How Traders (Legally) Pay ZERO in Taxes

Summary

TLDRThis video delves into essential tax strategies for traders, highlighting the benefits of using an S-Corp for trading activities. It explains critical concepts such as wash sales and the necessity of the Mark-to-Market election to optimize tax benefits. The speaker emphasizes the importance of leveraging tax-deferred accounts like solo 401(k)s and Roth IRAs to grow wealth while minimizing tax liabilities. Ultimately, the video encourages traders to seek professional accounting advice to navigate tax complexities and enhance their financial outcomes.

Takeaways

- 😀 Consider establishing an S-Corp for trading to potentially reduce tax liabilities.

- 😀 Mark-to-Market election is crucial for traders to avoid issues with wash sales.

- 😀 A wash sale occurs when you sell a security at a loss and repurchase it within 30 days, disallowing the loss for tax purposes.

- 😀 It's important to make the Mark-to-Market election by April 15 of the current tax year to apply it effectively.

- 😀 Deductible expenses for an S-Corp can include payroll and business-related costs, potentially balancing out income to zero.

- 😀 Maximize contributions to tax-advantaged accounts like solo 401(k)s to benefit from tax-free growth.

- 😀 Focus on growing tax-free accounts, as this can lead to significant compounding returns over time.

- 😀 Active trading income can fluctuate significantly; planning for varying income levels is essential.

- 😀 A good CPA can provide invaluable advice on optimizing tax strategies for traders.

- 😀 Many successful traders leverage tax strategies that the top 1% use to minimize their taxable income.

Q & A

What is the main advantage of trading through an S-Corp?

-Trading through an S-Corp allows traders to deduct payroll expenses and other business-related costs, potentially reducing their overall taxable income.

What is a Mark-to-Market election and why is it important?

-A Mark-to-Market election allows traders to report gains and losses based on the fair market value of their positions at year-end, helping to avoid the wash sale rule, which can disallow certain losses.

What are wash sales and how do they affect traders?

-Wash sales occur when a trader sells a security at a loss and buys a substantially identical security within 30 days. This can lead to disallowed losses for tax purposes, increasing taxable income.

How can traders benefit from deducting business expenses?

-By deducting business expenses such as office space, equipment, and other costs, traders can lower their taxable income, which can lead to significant tax savings.

Why should traders consider using tax-deferred accounts?

-Using tax-deferred accounts, like a solo 401(k), allows traders to grow their investments without immediate tax implications, enabling compounding returns to accumulate more effectively over time.

What is the recommended deadline for making a Mark-to-Market election?

-Traders must make the Mark-to-Market election by April 15th of the current tax year for it to apply to that tax year.

What does the speaker suggest regarding long-term trading strategies?

-The speaker suggests focusing on growing tax-free accounts to maximize returns, as this can potentially yield greater financial growth compared to relying solely on active trading profits.

How can traders effectively manage their tax liabilities?

-Traders can manage their tax liabilities by properly structuring their trading activities, utilizing tax-deferred accounts, and consulting with a knowledgeable CPA for tailored tax advice.

What financial goal did the speaker set early in their trading career?

-The speaker aimed to grow their trading account significantly so that the returns from investments could surpass their active trading profits over time.

Why is consulting with a CPA highlighted as important for traders?

-A CPA can provide expert advice on tax strategies and compliance, helping traders navigate complex tax rules and potentially save on taxes, which is critical for financial success.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Maximize S Corp Tax Savings

How Traders Use LLCs to (Legally) Save $69,000/yr on Taxes

3 Simple Crypto Tax Hacks The IRS Want You To Ignore

How To Day Trade As a Business (Using an LLC)

Crypto Tax Reporting (Made Easy!) - CryptoTrader.tax / CoinLedger.io - Full Review!

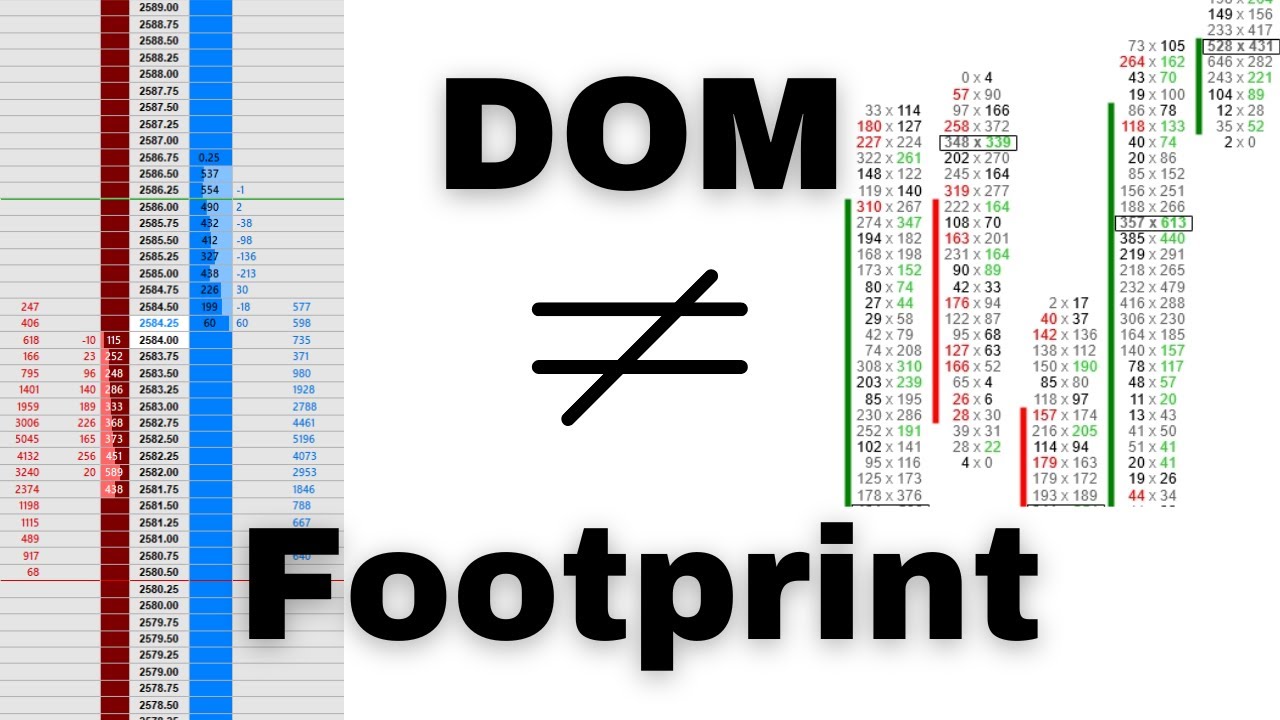

Understanding The Differences Between a DOM and Footprint Chart

5.0 / 5 (0 votes)