MAS: COST-VOLUME-PROFIT (CVP) ANALYSIS

Summary

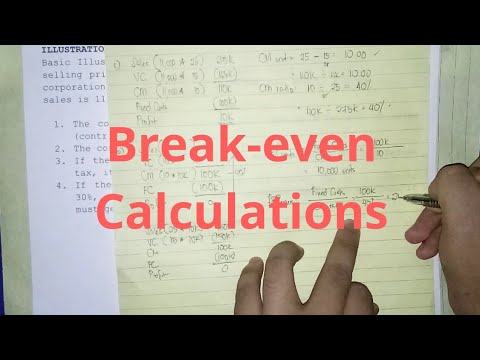

TLDRThis video explores the critical aspects of Cost-Volume-Profit (CVP) analysis, a fundamental financial tool for businesses. It delves into the relationships between costs, sales volume, and profit, highlighting key components such as variable and fixed costs, contribution margin, break-even point, and margin of safety. The video also emphasizes practical applications, illustrating how CVP analysis aids in decision-making and financial planning. By understanding these concepts, managers can strategically navigate pricing, product lines, and sales strategies to enhance profitability and ensure long-term success.

Takeaways

- 😀 CVP analysis helps businesses understand the relationship between sales volume, costs, and profits.

- 📊 A variable costing income statement includes sales, variable costs, contribution margin, and fixed costs.

- ⚖️ The break-even point is where total revenues equal total costs, resulting in zero profit.

- 📈 To calculate the break-even point in units, use the formula: Fixed Costs / Contribution Margin per unit.

- 💰 Desired profit can be added to fixed costs to find the sales needed to achieve a target profit.

- 📉 The margin of safety indicates how much sales can drop before incurring a loss.

- 🔍 Sensitivity analysis involves adjusting variables like selling price and costs to see their effect on profitability.

- 🧮 Key formulas are essential for calculating contribution margin, break-even points, and margin of safety.

- 📚 Practical examples help reinforce the concepts and calculations of CVP analysis.

- 🎓 Encouragement to engage with further tutorials enhances the learning experience.

Q & A

What is Cost-Volume-Profit (CVP) analysis?

-CVP analysis is a financial tool that helps businesses understand the relationship between costs, sales volume, and profits, aiding in decision-making regarding pricing, product lines, and resource allocation.

What are the key components of a Variable Costing Income Statement?

-A Variable Costing Income Statement is structured as follows: Sales minus Variable Costs equals Contribution Margin, which then minus Fixed Costs equals Profit.

How are variable costs defined in CVP analysis?

-Variable costs are expenses that fluctuate with production volume, including manufacturing costs and selling and administrative expenses.

What is the break-even point and why is it important?

-The break-even point is the sales level where total revenues equal total costs, resulting in zero profit. It is crucial for understanding the minimum sales required to avoid losses.

How is the break-even point calculated in units?

-The break-even point in units is calculated using the formula: Fixed Costs divided by Contribution Margin per Unit.

What is the formula for calculating the desired profit in terms of units?

-To calculate desired profit in units, the formula is: (Fixed Costs + Desired Profit) divided by Contribution Margin per Unit.

What does the margin of safety indicate?

-The margin of safety measures the difference between actual sales and break-even sales, indicating how much sales can drop before a business incurs losses.

How can the margin of safety be expressed in pesos?

-The margin of safety in pesos is calculated as Actual Sales in Pesos minus Break-even Sales in Pesos.

What role does sensitivity analysis play in CVP analysis?

-Sensitivity analysis examines how variations in key factors such as selling price, variable costs, and sales mix affect profit, helping businesses understand risk and make informed decisions.

Can you explain the formula for the Margin of Safety Ratio?

-The Margin of Safety Ratio is calculated by dividing the Margin of Safety by Actual Sales, providing a percentage that indicates how much sales can decline before reaching the break-even point.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FINANCIAL MANAGEMENT UNIT-2 COST VOLUME PROFIT ANALYSIS

MA22 - Breakeven Point and CVP Analysis - Explained

1 Relação Custo, Volume, Lucro - Introdução

Cost-Volume-Profit (CVP) Analysis- Break-even Point (Part 1)

Financial Management Strategy | FM Syllabus | Financial Management Important topics | MBA 2 nd Sem.

Soal&Pembahasan CVP Analysis

5.0 / 5 (0 votes)