HK Plans to Move v MPF Scheme into EMPF Centralized Platform

Summary

TLDRThe discussion centers on the Mandatory Provident Fund (MPF) program's high fees, largely due to paper transactions and administrative costs. The introduction of a centralized Electronic MPF Platform (eMPF) aims to streamline account consolidation and reduce transfer times from weeks to one-click. This could increase competition among the 14 trustees, potentially lowering fees. The eMPF also facilitates voluntary contributions, offering tax deductions up to 60,000 HKD for higher-income earners. The platform's potential to revolutionize retirement savings in Hong Kong is highlighted, encouraging micro-savings and changing savings behavior.

Takeaways

- 💼 The MPF (Mandatory Provident Fund) program has been criticized for higher fees, partly due to paper transactions and the volume of transactions.

- 🏦 The government has tasked the MPF to operate a centralized platform for managing the electronic transactions of around 4 million users.

- 🕒 Currently, it takes 2-3 weeks to transfer and consolidate MPF accounts due to the existing structure involving 12-14 trustee platforms.

- 📈 The EMPF (Electronic MPF) platform aims to allow one-click account visibility and transfers, potentially increasing competition and reducing fees.

- 💼 There are nearly 10 million MPF accounts due to people changing jobs and leaving accounts behind, which the centralized platform aims to address.

- 💸 High fees in Hong Kong's pension funds are attributed to both admin costs and a lack of competition among the 14 trustees.

- 📊 The centralized platform could lead to lower net returns by increasing price competition among trustees, potentially benefiting members.

- 💵 The government introduced tax-deductible voluntary contributions from April, benefiting middle and upper-income earners with additional retirement savings options.

- 🌐 The platform has the potential to evolve the market into a more comprehensive retirement planning system, encouraging micro-savings through便捷的 technology.

- 🔄 The platform's structure allows for the decoupling of infrastructure from product providers, which could lead to more competition and better pricing in the long run.

Q & A

What is a common criticism of the MPF program?

-A common criticism of the MPF program is the higher fees, partly due to paper transactions and the volume of transactions that add to the cost.

How does the EMPF structure change the economics for users?

-The EMPF structure changes the economics by introducing a centralized platform that allows for easier account management and potentially reduces costs due to increased competition among trustees.

How long does it currently take to transfer accounts within the MPF system?

-It currently takes about two to three weeks to transfer accounts within the MPF system.

What is the significance of the 4 million members mentioned in the script?

-The 4 million members represent the number of users in the MPF system, which is nearing 10 million accounts due to people changing jobs and leaving accounts behind.

How does the EMPF platform address the issue of members' inertia?

-The EMPF platform addresses members' inertia by allowing a one-click approach to see and manage accounts, reducing the time and effort required to transfer accounts.

What are the current fee structures like in Hong Kong pension funds?

-According to a PWC report from 2017, the fee structures in Hong Kong pension funds are quite high.

What factors contribute to the high fees in the MPF program?

-High fees are attributed to both administrative costs due to paper checks and a lack of competition among the 14 trustees.

How does the EMPF platform aim to improve net returns for members?

-The EMPF platform aims to improve net returns by increasing competition among trustees and reducing administrative costs through digital transactions.

What is the impact of the 1500 Hong Kong dollar monthly contribution limit on different income earners?

-The 1500 Hong Kong dollar monthly contribution limit is seen as more beneficial for low-income earners, as it provides basic protection, while middle and upper-income earners can benefit from tax-deductible voluntary contributions.

How does the EMPF platform encourage more people to save for retirement?

-The EMPF platform encourages saving by allowing users to easily add even small amounts to their retirement savings through a one-click approach on their smartphones.

What is the potential impact of the EMPF platform on the retirement planning market in Hong Kong?

-The EMPF platform has the potential to develop the market into a more full-blown retirement planning and saving system, changing the ecosystem and behavioral patterns of people regarding savings.

How does the EMPF platform plan to decouple infrastructure from product or fund providers?

-The EMPF platform plans to decouple infrastructure from product or fund providers by allowing them to plug into the central platform without needing their own scheme administration platform.

What is the significance of the number of trustees in the MPF market?

-The number of trustees (14) is significant as it represents the current competition in the market. The EMPF platform aims to increase competition by allowing more providers to plug into the central platform.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

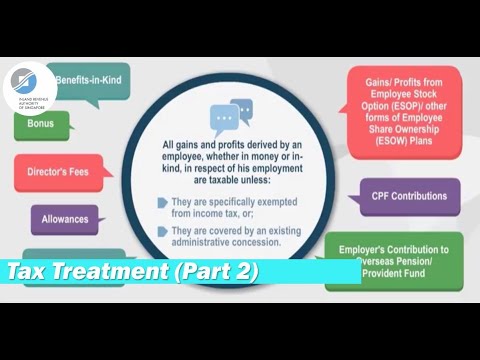

Tax Treatment of Remuneration Components (Part 2)

Fundo ARCA Grão do Primo Rico vale a pena? Comparativo com fundo Global Return (Vítreo / Empiricus)

Can Vietnam be the new Singapore?

Step 7: Silent Partners - Everyone Wants a Piece of the Pie

Quanto ti costa COMPRARE CASA? | Tutti i costi 2024

Hybrid Program LFG Training

5.0 / 5 (0 votes)