BOME Price Prediction. Book of Memes updates

Summary

TLDRIn this video, the presenter discusses the potential for growth in the 'bom' token, analyzing its price movements, accumulation zones, and market trends. They highlight key price levels, including the importance of buying in specific zones and withdrawing initial investments once targets are met. The presenter warns viewers to manage expectations and avoid impulsive decisions, emphasizing the need for careful planning and risk management in this volatile market. Overall, the video provides insights into technical analysis, potential price targets, and strategies for navigating the bom token's market momentum.

Takeaways

- 😀 The bom token is currently in an accumulation zone, with a recommended buy range around 0.02051.

- 📉 The invalidation level for the bom token is at 0.211, indicating a potential risk of price reversal if breached.

- 🚀 Target prices for the bom token are set at 0.27, with further potential for growth up to 0.478 or higher.

- 💡 After a 100% price increase, traders should consider withdrawing their initial deposit to protect profits.

- ⚠️ Be cautious of corrections that may occur even after a significant price increase, as the token could drop to sweep liquidity pools.

- 🧩 The bom token has been in an uptrend for six consecutive days, showing green price action despite occasional corrections.

- 📊 The speaker advises traders to prepare for both upward and downward price movements, ensuring they are not stressed by unexpected fluctuations.

- 💰 Traders should be ready to accumulate bom at current prices but must always be aware of the risk involved in such volatile assets.

- 📆 There is potential for the token to trade in the current range for several weeks, with price movements influenced by broader market events such as elections.

- 🔍 The speaker emphasizes the importance of risk management, encouraging traders to invest only what they are comfortable losing in high-risk assets like bom.

Q & A

What is the main topic of the video?

-The video focuses on analyzing the BOM token, its recent price movements, and potential trading opportunities based on key technical levels and models.

What is the recommended strategy for buying BOM token?

-The recommended strategy is to buy in the accumulation zone, where the price is expected to consolidate before moving higher. The key is to set clear entry points and be prepared for potential corrections.

What does the term 'accumulation zone' mean in this context?

-The 'accumulation zone' refers to a price range where investors are likely to buy the token, expecting the price to eventually rise. It’s typically a period of price consolidation before a breakout.

Why is the 0.2051 price level significant for BOM token?

-The 0.2051 price level is the invalidation zone, meaning if the price drops below this level, the trading strategy is no longer considered valid, and the investment could be at risk.

What should investors do after a 100% gain in BOM token?

-Investors should consider withdrawing their initial investment after a 100% gain to secure profits, while leaving the remaining balance as 'free money' to ride out any further gains.

What are the main targets for BOM token, according to the video?

-The main targets for BOM token are 0.27 as the first target and 0.478 as the second target, with the potential for further gains if momentum continues.

What does the video say about the importance of risk management?

-Risk management is crucial, especially when dealing with volatile assets like BOM. Investors should be prepared for both upward and downward price movements, and only invest money they are willing to lose.

How can traders manage their positions in a volatile market?

-Traders can manage their positions by using stop-loss orders, setting clear entry and exit points, and staying informed about market trends to adjust their strategy accordingly.

What does the video suggest about the potential for further gains in BOM token?

-The video suggests that BOM token still has potential for further gains, especially if the momentum continues and the price remains within the accumulation zone.

How should investors approach trading in the BOM token's current market environment?

-Investors should approach trading with caution, having a clear plan, monitoring key support and resistance levels, and being ready to adapt to market corrections or sudden price changes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

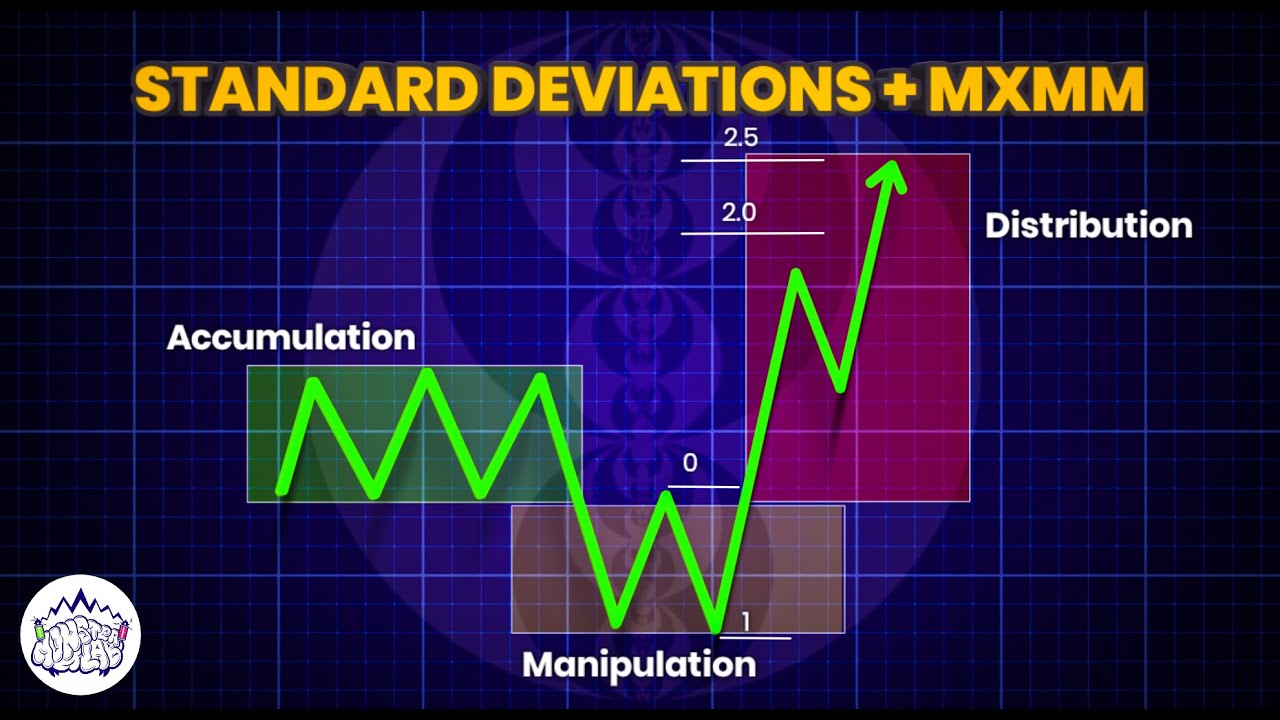

Standard Deviations + MMXM | ICT Concepts | DexterLab

TESLA Stock - Bullish Pattern Developing?

MY HONEST THOUGHTS ON ALTS... ~ ALTCOIN MARKET UPDATE

TESLA Stock - Was This A Bull Trap Or Not?

Bitcoin Dominanz fällt! Startet jetzt die Altcoin Rallye?

5 หุ้น USA ที่จะพุ่งต่อเนื่องยาวๆ | ถือกันยาวๆข้ามปี | จังหวะลงทุน | ห้ามพลาด!! #หุ้นอเมริกา

5.0 / 5 (0 votes)