Options Trading: Understanding Option Prices

Summary

TLDRThis video introduces the fundamentals of options trading, explaining the two main types—calls and puts—and how they can be traded on various platforms. It emphasizes the significance of time value, decay, and the impact of strike prices on option pricing. Viewers learn about the value of options at expiration and the crucial role of volatility in determining option prices. Understanding these concepts is essential for traders to position themselves effectively and maximize potential profits in the dynamic options market.

Takeaways

- 😀 Options are financial instruments that allow buying or selling stocks at predetermined prices within a specified timeframe.

- 📈 Call options are used when you expect stock prices to rise, while put options are for when you anticipate a decline.

- 💡 You can both buy and sell options; selling an option opens a position, while buying it back closes the position.

- ⏳ Options have expiration dates, and their prices are influenced by the time remaining until expiration, known as time decay.

- 💰 Longer expiration periods generally lead to higher option prices due to increased time value.

- 🔄 The strike price is the predetermined price at which shares can be exchanged, and options can be classified as in the money or out of the money.

- 📉 Out of the money options have no value at expiration, while in the money options are valued based on the difference between stock price and strike price.

- 🔄 You don't have to hold options until expiration; you can sell them for a profit anytime before expiration.

- 📊 Volatility measures the magnitude of stock price movements, and higher volatility leads to increased option prices due to greater risk.

- 🛡️ Understanding time decay, strike prices, and volatility is essential for developing effective trading strategies in options trading.

Q & A

What are the two main types of options?

-The two main types of options are call options and put options. Call options are bought when you expect the stock price to go up, while put options are bought when you expect the stock price to go down.

What does it mean to sell an option?

-Selling an option involves creating an opening trade by selling an option and hoping to buy it back later at a lower price for a profit.

How does time to expiration affect option prices?

-Options with a longer time until expiration are generally more expensive due to their greater time value. As time passes, the value of options decreases due to time decay, which accelerates as the expiration date approaches.

What is time decay in options trading?

-Time decay refers to the reduction in the value of an option as it approaches its expiration date. This decay is not linear; it accelerates as the expiration date gets closer.

What is a strike price?

-The strike price is the predetermined price at which the shares of stock will be exchanged if the option is exercised. It significantly influences the pricing of the option.

What are in the money and out of the money options?

-An option is considered 'in the money' if exercising it would be profitable, while 'out of the money' options have no intrinsic value at expiration.

Can you sell an option before it expires?

-Yes, you can sell an option before it expires. If the option's price increases after you buy it, you can sell it for a profit without waiting until expiration.

What is the relationship between stock price movements and option prices?

-As the underlying stock price changes, the prices of related options also change. If the stock price rises, call options generally become more expensive, while put options become cheaper, and vice versa.

What role does volatility play in option pricing?

-Volatility measures the magnitude of a stock's price swings. Higher volatility increases the risk for investors, leading to higher option prices, as options with more risk are generally more valuable.

How can you think of options trading in relation to insurance?

-Options can be compared to insurance policies: you pay for options to protect against price movements in the underlying stock, similar to how you pay for insurance to protect against risks in life or property.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

It Took Us 15,000 Trades To Find Our Preferred Delta

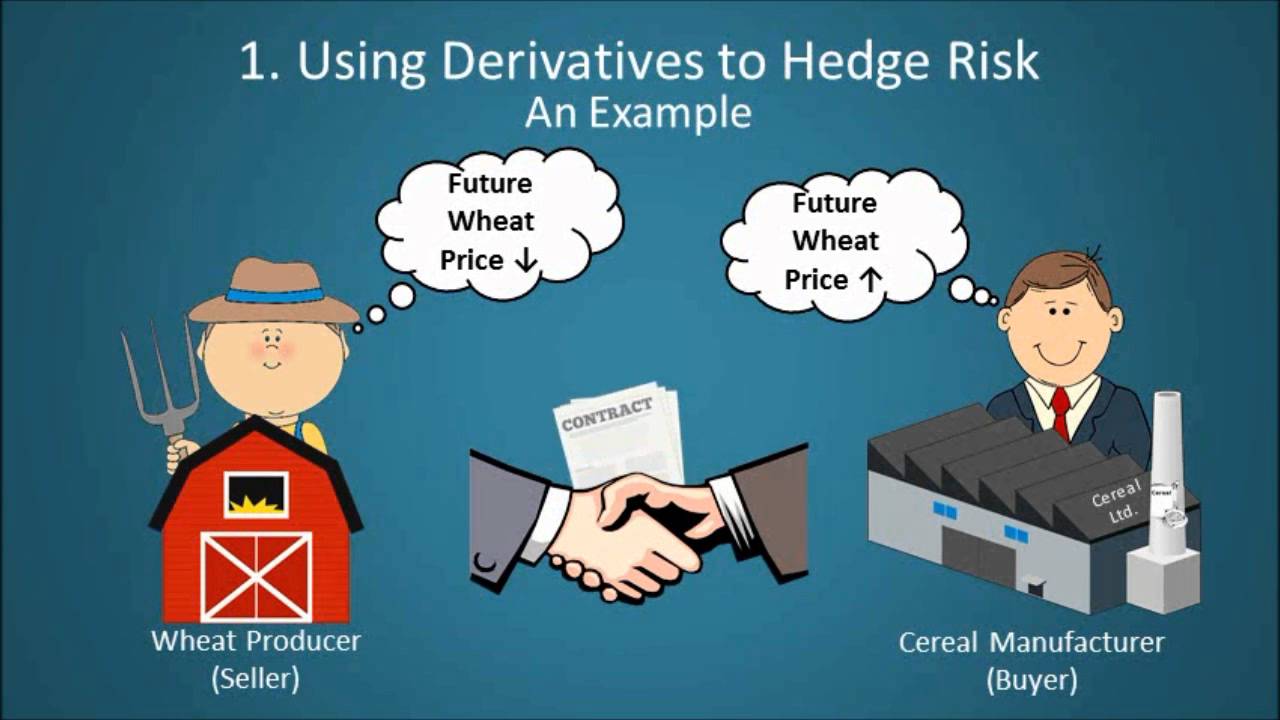

Financial Derivatives Explained

(PART 1) PANDUAN TERLENGKAP TRADING FOREX UNTUK PEMULA

INDEX OPTIONS EXPLAINED: What Are They & How Are They NOT Stock/Equity Options?

Como Usar as Opções com a Taxa de Juros em Alta!

COMO SALVAR SUA CARTEIRA COM OPÇÕES | ANÁLISE DE INVESTIMENTOS REAIS

5.0 / 5 (0 votes)