Daniel Lacalle: Raising Taxes Won't Fix the'Debt Bomb' and Why Currency Debasement is "Intentional"

Summary

TLDRThe discussion explores the complexities of government debt and the implications of currency debasement, highlighting the hidden nature of inflation as a tax. The speaker emphasizes the challenges posed by unfunded liabilities and critiques government policies that manipulate public perception. Bitcoin is positioned as an emerging asset class, gradually establishing itself as a viable alternative to traditional currencies. The conversation also touches on the relationship between Bitcoin and tech stocks, advocating for personal investment strategies that align with individual risk tolerance. Overall, the dialogue sheds light on the necessity of protecting wealth in an increasingly volatile economic landscape.

Takeaways

- 😀 The U.S. government debt stands at approximately $37 trillion, but the real financial burden includes unfunded liabilities that greatly exceed this figure.

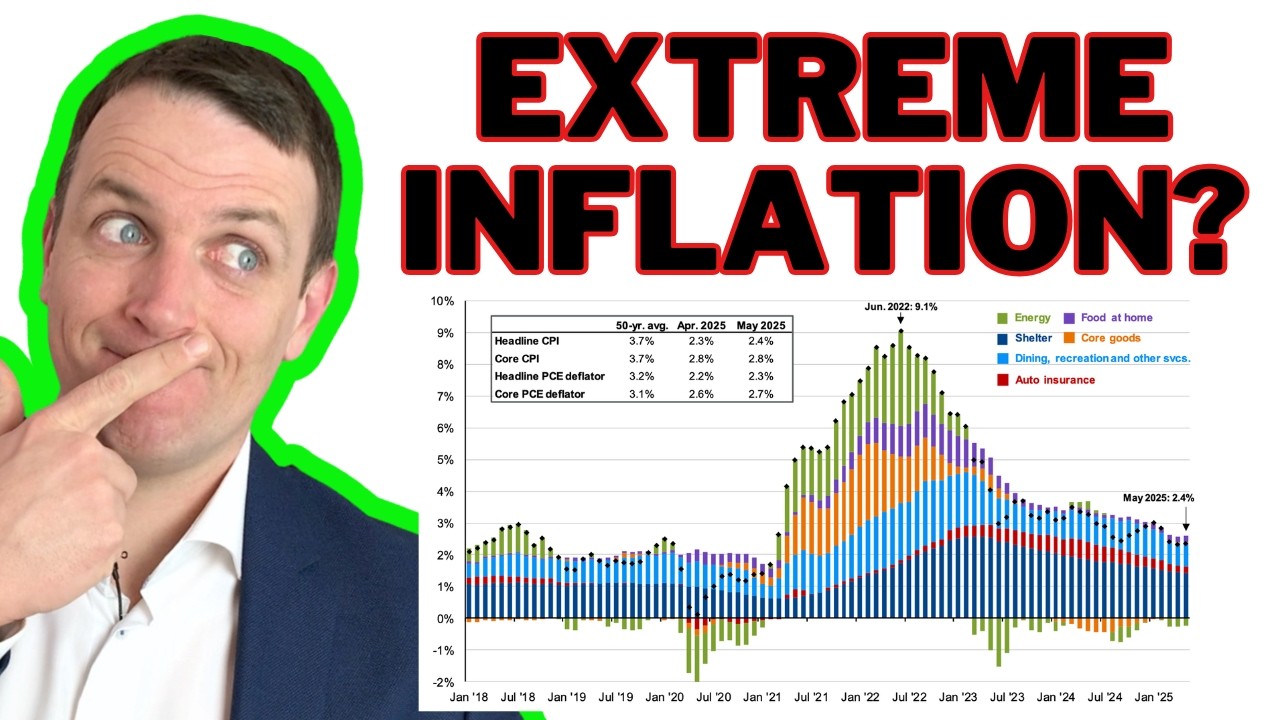

- 💰 Inflation is described as a hidden tax, allowing governments to finance spending without directly taxing citizens, often shifting blame to external factors.

- 🔍 The conversation highlights the destructive effects of inflation, including a significant loss in purchasing power, and suggests that this trend will continue.

- 📈 Bitcoin is emerging as an asset class that may provide a hedge against inflation and currency debasement, separating itself from other cryptocurrencies.

- ⚖️ The speaker notes that Bitcoin's volatility is becoming more intrinsic and less correlated with traditional tech stocks, suggesting it is maturing as an asset.

- 🌍 Global monetary expansion, particularly in light of recent Federal Reserve policies, is expected to benefit Bitcoin and gold as alternative investments.

- 🏦 Sovereign debt is no longer seen as a safe investment due to risks associated with inflation and potential defaults, prompting a shift in investment strategies.

- 📊 The speaker personally allocates 5-7% of their investment portfolio to Bitcoin, reflecting a cautious approach to capital preservation as they age.

- 🛡️ Investors are encouraged to understand their risk profiles and tailor their asset allocations to align with their tolerance for volatility and market fluctuations.

- 🚀 The overarching theme suggests that in a climate of increasing government debt and inflation, protecting wealth through alternative assets like Bitcoin is becoming increasingly critical.

Q & A

What is the main concern regarding current government debt?

-The main concern is that current debt reflects how much the government has spent beyond its revenues, financed through increasing debt, which can lead to higher future inflation, lower purchasing power, or increased taxes.

What are committed non-financed liabilities, and why are they significant?

-Committed non-financed liabilities refer to mandatory spending that the government must pay regardless of future circumstances. They are significant because they exceed the already issued debt, posing a major financial challenge, especially in economies like the Euro area and Japan.

How does inflation act as a hidden tax for citizens?

-Inflation is considered a hidden tax because it erodes the purchasing power of money without directly increasing taxes. Politicians can benefit from it by imposing spending cuts and tax hikes while deflecting blame onto external factors like corporations.

What role does dependency on government play in managing public perception of inflation?

-Increased dependency on government services can prevent citizens from holding the government accountable for inflation. By creating a reliance on subsidies and aid, governments can mitigate backlash against their monetary policies.

What is the current status of Bitcoin as an asset class?

-Bitcoin is seen as an emerging asset class that is gradually becoming recognized as money. It needs to establish itself as a unit of measure, a reserve of value, and a widely accepted means of payment.

How has Bitcoin performed during periods of monetary contraction?

-During periods of monetary contraction, Bitcoin has shown resilience, maintaining support levels and not declining as sharply as some technology stocks, indicating its development as a distinct asset class.

What is the relationship between Bitcoin and global liquidity measures?

-Bitcoin has been correlated with global liquidity measures, such as the expansion of M2 money supply. As global liquidity increases, Bitcoin tends to benefit, indicating its potential as a hedge against currency debasement.

What is the importance of understanding one's risk profile in investing?

-Understanding one's risk profile is crucial in determining capital allocation. Investors need to assess their comfort level with volatility to make informed decisions that align with their financial goals.

Why do some view gold as a better hedge against inflation compared to Bitcoin?

-Gold is often viewed as a better hedge against inflation because it has a long history as money and retains value during crises. Bitcoin, while emerging, does not yet have the same level of historical precedent.

What are the potential implications of government debt on investors?

-With governments likely to continue expanding debt and monetary supply, investors holding traditional safe assets like treasuries may face diminishing returns, leading them to seek alternative investments like Bitcoin or gold for better protection against inflation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

CRYPTO ALERT: ALL IN

Bank Crisis & Inflation: The Biggest Scam In The History Of Mankind - Hidden Secrets of Money Ep 4

Silver Price Close To A Bottom (Bitcoin Explodes On Trump Mania)

"This Will Collapse The US Dollar Any Day Now" - America's Biggest Ponzi Scheme | Peter Schiff

MEMAHAMI SISTEM MONETER INTERNASIONAL DAN KEKUATAN FINANSIAL 1

Ready for a possible extreme financial environment?

5.0 / 5 (0 votes)