Studi Kasus Jurnal, Posting, Neraca Saldo

Summary

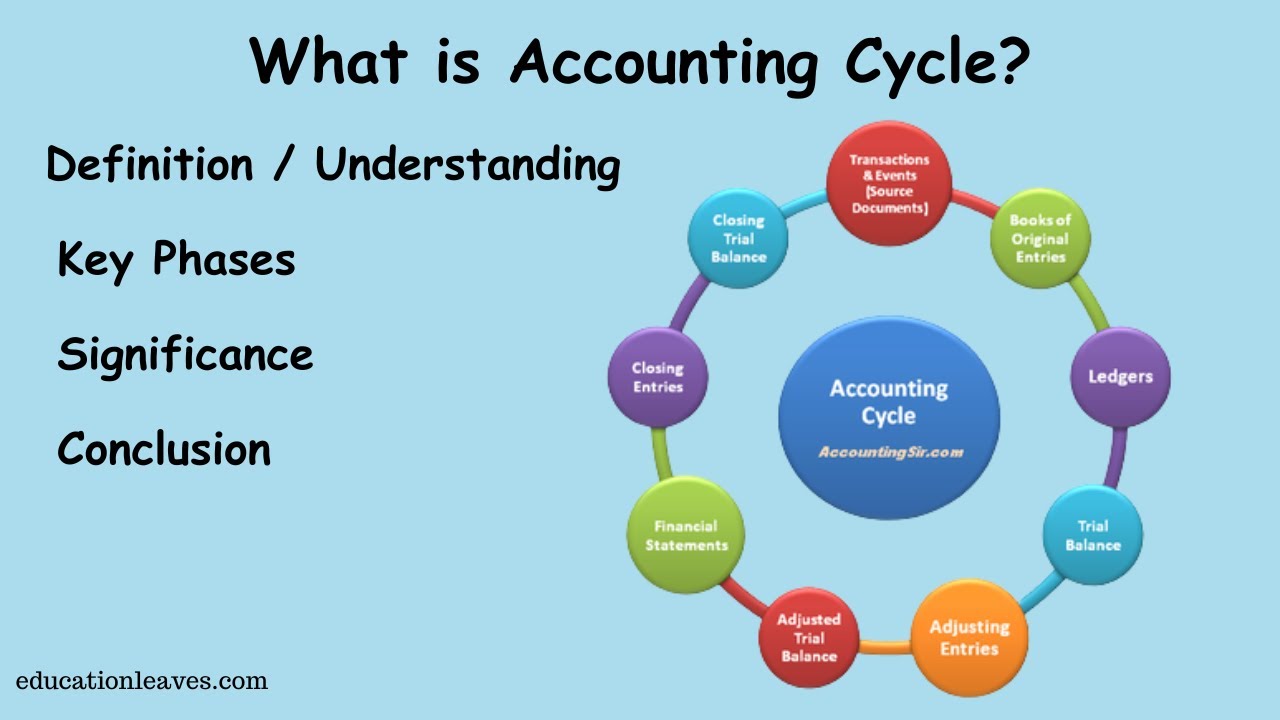

TLDRThis accounting lesson provides a thorough guide on how to analyze and record financial transactions through journal entries, posting them to the general ledger, and preparing a trial balance. It covers various examples, including cash transactions, equipment purchases, payments, and revenue recognition. The lesson emphasizes the importance of understanding the double-entry accounting system, using correct debit and credit rules, and ensuring balance in the trial balance to maintain accurate financial records. This is a practical step-by-step process for beginners in accounting.

Takeaways

- 😀 Understanding the process of journalizing transactions is essential for accurate financial recording.

- 😀 The concept of double-entry accounting is vital, where every transaction affects at least two accounts, ensuring the books stay balanced.

- 😀 When cash increases, it is recorded as a debit, and when it decreases, it is recorded as a credit, following basic accounting rules.

- 😀 Each asset increase is recorded as a debit entry, while liability and equity increases are recorded as credits.

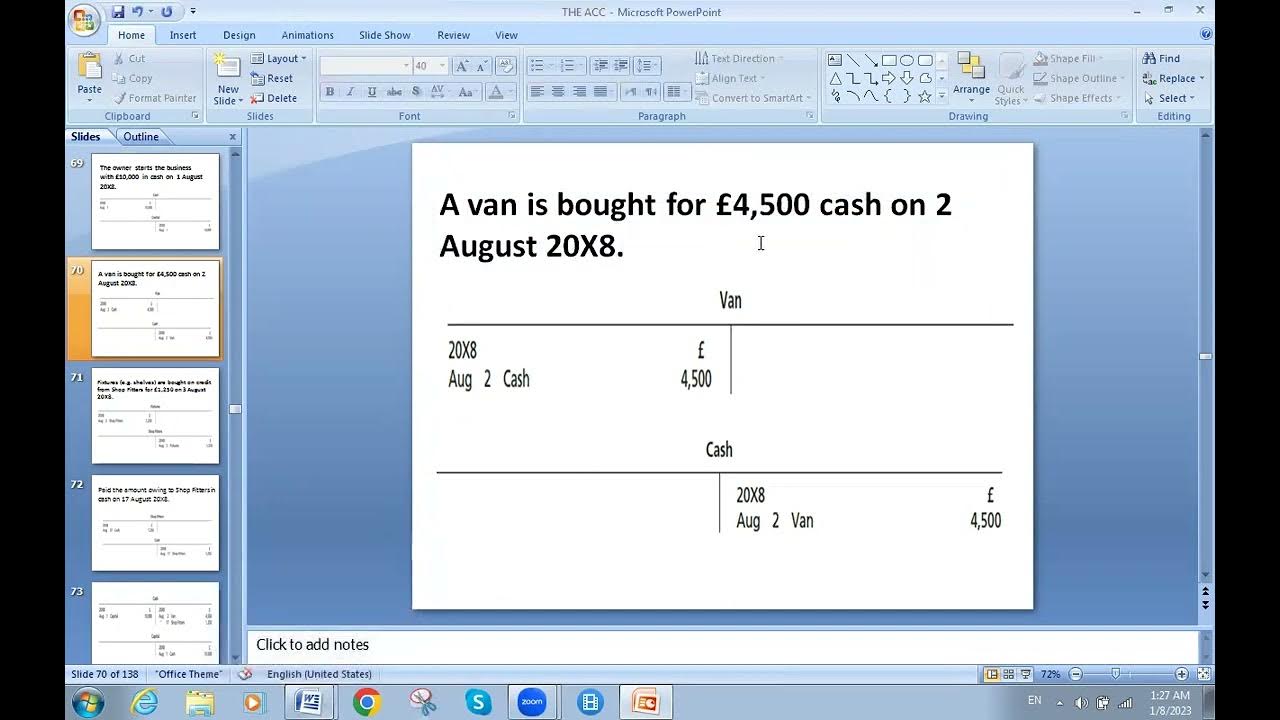

- 😀 When the company buys equipment or other assets, it must account for both the purchase and the payment method (cash or credit).

- 😀 Payment of bills, such as rent or salaries, decreases cash, which is recorded as a credit, while the expense is recorded as a debit.

- 😀 Tracking accounts such as accounts payable and accounts receivable is important for managing obligations and income from sales.

- 😀 The chart of accounts helps in classifying different types of transactions, like cash, liabilities, and equity, ensuring each entry is categorized correctly.

- 😀 A trial balance or balance sheet should always be checked to ensure that debits equal credits, reflecting accurate accounting.

- 😀 Posting transactions into the general ledger involves transferring amounts from journals to individual accounts, ensuring accurate tracking of balances.

Q & A

What is the purpose of analyzing accounting transactions using the accounting equation?

-The purpose of analyzing accounting transactions using the accounting equation is to ensure that journal entries are accurate and reflect the correct financial position of the company. It helps confirm whether the debits and credits are balanced.

Why is the double-entry system important in accounting?

-The double-entry system is important because it ensures that every financial transaction is recorded in at least two accounts, maintaining the balance of the accounting equation. This helps in preventing errors and ensures the accuracy of financial statements.

In the first transaction example, what accounts are affected and how?

-In the first transaction, cash and vehicles are both asset accounts that increase. Cash is debited by Rp100,000, and vehicles are debited by Rp75,000. The capital account is credited by Rp175,000 to reflect the owner's contribution to the company.

What does it mean when a liability increases in accounting?

-When a liability increases, it means the company has an obligation to pay or settle a debt. In accounting, liabilities are recorded as credits, which reflect the company's increased financial obligation.

How is a payment for office rent recorded in the journal?

-The payment for office rent is recorded by debiting rent expense (a debit entry to the expense account) and crediting cash (a credit entry to the asset account), reflecting the outflow of money for the rental payment.

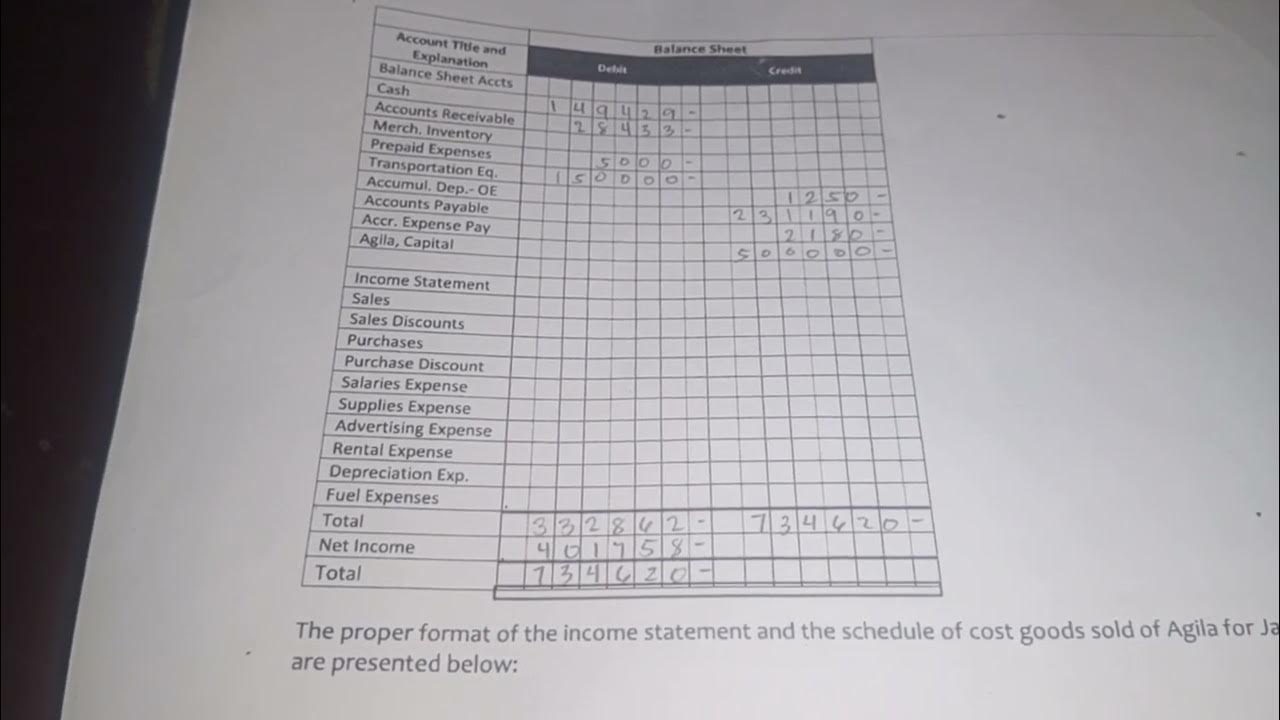

What is the significance of the trial balance in accounting?

-The trial balance is significant because it helps ensure that the total of debit balances equals the total of credit balances, confirming that the accounting books are in balance before preparing financial statements.

How do transactions involving accounts payable and receivable affect the journal?

-Transactions involving accounts payable and receivable affect the journal by either increasing or decreasing asset or liability accounts. For example, when a company buys materials on credit, accounts payable increases (credit) and inventory increases (debit).

What is the purpose of posting to the general ledger?

-Posting to the general ledger is essential to track the balance of each account in the company's financial records. It organizes transaction details and ensures that all debits and credits are properly recorded in their respective accounts.

Why is it necessary to have correct normal balances for accounts?

-Having the correct normal balances for accounts is necessary to ensure the accuracy of financial reporting. For example, asset accounts should have debit balances, while liability and equity accounts should have credit balances. Any deviation from these normal balances could indicate errors in the accounting process.

What role does the journal play in the accounting cycle?

-The journal plays a critical role in the accounting cycle by recording all transactions as they occur. This step ensures that financial events are captured in chronological order before they are posted to the general ledger and subsequently used to create financial statements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

November 15, 2024

8 ACC JOURNA STARTING AND BUYING

What is Accounting cycle? | Key phase, Significance of Accounting cycle

TRIAL BALANCE CHAPTER -14 T.S.Grewal Solution question number -2 Class-11 accounts session (2022)

Prepare Journal Entries Part 1 (Filipino)

Accounting Cycle Step 1: Analyze Transactions

5.0 / 5 (0 votes)