Follow the 340B Prescription Dollar: How PBMs Profit from 340B Contract Pharmacies

Summary

TLDRThe video discusses the rapid growth of contract pharmacies under the 340B program, highlighting its expansion from 1,300 pharmacies in 2010 to 33,000 by 2024. The significant rise in relationships between covered entities and pharmacies has led to increased involvement from Pharmacy Benefit Managers (PBMs), driving the market's complexity. The speaker explains how this growth has impacted profits, pricing, and patient costs, particularly in specialty drugs, sparking controversy over the financial dynamics between manufacturers, payers, and covered entities.

Takeaways

- 💊 The growth of contract pharmacies, which partner with covered entities to provide 340B-priced drugs, has become a significant and controversial trend.

- 📈 The number of contract pharmacies has exploded from 1,300 in 2010 to 33,000 in 2024, representing more than half of U.S. pharmacy locations.

- 🤝 These pharmacies are not just increasing in number but also in relationships with covered entities, which have surged from 2,000 to 220,000 since 2010.

- 💼 Pharmacy Benefit Managers (PBMs) began heavily involving themselves in the 340B program around 2017, driving the rapid growth, especially in mail-order and specialty pharmacies.

- 🏢 Five major companies—CVS Health, Walgreens, Walmart, Express Scripts, and OptumRx—now account for 75% of all contract pharmacy relationships.

- 🔄 Many retail pharmacies work with 3-6 covered entities, while mail and specialty pharmacies often maintain relationships with hundreds or even thousands of covered entities.

- 💰 The profit margins in the 340B program are significantly higher for specialty drugs, with pharmacies earning up to four times more than with traditional commercial plans.

- ⚖️ The 340B discount can shift costs from manufacturers to third-party payers and patients, creating ethical concerns and controversies.

- 🏥 Retail pharmacies mainly align with federal grantees, while hospitals partner more with mail-order and specialty pharmacies, creating distinct segments within the 340B market.

- 🔎 Complexities arise when determining 340B eligibility for prescriptions, which can be identified after a transaction, creating potential overlaps and inefficiencies in the process.

Q & A

What is a contract pharmacy in the context of the 340B program?

-A contract pharmacy is an independent business that contracts with a covered entity to dispense drugs at the 340B discounted price to patients. This allows entities without their own pharmacy to participate in the 340B program.

Why has the number of contract pharmacies grown so significantly since 2010?

-The growth is largely due to guidance issued in 2010 that allowed covered entities to contract with as many pharmacies as they wish. Additionally, the rise of pharmacy benefit managers (PBMs) and mail and specialty pharmacies further accelerated this growth.

How many contract pharmacies were participating in the 340B program in 2010 compared to 2024?

-In 2010, there were 1,300 contract pharmacies, but by 2024, this number had grown to 33,000, accounting for more than half of all pharmacy locations in the U.S.

What role do PBMs play in the growth of 340B contract pharmacy relationships?

-PBMs have become heavily involved in the 340B program, especially through mail and specialty pharmacies. Their participation has driven a significant increase in the number of contract pharmacy relationships, especially starting around 2017-2019.

What is the current trend in the number of relationships between covered entities and contract pharmacies?

-The number of relationships has exploded from around 32,000 in 2013 to 220,000 in 2024. This indicates that pharmacies are partnering with multiple covered entities, not just a single one.

Which companies account for the majority of 340B contract pharmacy relationships?

-Five companies—CVS Health, Walgreens Boots Alliance, Walmart, Express Scripts (part of Cigna), and OptumRx (part of UnitedHealth Group)—account for 75% of all contract pharmacy relationships in the 340B program.

What is the significance of retail pharmacies in the 340B program?

-Retail pharmacies, such as CVS and Walgreens, play a major role in the 340B program, with many of their locations participating and maintaining relationships with multiple covered entities.

How do specialty drugs factor into the profitability of the 340B program for PBMs?

-Specialty drugs dispensed through the 340B program provide PBMs with larger profit margins. Specialty prescriptions have high costs and high reimbursement rates, leading to greater profits compared to traditional commercial plans.

What happens when a prescription is retroactively determined to be 340B-eligible?

-When a prescription is identified as 340B-eligible after being dispensed, the pharmacy or covered entity may receive the 340B discount, which can change how the prescription is paid for, often shifting costs to the third-party payer and patient.

Why is the 340B program controversial regarding its financial impact on commercial payers and patients?

-The controversy arises because the 340B program allows covered entities to purchase drugs at discounted prices, yet the full cost may still be passed on to commercial payers and patients. This dynamic leads to increased payer costs and questions about who truly benefits from the program.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

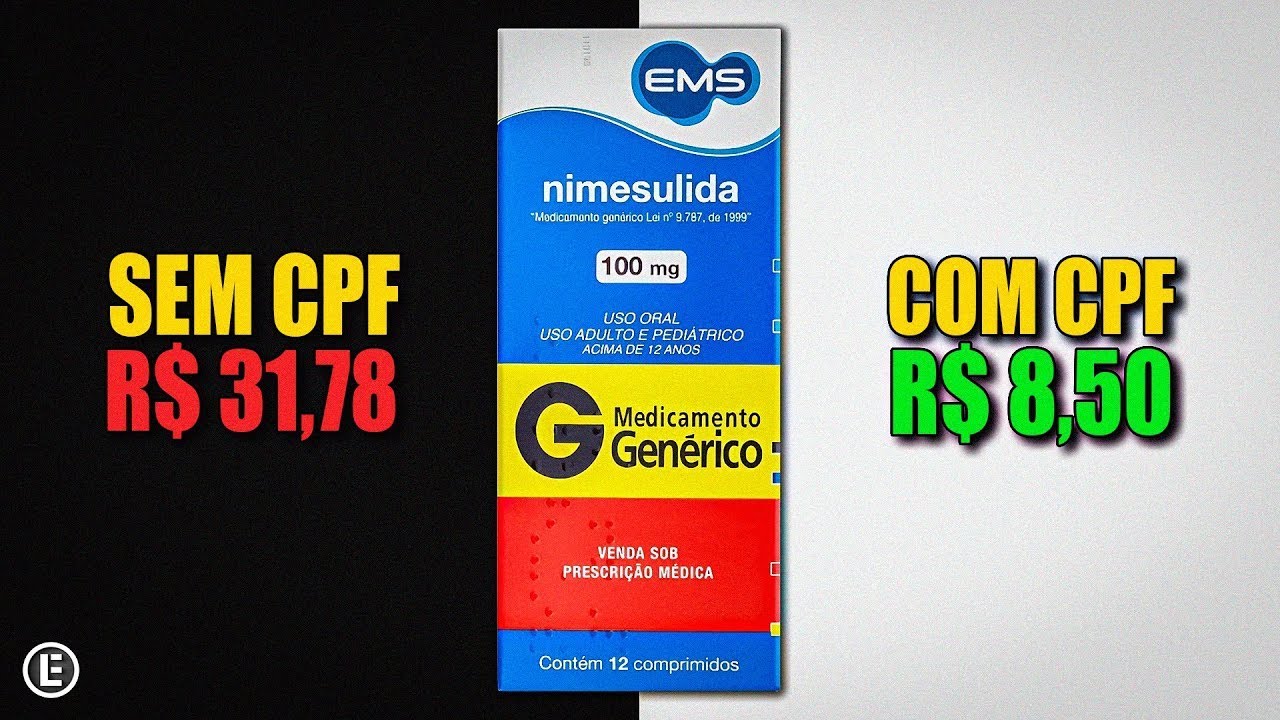

Por que tem MAIS FARMÁCIAS do que escolas no Brasil?

O Novo ESQUEMA das Farmácias (Você está sendo manipulado!)

Pharmeasy Case Study: Everything You Need To Know

Serviços farmacêuticos em farmácias e drogarias

Standar Pelayanan Kefarmasian di Apotek [Part 1]

7 Prasarana Wajib yang Harus Ada di Setiap Apotek #Swipreneur eps.37

5.0 / 5 (0 votes)