Financial Modeling Quick Lessons: Building a Discounted Cash Flow (DCF) Model (Part 2) [UPDATED]

Summary

TLDRIn this video lesson on DCF modeling, the focus is on calculating the Weighted Average Cost of Capital (WACC) and transitioning from Enterprise Value to Equity Value. After a recap of forecasting free cash flows, the presenter explains why WACC is essential for discounting cash flows in unlevered analyses. Key components such as after-tax cost of debt and cost of equity are discussed, with an emphasis on using market values for capital structure. The video concludes by demonstrating how to determine equity value per share and make informed investment decisions based on the DCF analysis.

Takeaways

- 😀 WACC (Weighted Average Cost of Capital) is essential for discounting cash flows in DCF analysis.

- 📈 Unlevered free cash flows represent cash available to all capital providers, not just equity investors.

- 💡 The cost of debt is adjusted for taxes to account for the tax shield provided by interest payments.

- 🔍 Cost of equity is often calculated using the Capital Asset Pricing Model (CAPM), reflecting the required return for equity holders.

- 📊 The target capital structure used in WACC calculations should reflect the existing structure of the company.

- 💵 Equity value is determined by subtracting net debt from enterprise value.

- 🔗 Net debt is calculated as total debt minus cash and cash equivalents, providing a clearer picture of financial obligations.

- 💰 If the calculated equity value per share is higher than the market price, the stock may be considered undervalued.

- 📉 DCF analysis involves forecasting future cash flows and discounting them to arrive at present value.

- 🔄 The terminal value represents the estimated value of a company beyond the explicit forecast period, crucial for long-term valuation.

Q & A

What does WACC stand for and why is it important?

-WACC stands for Weighted Average Cost of Capital. It is important because it represents the average rate of return expected by all capital providers of a company, and is used as the discount rate for cash flow analysis.

What is the difference between unlevered and levered free cash flow?

-Unlevered free cash flow refers to cash flows available to all capital providers before interest payments, while levered free cash flow accounts for interest expenses, reflecting cash flows available only to equity holders.

How is the after-tax cost of debt calculated?

-The after-tax cost of debt is calculated by taking the cost of debt and multiplying it by (1 - tax rate), accounting for the tax shield provided by interest expense.

What is terminal value and how is it determined?

-Terminal value is the estimated value of a company's cash flows beyond the explicit forecast period, typically calculated using growth and perpetuity methods.

Why is diluted share count used in valuation?

-Diluted share count accounts for all ownership claims, including options and convertible securities, providing a more accurate representation of the total equity available.

What is the capital asset pricing model (CAPM)?

-CAPM is a formula used to determine the cost of equity, calculated as the risk-free rate plus beta times the market risk premium, reflecting the expected return on investment.

How is equity value derived from enterprise value?

-Equity value is derived from enterprise value by subtracting net debt, where net debt is calculated as total debt minus cash and cash equivalents.

What assumptions are made regarding the capital structure in this analysis?

-The analysis assumes that the existing capital structure reflects the target capital structure for the company, using market values for equity and book values for debt when necessary.

What does it mean if the equity value per share is higher than the market price?

-If the equity value per share is higher than the market price, it suggests that the stock is undervalued, indicating a potential buying opportunity.

What steps were taken to update cash flows in the model?

-Cash flows were updated by applying the calculated WACC as the discount rate, which adjusts the present values for both stage one and stage two of the cash flow analysis.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The DCF Model Explained - How The Pros Value Stocks/Businesses

Investment Banking - Finance Technicals Mock Interview

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

BIAYA MODAL PART 2 - FARFIN CLASS

Walk me through a DCF? (NEW) | Interview Answer

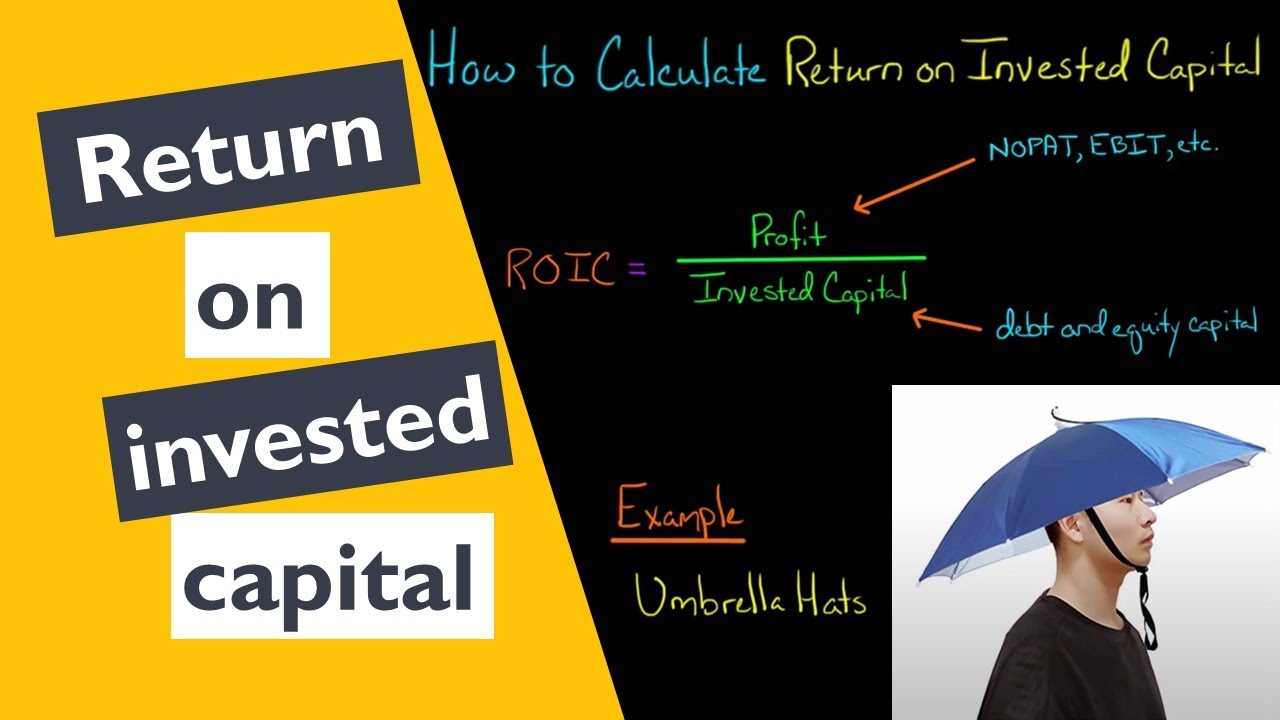

How to Calculate Return on Invested Capital

5.0 / 5 (0 votes)