Market Commentary 07 APR 2024

Summary

TLDRThe speaker discusses their trading activities over the week, highlighting the importance of understanding market maker models and price action. They emphasize the significance of identifying key support and resistance levels, as well as optimal trade entries and exits. The narrative also touches on the impact of news releases on market volatility and the benefits of focusing on a single asset and time window for more consistent trading results. The speaker concludes by advocating a disciplined approach to trading, suggesting that contentment with smaller gains and strict risk management can lead to long-term profitability.

Takeaways

- 📈 The speaker reviews their trades for the week, highlighting a mix of wins and losses.

- 📊 Emphasis on the importance of price action and understanding market behavior within specific time frames.

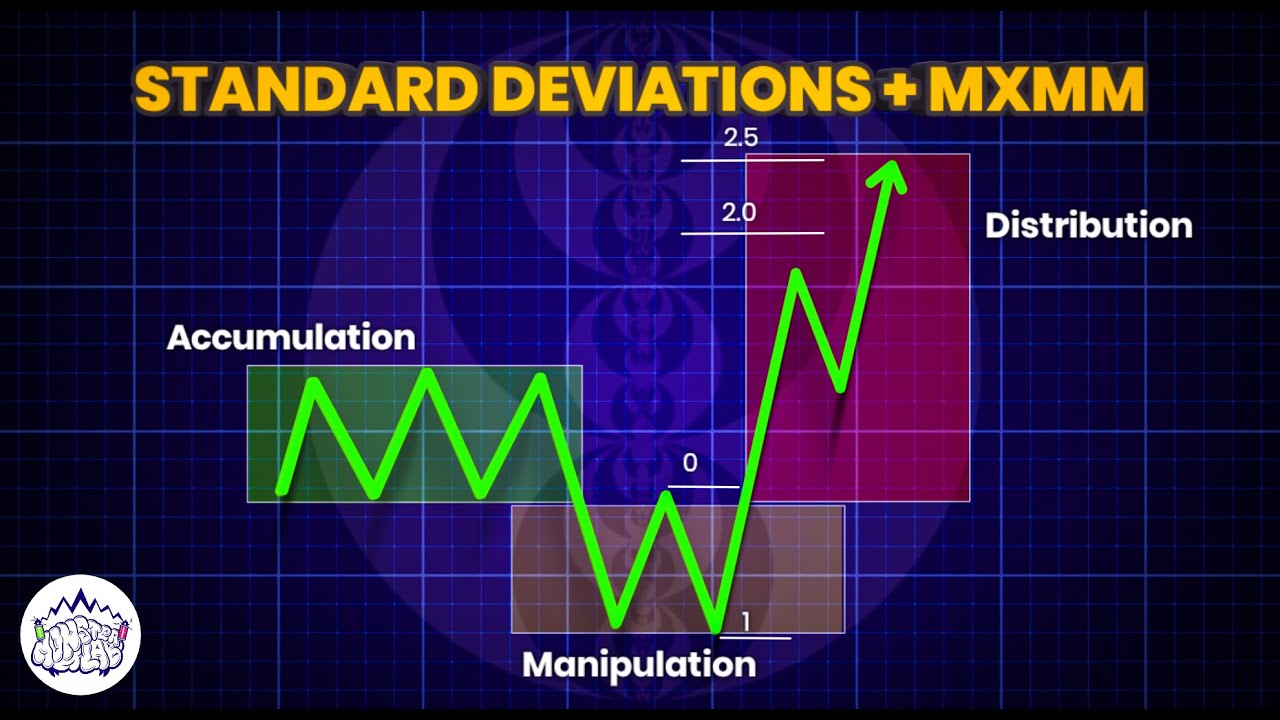

- 🛠️ Utilization of the market maker model to identify sell and buy sets of the curve for potential trading opportunities.

- 🔄 Focus on the reaccumulation area within the market maker model to predict future price movements.

- 📌 Identification of 'optimal trade entries' and 'return to equilibrium' points for high probability trades.

- 📈 'Bullish institutional order flow' is characterized by breaking highs and protected lows, using down close candles as support.

- 📊 The significance of volume imbalance and liquidity levels in confirming market trends and potential reversal points.

- ⏰ Timing is crucial, with news releases and market sessions like London and New York overlap being key for price movements.

- 🚫 Avoidance of trading high-risk events like NFP due to potential for significant losses in a short time.

- 🎯 Focusing on a single asset and time window can lead to more consistent results and less analysis paralysis.

- 💡 The importance of risk management, setting clear rules for when to engage, how much to risk, and taking breaks after wins or losses.

Q & A

What was the speaker's overall performance for the week in terms of trading?

-The speaker had a positive week in terms of trading, with two trades on Monday and Wednesday, one win and one loss. The other days, Tuesday, Thursday, and Friday, were also good.

What trading strategy was the speaker using based on the market maker model?

-The speaker was using a strategy that involved identifying sell and buy sets of the curve based on the market maker model. They were looking for reaccumulation within specific areas and projecting price movements from the sell set to the buy set of the curve.

How did the speaker analyze the market on Monday?

-On Monday, the speaker analyzed the market by looking at the previous week's down close candle, which indicated manipulation for the week. They were waiting for the market to complete the market maker model by expanding on Monday, which indeed happened.

What news-related aspect did the speaker mention as being important for market timing?

-The speaker emphasized the importance of high impact news for market timing. They mentioned that while they do not care about the fundamentals behind the news, the timing aspect is crucial for capitalizing on market movements.

What was the speaker's approach to trading on Tuesday and how did it differ from Monday?

-On Tuesday, the speaker observed that the market ran below Monday's low, filling the buy side imbalance. This was different from Monday's approach, which was based on the completion of the market maker model. Tuesday's trade was more about reversing the previous day's low and exploiting the new imbalance.

How did the speaker use the concept of 'bullish institutional order flow' in their analysis?

-The speaker used the concept of 'bullish institutional order flow' by looking for signs of breaking highs and protected lows. They used this concept to identify areas of potential accumulation and to confirm their analysis of the market's behavior.

What time frame did the speaker find most effective for identifying optimal trade entries?

-The speaker found the 5-minute time frame most effective for identifying optimal trade entries, as it provided a clearer view of price movements and allowed for more precise annotations and analysis.

What did the speaker advise regarding the approach to trading NFP (Non-Farm Payrolls) news releases?

-The speaker advised against trading NFP news releases due to the high risk of ruin. They mentioned that the volatility and liquidity issues during such events can lead to significant losses in a very short time.

What is the speaker's philosophy on handling losses in trading?

-The speaker's philosophy on handling losses is to be happy to take a loss because it means they are done for the day. They emphasize the importance of not being worried about losses and focusing on the long-term gains that consistent trading strategies will yield.

What advice does the speaker give for traders struggling with consistency?

-The speaker advises struggling traders to focus on one asset, one time window, and one strict approach. They suggest aiming for 20 to 30 pips during the New York session and being content with one to three good trading days per week.

How does the speaker suggest managing risk in trading?

-The speaker suggests managing risk by having clear rules and protocols for when to engage, how much to risk, and how often to expose oneself to risk. They emphasize the importance of controlling one's risk and not being overly fixated on the potential gains of each trade.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Forex - Market Maker Series Vol. 4 of 5

MMXM IPDA cycles + PO3 | Fractal Cheat Code For Price Anticipation

ICT Mentorship Core Content - Month 04 - Reclaimed ICT Orderblock

My List of Top ICT Concepts for Successful Trading

ICT Mentorship Core Content - Month 04 - Divergence Phantoms

Standard Deviations + MMXM | ICT Concepts | DexterLab

5.0 / 5 (0 votes)