financial crisis.

What is the speaker's approach to investing during periods of market uncertainty?

-The speaker emphasizes a flexible and short-term investment strategy. They prefer to hold cash for speculation, engage in guerrilla warfare-style trading (quick in-and-out trades), and avoid staying too long in the market during volatile periods. Their goal is to take profits quickly and protect capital.

What role do gold and Bitcoin play in the speaker's investment strategy?

-Gold is used as a safe-haven asset due to risks such as war and potential dollar depreciation. The speaker also invests in Bitcoin when certain price levels break, viewing it as a speculative asset with significant potential for short-term gains.

Why does the speaker focus on short-term trading rather than long-term investments in stocks?

-The speaker believes that long-term holding in stocks can be risky, especially during uncertain times when markets may crash. Instead, they focus on short-term trading to capitalize on market fluctuations, using a system to identify optimal buying points and minimize risk.

What does the speaker mean by 'guerrilla warfare' in trading, and how does it apply to their investment style?

-In trading, 'guerrilla warfare' refers to a strategy of making quick, smaller profits from short-term trades rather than holding assets for long periods. The speaker employs this tactic to take advantage of short-term market movements while maintaining the flexibility to exit quickly if necessary.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Vowel Sounds

Decoding Intel's Confusing Processor Names: Core i3, i5, i7, i9 Explained!

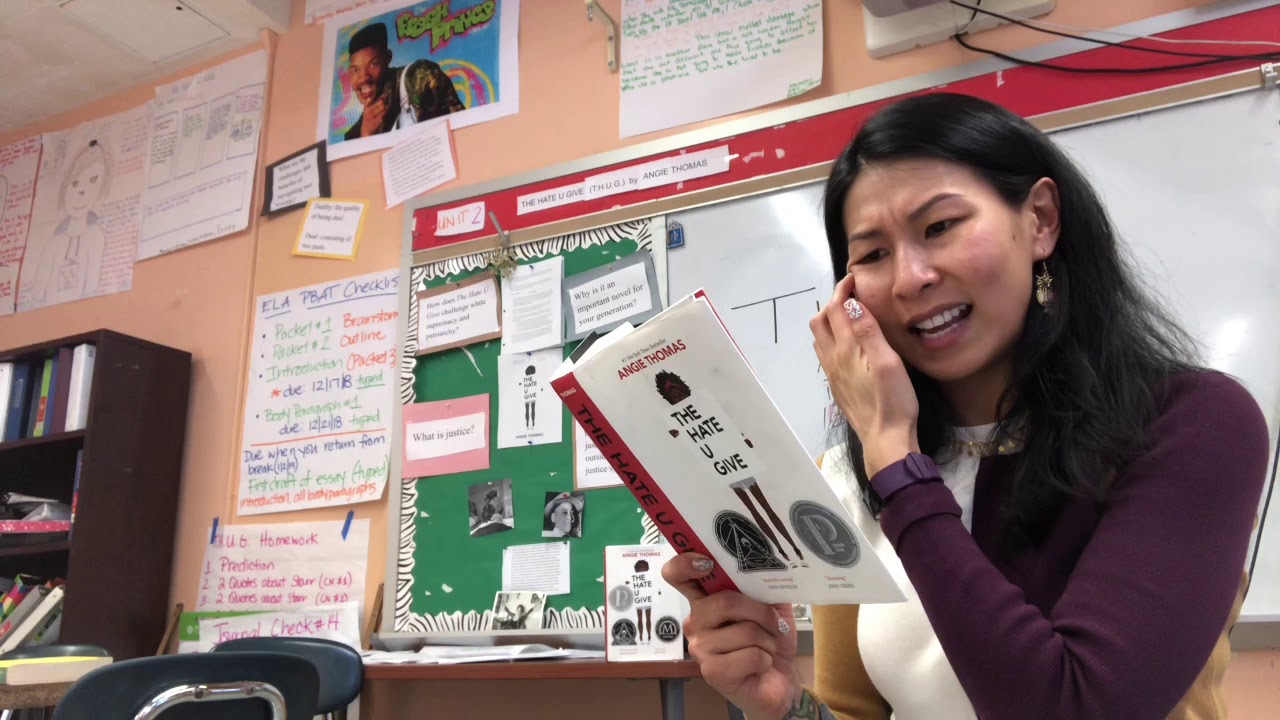

The Hate U Give Chapter 1 - Read by Ms. Nisa

For Oom Piet - Poem Analysis

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Complements of Sets

5.0 / 5 (0 votes)