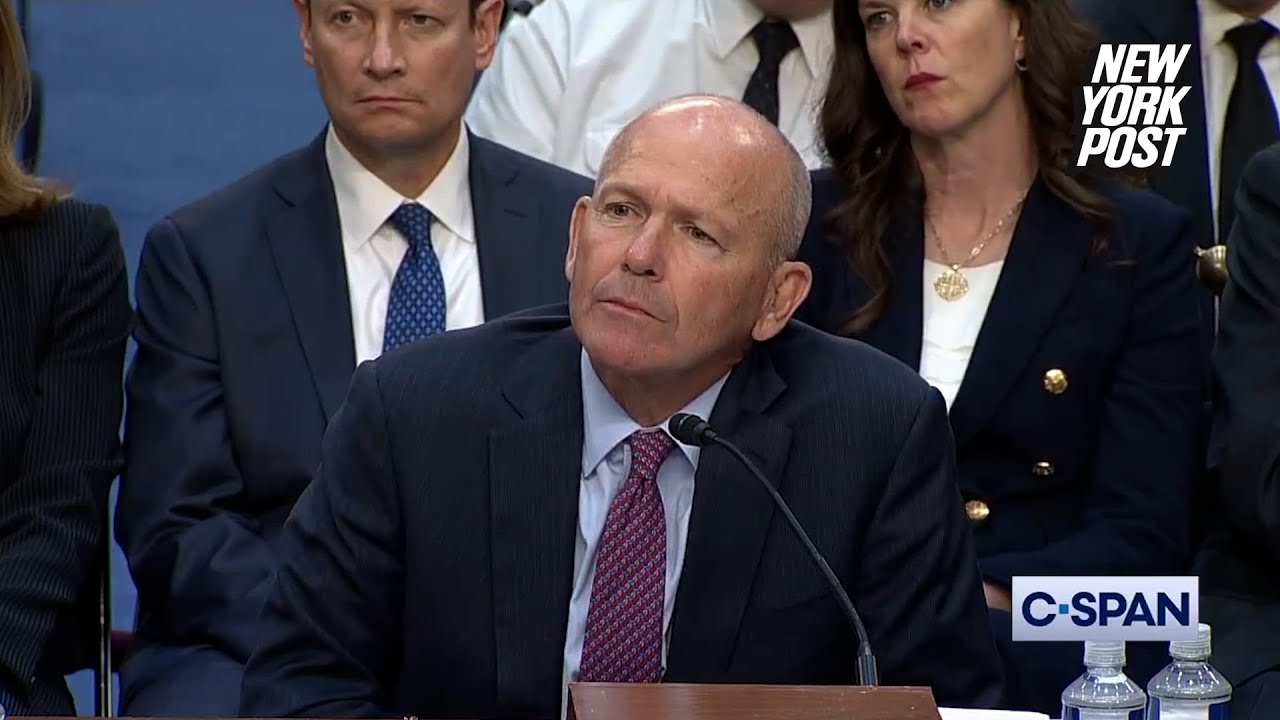

Senator Elizabeth Warren questions Wells Fargo CEO John Stumpf at Banking Committee Hearing

Summary

TLDRIn a powerful exchange, Senator Elizabeth Warren challenges Wells Fargo CEO John Stumpf on the bank's ethics and accountability following a scandal involving the creation of millions of fake accounts. Warren scrutinizes Stumpf's lack of personal accountability, highlighting his retention of millions in earnings while employees faced repercussions. She questions the board's decision-making process regarding executive compensation and emphasizes the need for corporate accountability. Warren's fiery critique underscores the disparity in consequences for executives versus lower-level employees, advocating for tougher regulations to ensure that corporate leaders are held accountable for fraud and misconduct.

Takeaways

- 💼 Accountability in Leadership: Senator Warren highlights that real accountability involves actions, not just words, emphasizing that CEO Stumpf has not resigned or returned his earnings despite the scandal.

- 💰 Compensation Controversy: Stumpf has not returned any of the millions he earned while the fraud was ongoing, raising questions about ethical responsibility in corporate leadership.

- 🚨 Lack of Consequences for Executives: Warren points out that no senior executives were fired for their roles in the scandal, suggesting a failure of leadership to take responsibility.

- 📈 Cross-Selling Critique: The practice of cross-selling at Wells Fargo, intended to deepen customer relationships, is portrayed as a mechanism for boosting stock prices, rather than serving customer needs.

- 📞 Earnings Calls Evidence: Warren references transcripts from earnings calls where Stumpf touted cross-selling successes, which coincided with the fraudulent activities at the bank.

- 📉 Customer Exploitation: The scandal involved the creation of millions of fake accounts, suggesting that customer trust was exploited for corporate gain.

- 🏦 Regulatory Awareness: Stumpf admitted to being aware of regulatory investigations before key executives, including Carrie Tolstedt, left the company.

- 🛑 No Consideration for Termination: Despite being aware of the ongoing fraud, Stumpf did not consider firing Tolstedt, who oversaw the community banking division where the issues arose.

- 💵 Incentive Awards Controversy: Concerns are raised about Tolstedt potentially receiving additional bonuses despite her involvement in the scandal, highlighting governance issues.

- 🔍 Need for Regulatory Change: Warren argues for stronger laws and accountability measures to prevent corporate fraud, emphasizing that the status quo allows for continued misconduct in the banking industry.

Q & A

What does Elizabeth Warren criticize about Wells Fargo's leadership?

-Elizabeth Warren criticizes Wells Fargo's leadership for failing to take accountability during the scandal, including not resigning, not returning earnings, and not firing senior executives responsible for the fraud.

How does Warren define accountability in the context of corporate leadership?

-Warren defines accountability as taking responsibility for one's actions, which includes resigning from positions, returning ill-gotten earnings, and ensuring that those responsible for wrongdoing are held accountable.

What specific financial gains did Stumpf achieve during the Wells Fargo scandal?

-Stumpf held an average of 6.75 million shares of Wells Fargo stock, which gained approximately $30 per share during the scandal, resulting in over $200 million in personal gains.

What was the reason behind Wells Fargo's aggressive cross-selling strategy?

-Wells Fargo's cross-selling strategy aimed to increase the number of accounts per customer to drive up stock prices, rather than genuinely helping customers with their banking needs.

What was Warren's stance on the consequences faced by lower-level employees compared to executives?

-Warren pointed out the disparity in accountability, stating that lower-level employees who engaged in wrongdoing faced severe consequences, while executives like Stumpf continued to profit and avoid punishment.

What was said about Carrie Tolstedt's retirement and compensation?

-Carrie Tolstedt, who oversaw the community banking division during the scandal, retired with over $90 million in compensation. Warren highlighted that if she had been fired instead, she would have lost a significant portion of that compensation.

How did Stumpf respond to Warren's questioning about whether he considered firing Tolstedt?

-Stumpf stated that he did not consider firing Tolstedt, citing her overall performance and contributions, despite the significant issues under her oversight.

What were some of the actions taken by Wells Fargo in response to the scandal?

-Wells Fargo made changes to its compensation schemes, removed sales quotas for thousands of employees, and indicated a process was in place for dealing with executive compensation related to the scandal.

What was the main message Warren conveyed regarding the need for regulatory changes?

-Warren emphasized that without tougher laws holding corporate executives personally accountable, fraud and unethical behavior would continue unchecked in the banking industry.

How did Stumpf justify the cross-selling strategy despite the fraud?

-Stumpf claimed that cross-selling was about deepening customer relationships, denying that it was primarily driven by stock price concerns or that it contributed to the fraudulent activities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Wells Fargo Scandal - A Simple Overview

Wells Fargo whistleblower on fraudulent banking practices

Josh Hawley To Acting Secret Service Director: Why Has No One Involved In Trump Shooting Been Fired?

Wells Fargo Presents: The Power of Employee Engagement

Boeing CEO Dave Calhoun faces grilling at Senate hearing

Markets will 'crash' if Trump can fire Fed's Powell, Elizabeth Warren warns

5.0 / 5 (0 votes)