D-St Down 7% From Peak: More Correction Likely? | Raamdeo Agrawal & Navneet Munot Share Insights

Summary

TLDRIn celebration of its 25th anniversary, CNBC TV18 reflects on market trends amid a festive backdrop. While the Nifty has seen a significant rise, experts discuss potential corrections and the implications of high valuations. With foreign institutional investors pulling back, domestic mutual funds have stepped in, raising concerns about sustainability. Market veterans Ram Agarwal and Nait Monot highlight the maturity of retail investors and the growth of the mutual fund sector as positive indicators for the future. They express cautious optimism, asserting that while volatility may persist, the long-term outlook for India's capital markets remains strong.

Takeaways

- 🎉 CNBC TV18 celebrates its 25th anniversary during the Diwali festivities, highlighting significant market achievements.

- 📈 The Nifty Index has risen by 30%, with record-high SIP inflows, signaling a positive market trend despite recent corrections.

- 🔍 Concerns about high market valuations are raised, with the MSCI India Index trading at a premium relative to historical averages.

- 📉 Analysts note earning downgrades and question the sustainability of the market's euphoric run, suggesting potential corrections.

- 💰 Domestic mutual funds have significantly contributed to market stability, buying nearly $10 billion amidst foreign selling.

- 🌍 Global uncertainties, including US election outcomes and ongoing conflicts, pose risks to market stability.

- ⏳ Market veterans express that recent corrections are healthy and necessary for long-term growth, countering over-expectations.

- 📊 The growth of the mutual fund industry in India is highlighted, with significant AUM increases over the past years.

- 🧑🤝🧑 Retail investors are seen as resilient and mature, supporting market movements even during volatility.

- 🔮 The discussion concludes with optimism about the future of India's financial markets, comparing it to the historical growth of US investment trends.

Q & A

What milestone is CNBC TV18 celebrating?

-CNBC TV18 is celebrating its 25th anniversary.

What has been the recent performance of the Nifty index?

-The Nifty has seen a 30% rise recently.

How are mutual fund inflows described in the current market?

-Mutual fund inflows are at record highs, with nearly $10 billion bought month to date.

What concerns are investors currently expressing?

-Investors are concerned about high starting valuations and recent earnings downgrades across the board.

What is the current price-to-earnings ratio for the MSCI India index?

-The MSCI India index is currently trading at about 24 times one-year forward earnings.

What do the experts think about the recent market correction?

-The experts view the recent correction as healthy and overdue, suggesting it reflects a necessary sanity check.

How do the experts perceive the future outlook for the Indian market?

-They remain optimistic about the next 25 years, believing that despite the correction, long-term growth potential remains strong.

What is noted about the retail investors' behavior in the current market?

-Retail investors are showing resilience and maturity, actively participating in the market even during corrections.

What role do domestic mutual funds play in the current market context?

-Domestic mutual funds are helping to prop up the markets amidst FII selling, with significant cash reserves still available.

What was compared to the U.S. 401(k) movement in the discussion?

-The current financialization of savings in India, particularly through SIPs, was compared to the U.S. 401(k) movement.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cardinals Prepare For Conclave As Pope Francis Is Laid To Rest | N18G

Diwali 2024 | Finolex Pipes & Fittings

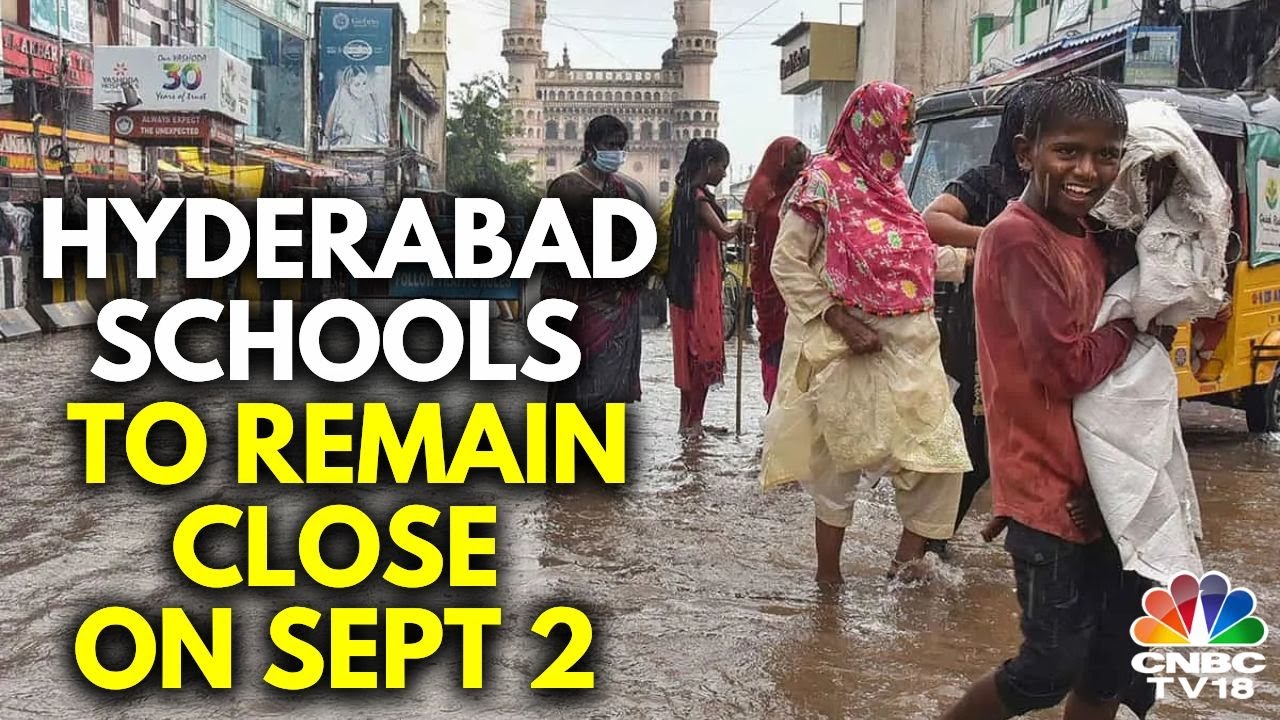

Rain Havoc In Telangana & Andhra, Flooding Disrupts Train Services | Hyderabad | N18V

Expect To See Significant Growth In Less Than ₹10 Lk Segment: Hyundai Motor India | SIAM 2025

PCBL Ltd. to See 5x Profit Growth in 5 Years, Says Sanjiv Goenka in Exclusive Interview | CNBC TV18

What is Next For Walt Disney World?

5.0 / 5 (0 votes)