How to Read Company Financial Statements (Basics Explained)

Summary

TLDRThe video explains the importance of analyzing a company's financial statements for potential investments, highlighting the key components: the balance sheet, income statement, and cash flow statement. It emphasizes how many investors overlook these vital documents due to confusion, yet understanding them is crucial for assessing a company's financial health. The video breaks down each section of these statements, showing how they provide insights into a company's assets, liabilities, earnings, and cash flow. By mastering the basics, investors can make more informed decisions and avoid unnecessary risks.

Takeaways

- 🔍 Understanding a company's financial health is crucial for potential investors.

- 🚫 Many investors overlook financial analysis and focus solely on products and services.

- 📈 Financial statements are often misunderstood but are essential for assessing a company's health.

- 📚 The basics of financial statements are not complicated and can be quite revealing.

- 📋 The main financial statements include the balance sheet, income statement, and cash flow statement.

- 💼 The balance sheet provides a snapshot of assets, liabilities, and equity at a specific point in time.

- 💵 Assets are categorized as current or non-current, and liabilities are current or non-current.

- 📊 The income statement shows a company's earnings and expenses over a period, not just a snapshot.

- 💹 The cash flow statement is critical for understanding a company's liquidity and solvency.

- 🌐 Financial statements may vary slightly by company, industry, or country but generally follow similar formats.

- 💡 Investors are encouraged to read financial statements from various industries to enhance their understanding.

Q & A

What is the importance of analyzing a company's financial statements before investing?

-Analyzing a company's financial statements is essential for understanding its past, current, and potential future financial situation. This analysis helps investors make informed decisions rather than taking unnecessary risks based on products or services alone.

Why do many investors avoid analyzing financial statements?

-Many investors avoid analyzing financial statements because they find them complex and full of numbers, which can be confusing or intimidating. However, with a basic understanding, financial statements are not as complicated as they might appear.

What are the three main financial statements typically included in a company's financial report?

-The three main financial statements are the balance sheet, the income statement, and the cash flow statement. These provide an overview of the company's financial health from different perspectives.

What is the purpose of a balance sheet?

-The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It helps investors understand the company’s financial position, including its liquidity and overall stability.

How is the balance sheet structured?

-The balance sheet is divided into five sections: current assets, non-current (or long-term) assets, current liabilities, non-current (or long-term) liabilities, and equity. These sections show what the company owns, owes, and the shareholders' stake.

What is the difference between current and non-current assets?

-Current assets are expected to be used or sold within one year, including items like cash and inventory. Non-current assets, on the other hand, are long-term and not expected to be sold or used within the year, such as property and equipment.

What does the income statement show?

-The income statement shows the earnings and expenses of a company over a specific period of time, detailing the company's financial performance. It covers items like gross profit, operating income, and net income after taxes.

How does the income statement differ from the balance sheet?

-The balance sheet is a snapshot of the company's financial position at a specific point in time, while the income statement tracks the company's financial performance over a specific period, detailing how much revenue and profit the company generated.

What is the purpose of the cash flow statement?

-The cash flow statement provides information about the cash inflows and outflows during a period, showing the company’s liquidity. It helps investors assess whether the company has enough cash to meet its obligations and continue operations.

What are the three main sections of a cash flow statement?

-The cash flow statement is divided into three sections: cash flow from operations (day-to-day activities), cash flow from investing (acquisition and disposal of long-term assets), and cash flow from financing (borrowing and equity transactions).

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Financial Statements & their Relationship / Connection | Explained with Examples

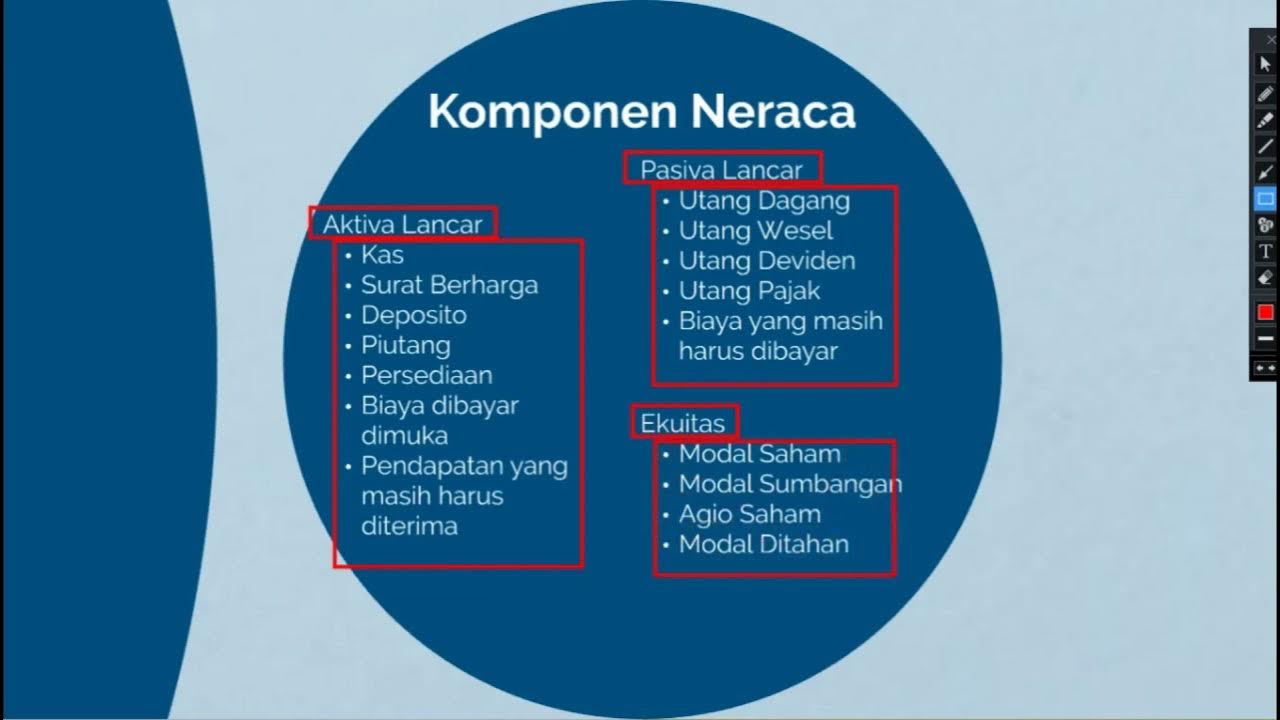

KD 3 10 MENGANALISIS LAPORAN KEUANGAN SEDERHANA || PRODUK KREATIF DAN KEWIRAUSAHAAN

Financial Statements - Interconnectivity

Connecting the Income Statement, Balance Sheet, and Cash Flow Statement

Video Pembelajaran Jenis Laporan keuangan

Financial Statement Based on PAS #1

5.0 / 5 (0 votes)