What Does an Accounts Receivable Specialists Do?

Summary

TLDRAn accounts receivable specialist manages the process of receiving payments for customer invoices. In a large law firm, this role involves tasks like creating invoices, sending them to clients, following up on overdue payments, and reconciling receipts. The job requires good system skills and an ability to communicate with clients. While experience may not be necessary for entry-level positions, enthusiasm, motivation, and a willingness to learn are key to success in this role. This video gives an overview of the day-to-day responsibilities of an accounts receivable specialist and how to start a career in this field.

Takeaways

- 😀 Accounts receivable refers to money owed to a business by customers, other businesses, or third parties.

- 😀 Accounts receivable specialists manage the process of receiving payments for customer invoices.

- 😀 A large law firm example shows how clients are given 30 days to pay invoices without penalties, which becomes accounts receivable for the firm.

- 😀 The accounts receivable department is responsible for issuing invoices, following up on payments, and managing overdue accounts.

- 😀 Key tasks of an accounts receivable specialist include entering customer details, creating invoices, and monitoring unpaid accounts.

- 😀 Accounts receivable specialists are also tasked with calling clients to inquire about due payments and reconciling receipts.

- 😀 Producing regular reports for management on the status of accounts and overdue payments is another responsibility of the role.

- 😀 Effective communication with customers is important, as specialists often deal with client inquiries and overdue payments.

- 😀 Strong system skills are beneficial for accounts receivable specialists due to the use of accounting software.

- 😀 Accounts receivable jobs are typically entry-level positions, offering opportunities for those with little experience but a strong willingness to learn.

- 😀 Enthusiasm, motivation, and a desire to learn can help individuals get started in accounts receivable roles, even without extensive experience.

Q & A

What is an accounts receivable specialist responsible for?

-An accounts receivable specialist is responsible for managing the process of receiving payments for customer invoices, including tasks like entering customer details, creating and sending invoices, following up on overdue payments, and reconciling receipts.

What does 'accounts receivable' mean in a business context?

-'Accounts receivable' refers to money owed to a business from customers, other businesses, or third parties for goods or services provided on credit.

Can you give an example of how accounts receivable works in a business?

-In a law firm, lawyers send invoices to clients after providing legal services, offering 30-day payment terms. These invoices then become accounts receivable until the payments are made.

What are some common tasks that accounts receivable specialists perform?

-Common tasks include entering new customer details, generating and sending invoices, calling clients about overdue payments, reconciling receipts, and generating reports for management.

What skills are important for someone working in accounts receivable?

-Key skills include good system skills for managing accounting software, effective communication for dealing with clients, and strong organizational skills for tracking payments and managing overdue accounts.

Are accounts receivable positions suitable for beginners?

-Yes, accounts receivable jobs are often entry-level, meaning they don’t require much prior experience. Enthusiasm, motivation, and a willingness to learn are more important for getting started.

What is the purpose of accounts receivable reports?

-Accounts receivable reports provide management with an overview of outstanding payments, overdue accounts, and the overall cash flow situation, helping to inform financial decisions.

What might happen if an accounts receivable specialist does not follow up on overdue payments?

-If overdue payments aren’t followed up on, the business could face cash flow issues, as payments that should have been received remain outstanding, potentially affecting the company’s financial stability.

Why is it helpful for an accounts receivable specialist to enjoy dealing with people?

-Enjoying interaction with people is important because accounts receivable specialists often communicate with clients to inquire about payments, and maintaining good relationships is key to ensuring timely payment.

How does a law firm manage accounts receivable specifically?

-A law firm manages accounts receivable by issuing invoices to clients for legal services, with a 30-day payment term. The accounts receivable department tracks these invoices and follows up with clients to ensure payment is received.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

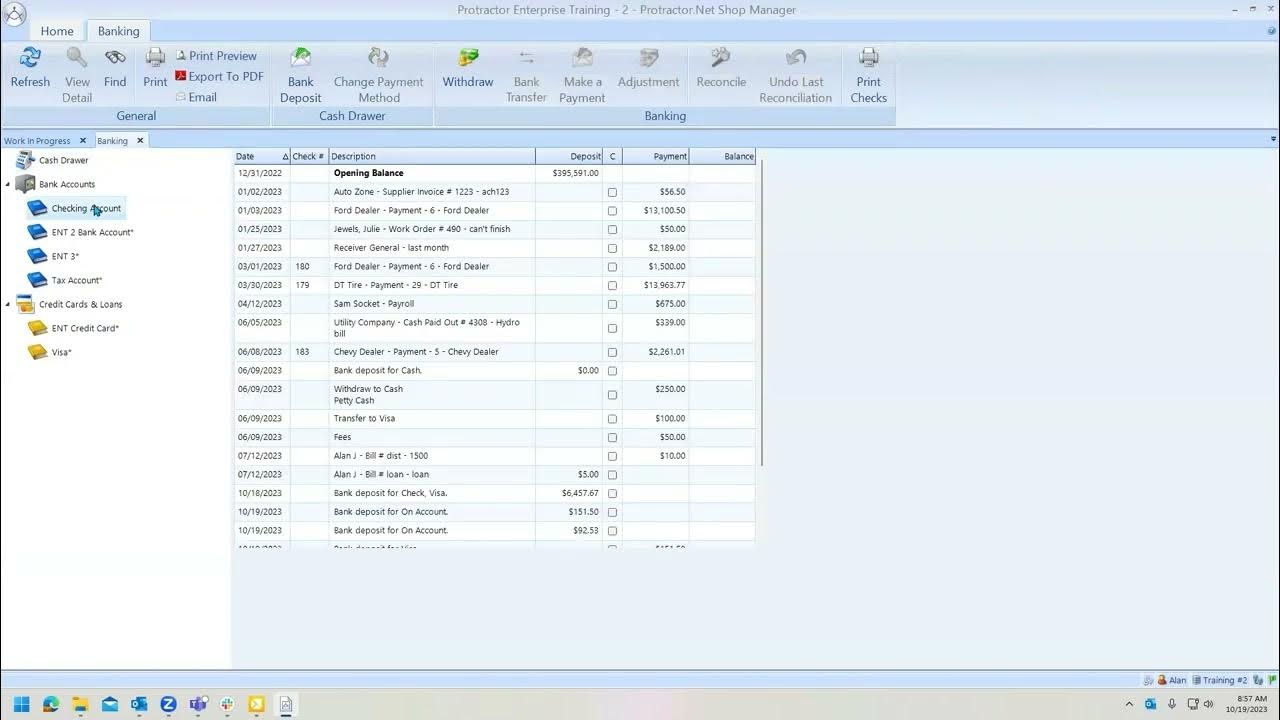

Change Payment Method of Receivable Payment UPDATED

Payments and outstanding accounts | Odoo Accounting

FA25 - How do you Write Off a Receivable?

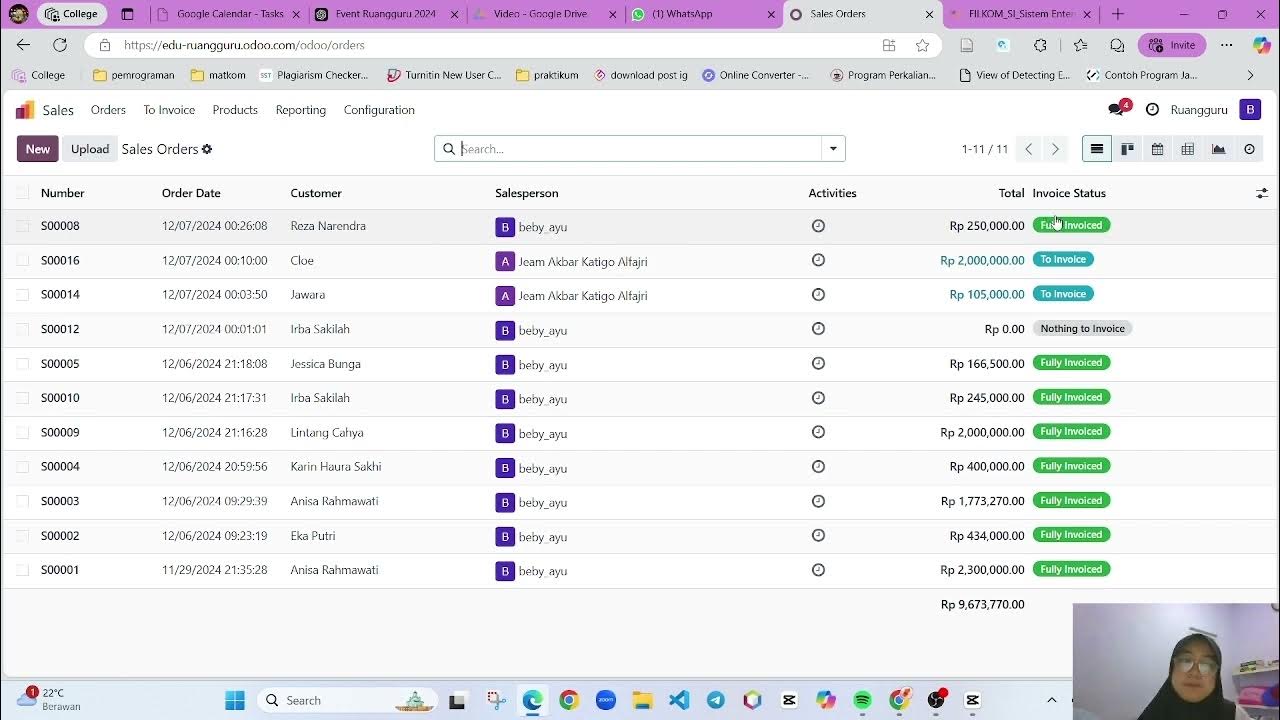

CARA MENGGUNAKAN MODUL SALES PADA APLIKASI ODOO

What is Batch Payment in Odoo 17 Accounting | How to Group Payments Into a Single Batch in Odoo 17

SETTING LINKED ACCOUNT | PD MITRA

5.0 / 5 (0 votes)