Introduction to FinTech and AI & ML in FinTech: Foundations and Concepts

Summary

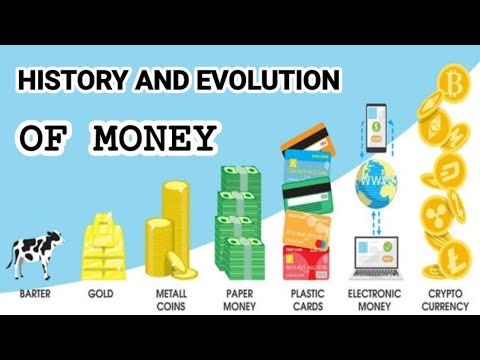

TLDRProfessor Pipart from Su Denver introduces the world of Fintech, highlighting its rapid evolution from credit cards and ATMs to digital assets and cryptocurrencies. The lecture covers key areas in Fintech, including digital payments, blockchain, and AI's role in algorithmic trading and fraud detection. The future of Fintech is explored with a focus on DeFi, open banking, and regulatory changes, while AI's benefits and challenges in the financial industry are discussed, including data privacy and algorithmic bias.

Takeaways

- 💼 Fintech stands for financial technology, which integrates technology into financial services, covering a broad range from mobile banking to cryptocurrency.

- 📈 The fintech sector has seen rapid growth, with expectations that it will transform the entire finance industry.

- 🏦 Key areas in fintech include digital payments, blockchain and cryptocurrency, robo-advisors, insurance tech, and regtech.

- 🔐 Blockchain technology is characterized by decentralization, immutability, and security, with applications beyond cryptocurrency in various fields.

- 💹 AI in fintech plays a significant role in areas like algorithmic trading, fraud detection, customer service, and data classification.

- 📊 Machine learning, a subset of AI, is crucial for automating processes and enhancing decision-making in the financial industry.

- 🌐 The future of fintech includes developments in decentralized finance (DeFi), open banking, and regulatory changes, along with addressing security and market volatility.

- 🤖 The benefits of AI in finance include efficiency, accuracy, personalization, scalability, and better risk management.

- 🚀 The adoption of AI and machine learning in the financial sector is high, with client acquisition being a leading area of implementation.

- 🔑 Challenges in AI include data privacy, regulatory compliance, algorithmic bias, and the need for explainable AI models.

Q & A

What does 'fintech' stand for and what is its scope?

-Fintech stands for financial technology, which refers to the integration of technology into offerings by financial services. Its scope covers a wide range of applications from mobile banking to insurance, cryptocurrency, and investment apps.

How has the fintech sector evolved over time?

-The fintech sector has evolved rapidly since the 1950s, starting with the credit card and ATM, moving to electronic trading on NASDAQ in the 60s and 70s, online and tele banking in the 1980s, and more recently with the advent of digital assets and cryptocurrencies in the 2010s.

What are some key areas in fintech?

-Key areas in fintech include digital payments, blockchain and cryptocurrency, robo-advisors, insurance tech, and regtech, which is technology that helps companies comply with financial regulations.

What is the definition of blockchain technology?

-Blockchain technology is a decentralized, digital ledger that is immutable, meaning once a block is added to the chain, it cannot be deleted. It has applications beyond cryptocurrency, such as in supply chain management, healthcare, voting systems, and even the US Army.

What is the role of AI in fintech?

-AI in fintech plays a role in areas such as algorithmic trading, fraud detection, customer service, and data classification. It enhances decision-making and automates processes, with over 80% of trades in the market being done by machines.

What are some benefits of AI in fintech?

-AI in fintech offers benefits such as efficiency, accuracy, personalization, scalability, and risk management. It also helps in reducing biases and improving customer engagement.

What are the key languages and techniques used in AI and machine learning in fintech?

-Key languages and techniques used in AI and machine learning in fintech include natural language processing, predictive analytics, deep learning, and reinforcement learning.

What is the future of fintech according to the lecture?

-The future of fintech includes the growth of decentralized finance (DeFi), open banking, regulatory changes, increased adoption, and addressing challenges such as security concerns and market volatility.

What are the three generations of AI mentioned in the script?

-The three generations of AI mentioned are narrow AI, general AI, and superintelligent AI. The current focus is moving from narrow AI to general AI, which is expected to have an accuracy of 96% as of the time of the lecture.

What are the challenges in AI that were discussed in the script?

-Challenges in AI discussed in the script include data privacy, regulatory compliance, algorithmic bias, and the need for explainable AI. It also mentions the importance of emotional intelligence in relation to AI.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Evolution of Money

¿Qué es Fintech? Al tablero con Colombia Fintech

History and Evolution of Money - The History

How Cryptocurrency ACTUALLY works.

TIPOS DE CARTEIRA BITCOIN (Saiba onde guardar suas criptomoedas!)

Financial Technology - Definisi Fintech, sejarah perkembangan, ruang lingkup, manfaat, dan jenisnya

5.0 / 5 (0 votes)