What is Risk Management? (With Real-World Examples) | From A Business Professor

Summary

TLDRThis video explains the importance of risk management in business, outlining the process of identifying, assessing, and mitigating various types of risks that can impact a company's success. It covers six major business risks—financial, operational, legal and regulatory, reputational, strategic, and cybersecurity—and provides real-world examples from Zoom and Ford. The video emphasizes the need for businesses to integrate effective risk management strategies to safeguard operations, allocate resources wisely, and ensure long-term sustainability. The overall goal is to help businesses navigate uncertainties and stay resilient in a dynamic environment.

Takeaways

- 😀 Risk management is critical for all businesses, big or small, to safeguard against financial, physical, or technological problems.

- 😀 The process of risk management includes identifying, assessing, and mitigating potential risks to a company’s strategic objectives.

- 😀 There are six major types of risks that businesses face: Financial, Operational, Legal & Regulatory, Reputational, Strategic, and Cybersecurity.

- 😀 Financial risk involves uncertainties like interest rate changes, currency fluctuations, and credit defaults, which can affect a company's profitability.

- 😀 Operational risk includes factors like equipment failure, supply chain disruptions, and employee errors, impacting productivity and quality.

- 😀 Legal and regulatory risks come from changes in laws and regulations, which can affect compliance and increase operational costs.

- 😀 Reputational risk arises from public perception, including issues like product recalls or data breaches, which can harm brand value and customer trust.

- 😀 Strategic risk involves uncertainty about the success of decisions like entering new markets, launching new products, or pursuing mergers.

- 😀 Cybersecurity risk is related to threats like hacking, phishing, and malware, impacting data security and company reputation.

- 😀 The risk management process includes seven steps: identifying risks, assessing them, prioritizing them, developing strategies, implementing strategies, monitoring risks, and ensuring clear communication with stakeholders.

- 😀 Real-world examples such as Zoom scaling its infrastructure during the pandemic and Ford managing the semiconductor chip shortage illustrate how companies can successfully navigate risks through strategic planning and proactive communication.

Q & A

What is the definition of risk management in business?

-Risk management refers to the process of identifying, assessing, and mitigating risks that could impact a company's strategic objectives, such as financial instability, operational challenges, or external threats.

Why is risk management important for businesses of all sizes?

-Risk management is essential because it helps businesses prepare for potential disruptions, protect their assets, and ensure long-term success by minimizing the impact of financial, operational, and external risks.

What are the six major categories of business risks?

-The six major categories of business risks are: 1) Financial Risk, 2) Operational Risk, 3) Legal and Regulatory Risk, 4) Reputational Risk, 5) Strategic Risk, and 6) Cybersecurity Risk.

What is an example of financial risk in business?

-An example of financial risk is a company facing increased interest expenses due to rising interest rates, which could reduce its profitability, especially if the company has significant debt.

How can operational risk affect a company?

-Operational risks, such as equipment failures, supply chain disruptions, or employee errors, can negatively impact productivity, product quality, and customer satisfaction, leading to lost revenue or reputational damage.

What steps can a business take to manage legal and regulatory risks?

-To manage legal and regulatory risks, businesses can stay informed about changes in laws and regulations, ensure compliance with relevant requirements, and implement strategies to minimize the potential financial and operational impact of new regulations.

How can reputational risk impact a company?

-Reputational risk can damage a company's brand, erode customer loyalty, and reduce investor confidence, as seen in cases of negative media coverage, product recalls, or data breaches.

What is strategic risk, and how does it affect business decisions?

-Strategic risk arises from uncertainty in business decisions, such as entering new markets or launching new products. If these decisions fail, the company may experience financial losses, market share reduction, or long-term decline.

What measures can businesses take to mitigate cybersecurity risk?

-To mitigate cybersecurity risk, businesses can implement robust security protocols like end-to-end encryption, conduct regular security audits, train employees on safe practices, and create contingency plans to respond to cyberattacks or data breaches.

Can you provide an example of how a company managed risk during the COVID-19 pandemic?

-Zoom managed risks during the COVID-19 pandemic by scaling its infrastructure to accommodate the surge in users, addressing security concerns with enhanced encryption and password protections, and improving the user interface to enhance the overall customer experience.

What was Ford's strategy for managing the semiconductor chip shortage in 2021?

-Ford's strategy during the semiconductor chip shortage included prioritizing the production of high-demand vehicles, manufacturing partially completed vehicles, diversifying its suppliers, and making long-term investments in chip production facilities to reduce future supply chain risks.

What are the seven steps in the risk management process?

-The seven steps in the risk management process are: 1) Identify risks, 2) Assess risks, 3) Prioritize risks, 4) Develop strategies, 5) Implement strategies, 6) Monitor and reassess risks, and 7) Communicate risks to stakeholders.

Why is continuous monitoring important in risk management?

-Continuous monitoring is important because it allows businesses to reassess risks based on changing market conditions, regulatory updates, and internal factors, ensuring that risk management strategies remain effective and relevant over time.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Mengenal Metode dan Tahapan Penyusunan Manajemen Risiko | Mochamad Badowi, MBA

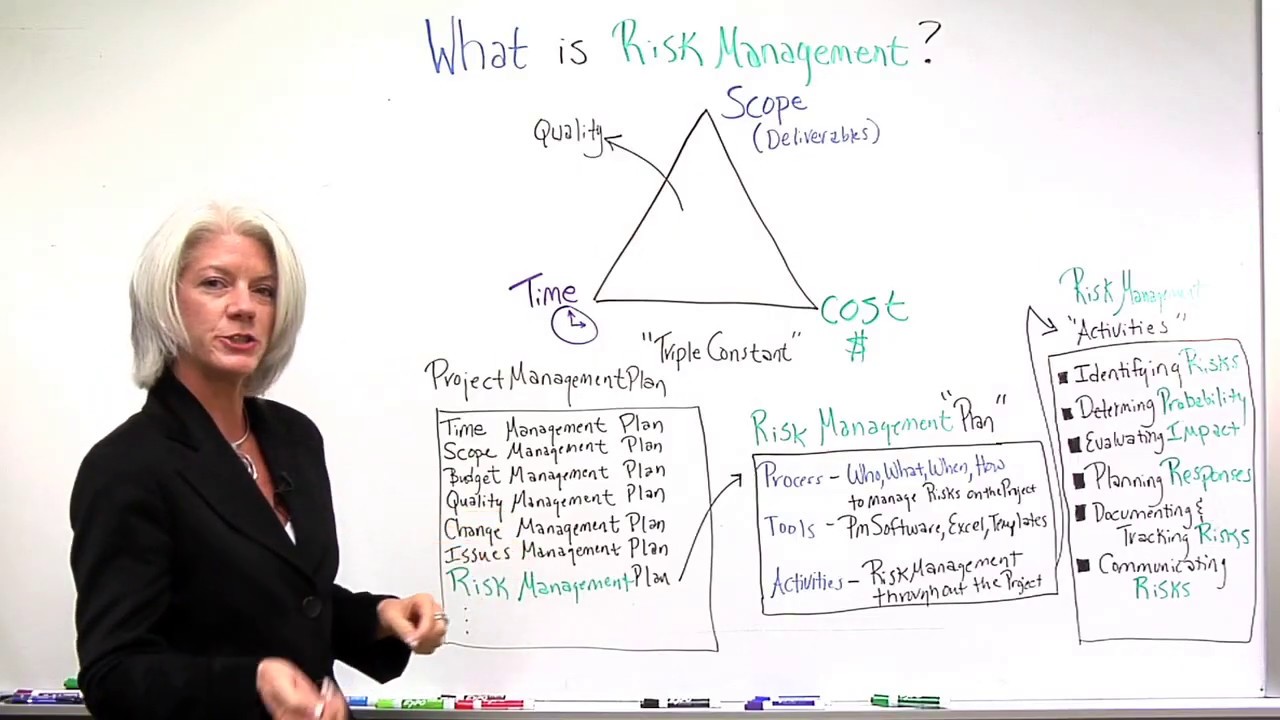

What Is Risk Management In Project Management? All you need to know...

Enterprise Risk Management (ERM) | What is Enterprise Risk Management Process / Strategies

13 What are the various categories of risk?

A beginners guide to cyber security risk management.

What Is Risk Management In Projects?

5.0 / 5 (0 votes)