Strategi Bank Indonesia Jaga Stabilitas Perekonomian Indonesia

Summary

TLDRIn this discussion, Bank Indonesia maintains its benchmark interest rate at 5.75% amidst global economic uncertainties, particularly influenced by rising U.S. interest rates and slower growth in China. Despite external pressures, Indonesia's economy grew by 5.17% in Q2 2023, driven by strong domestic consumption and fiscal stimuli. Bank Indonesia also plans to introduce Rupiah securities to enhance financial market stability and attract foreign investment. The focus remains on sustaining economic growth while managing inflation and maintaining the stability of the Rupiah against global currency fluctuations.

Takeaways

- 😀 Bank Indonesia maintains the benchmark interest rate at 5.75% to ensure economic stability.

- 😀 The target inflation rate for 2023 is set at 3% ± 1%, with a projection of around 2.5% for 2024.

- 😀 Global economic uncertainty remains high, influenced by varying growth rates in major economies like the U.S. and China.

- 😀 U.S. economic growth has outperformed expectations, which has implications for global inflation rates.

- 😀 Inflation in developed countries is still above target levels, contributing to the likelihood of sustained high interest rates.

- 😀 The strengthening of the dollar has caused instability in global financial markets.

- 😀 Indonesia's economy grew by 5.17% in Q2 2023, driven by robust domestic consumption and investment despite global challenges.

- 😀 Bank Indonesia is focused on stabilizing the Rupiah amid pressures from global economic factors.

- 😀 New financial instruments, such as Rupiah Securities (SRBI), are being introduced to deepen the financial market and attract foreign investment.

- 😀 Future strategies for Bank Indonesia include maintaining macroeconomic stability, fostering innovation, and enhancing coordination with government agencies for effective inflation control.

Q & A

What is the primary reason for Bank Indonesia to maintain the benchmark interest rate at 5.75%?

-Bank Indonesia aims to stabilize the economy and control inflation, targeting it within a range of 3% plus or minus 1% for the remainder of 2023 and around 2.5% for 2024.

How has the economic growth in the United States affected global economic conditions?

-The U.S. economy has shown stronger-than-expected growth, achieving 1.6% growth in 2023, which contributes to global uncertainties and impacts inflation rates in other countries.

What are the main challenges currently facing the global economy as mentioned in the discussion?

-The main challenges include high inflation in developed countries, uncertainty in global financial markets, and the slower-than-expected recovery of the Chinese economy.

What factors contributed to Indonesia's economic growth of 5.17% in Q2 2023?

-The growth was supported by strong domestic consumption, improved investments, and government fiscal stimulus, particularly the thirteenth salary payout, despite a decline in exports.

How does Bank Indonesia view the strengthening of the U.S. dollar?

-Bank Indonesia acknowledges the pressure the strengthening dollar puts on the Indonesian Rupiah and is focusing on stabilizing the Rupiah through various monetary policy interventions.

What is the purpose of introducing Rupiah Securities (SRBI) by Bank Indonesia?

-The SRBI aims to deepen the financial market, optimize government securities held by Bank Indonesia, and attract foreign investments to mitigate external shocks.

What are the expected outcomes of the SRBI implementation scheduled for mid-September?

-The implementation is expected to enhance liquidity in the financial market, support the effectiveness of monetary policy, and potentially provide better returns for investors.

In addition to maintaining interest rates, what other strategies will Bank Indonesia employ to support the economy?

-Bank Indonesia will focus on maintaining macroeconomic stability, fostering innovation in financial instruments, and enhancing coordination with government authorities to promote sustainable economic growth.

How does the discussion characterize the current state of inflation in Indonesia?

-Inflation in Indonesia is currently under control at around 3.08%, with expectations of further decline, which is seen as a positive sign for the economy.

What is the significance of the government fiscal stimulus mentioned in the discussion?

-The fiscal stimulus, particularly through measures like the thirteenth salary, is crucial in boosting domestic consumption and overall economic growth amidst global uncertainties.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Ini Peringatan BI, Soal Kondisi Ekonomi Global & RI pada 2025

BI-Rate Tetap, Rupiah Semakin Stabil

RBI’s Repo Rate Calculations: How Does The RBI Policy Actually Affect You?

Canadian mortgage renewals will weigh on economic growth: Deloitte

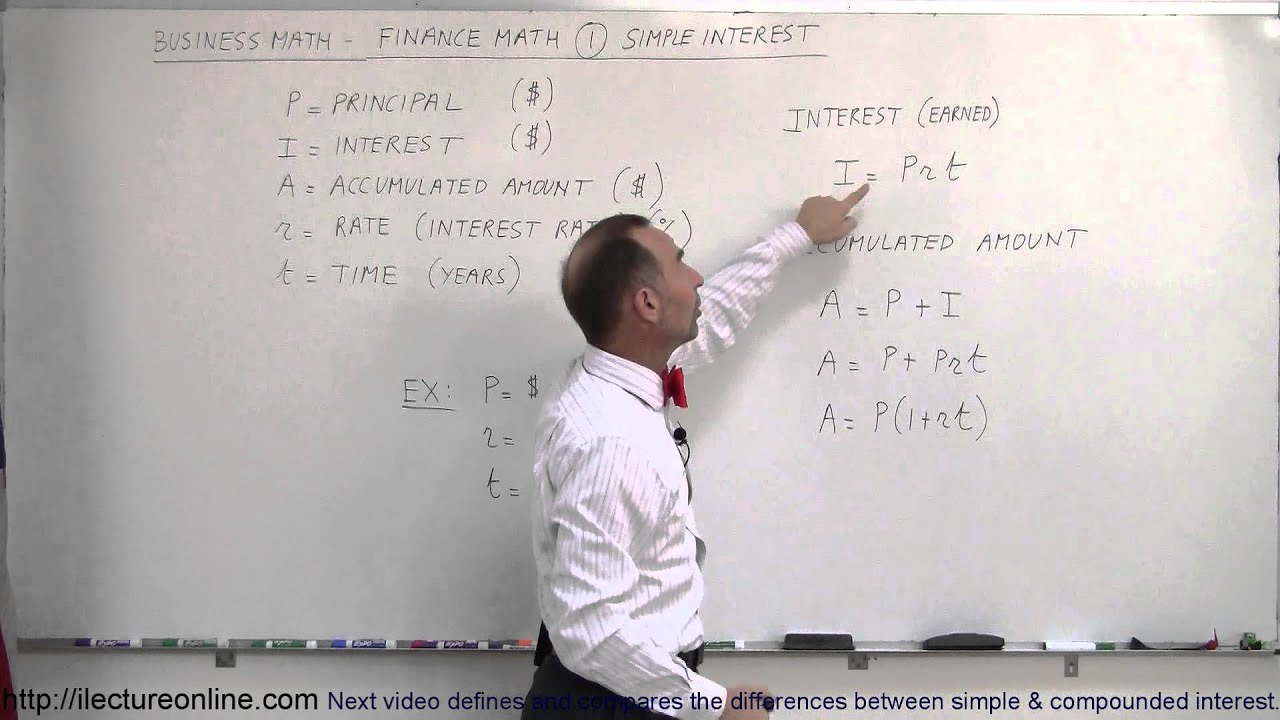

Business Math - Finance Math (1 of 30) Simple Interest

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.1

5.0 / 5 (0 votes)