L-2 Ratio Analysis I B.Com Sem-5 I Management Accounting I Dr. Kamlesh Varvadiya

Summary

TLDRIn this informative video, Ajay discusses strategies for calculating profitability in business investments. He explains key concepts such as capital employed, net profit, and return on equity, offering formulas and examples to clarify the calculations. Viewers learn how to evaluate their investments and understand the importance of dividends and shareholder returns. The presentation emphasizes the need for accurate financial analysis to maximize profitability, encouraging viewers to subscribe for more insights and resources on investment strategies.

Takeaways

- 📈 Understanding profitability is crucial for evaluating business success and making informed investment decisions.

- 💡 Total capital employed is a key metric to analyze, as it encompasses both equity and debt financing.

- 📊 The formula for calculating return on capital employed (ROCE) is net profit divided by total capital employed.

- 🔍 Net profit should be clearly defined to ensure accurate calculations of returns.

- 📉 Investors should be aware of the impact of taxes on net profits and how it affects overall returns.

- 🧾 Return on equity (ROE) focuses on the profitability of shareholder equity, highlighting its importance for investors.

- 💰 Dividends are a critical aspect of returns; calculating dividend yield helps assess the profitability of investments.

- 🔗 Investors should calculate the ratio of dividends to profits to understand the financial health of the company.

- 📚 The video emphasizes the need for thorough documentation of investment calculations for transparency.

- 🤝 Subscribers are encouraged to engage with the content by sharing and liking videos, promoting community learning.

Q & A

What is the main topic of the video?

-The video discusses profitability and investment strategies, focusing on how to determine returns on investment and the concept of capital employed.

What formula is suggested to calculate the return on capital employed?

-The formula for return on capital employed is net profit divided by capital employed.

What is the significance of net profit in investment analysis?

-Net profit is crucial as it reflects the actual earnings of a business after deducting expenses, taxes, and other costs, thus indicating the profitability of the investment.

How should one consider equity capital in their analysis?

-Equity capital should be treated as a separate entity when calculating returns, focusing only on the profits attributable to equity shareholders.

What does the video suggest about long-term loans?

-Long-term loans must be included in the total capital employed calculation to accurately assess the business's overall financial health and return metrics.

What is the relationship between dividends and net profit according to the video?

-Dividends are derived from the net profit of a company, and the video emphasizes the need to evaluate how much of the profit is returned to shareholders as dividends.

What example does the video provide regarding the calculation of return on equity?

-The video suggests calculating return on equity by dividing net profit by equity capital, demonstrating a clear and straightforward method.

What tools or formulas are recommended for calculating capital employed?

-The video recommends adding various capital sources, such as equity capital and any long-term loans, to calculate the total capital employed.

Why is it important to understand the return on investment (ROI)?

-Understanding ROI is crucial as it helps investors gauge the effectiveness of their investments and make informed decisions about where to allocate resources.

How can the audience stay updated with the video's content?

-The video encourages viewers to subscribe to the channel, share with friends, and like the video for future updates and additional financial insights.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Statistika Analisa Usaha

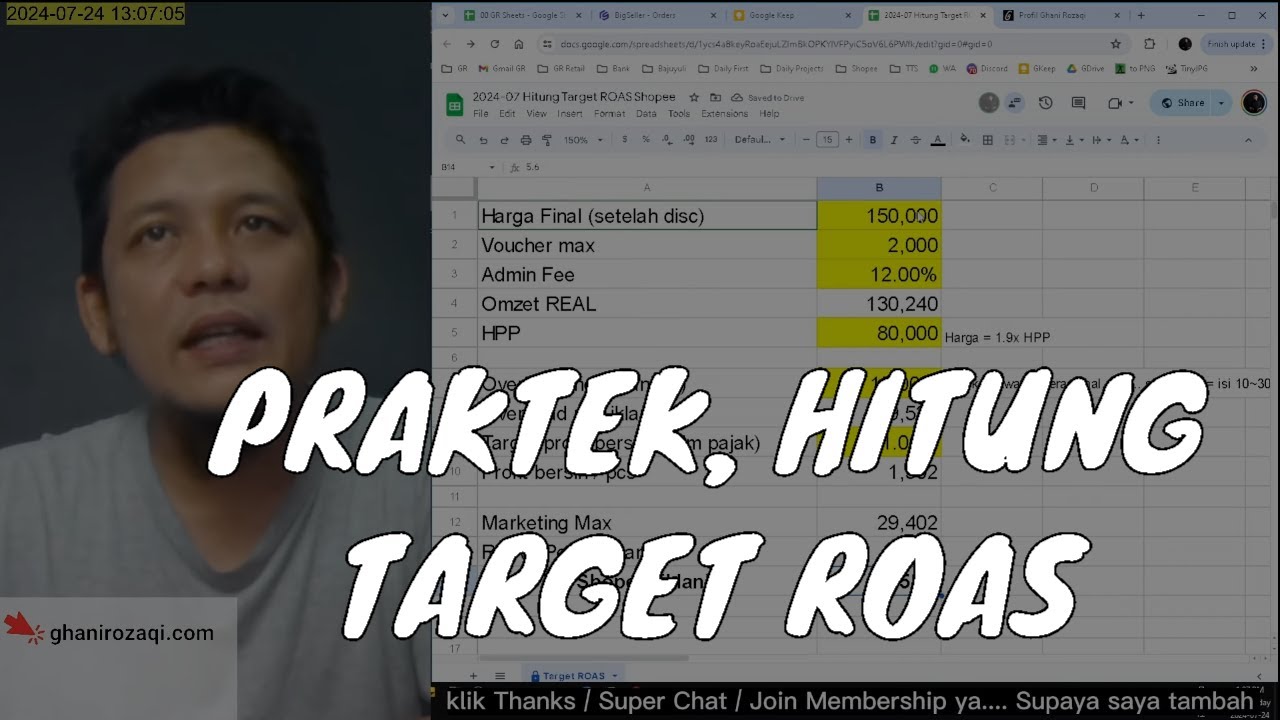

[PRAKTEK] Cara Hitung TARGET ROAS Iklan Shopee | GMV Max Shopee

PKWU Kelas 11 Wirausaha kerajinan dari bahan limbah berbentuk bangun ruang (2/2) SMA Doa Bangsa

Manajemen Pembelanjaan

ULTIMATE CAREER GUIDE BUSINESS OPERATIONS MANAGER | Career in Business Operations Management

BAHAYA!! Jangan Taruh Dana Pensiun dalam Bentuk Non-Likuid Semua

5.0 / 5 (0 votes)